1. mobility differences

2. currency differences

3. politics

B. The Key Facts of International Trade

2013: https://www.census.gov/foreign-trade/statistics/highlights/top/top1312yr.html

2014: http://trade.gov/mas/ian/build/groups/public/@tg_ian/documents/webcontent/tg_ian_003364.pdf

2017: https://www.census.gov/foreign-trade/statistics/highlights/top/top1712yr.html

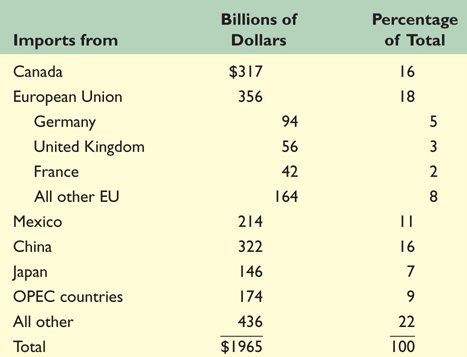

1. US Trading PartnersFrom whom do we buy the most ?

2017 Imports

https://www.census.gov/foreign-trade/statistics/highlights/top/top1712yr.html#imports

2007

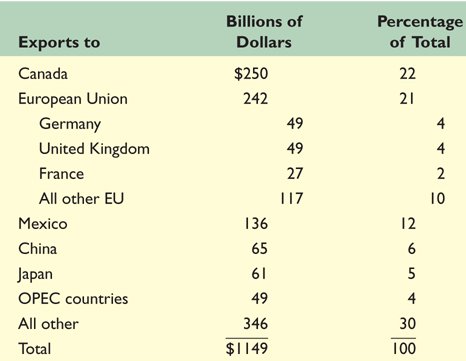

To whom do we sell the most ?

2017 Exports

https://www.census.gov/foreign-trade/statistics/highlights/top/top1712yr.html#exports

2007

2017 Total Trade

https://www.census.gov/foreign-trade/statistics/highlights/top/top1712yr.html

2. What do we trade?

What are the principal US exports?

Principal US Exports of Goods

2017: http://www.worldstopexports.com/united-states-top-10-exports/

- Machinery including computers: US$201.7 billion (13% of total exports)

- Electrical machinery, equipment: $174.2 billion (11.3%)

- Mineral fuels including oil: $138 billion (8.9%)

- Aircraft, spacecraft: $131.2 billion (8.5%)

- Vehicles: $130.1 billion (8.4%)

- Optical, technical, medical apparatus: $83.6 billion (5.4%)

- Plastics, plastic articles: $61.5 billion (4%)

- Gems, precious metals: $60.4 billion (3.9%)

- Pharmaceuticals: $45.1 billion (2.9%)

- Organic chemicals: $36.2 billion (2.3%)

2007: (in Billions of Dollars)

What are the principal US Imports?

Principal US Imports of Goods (2007, in Billions of Dollars)

2017: http://www.worldstopexports.com/united-states-top-10-imports/

- Electrical machinery, equipment: US$356.8 billion (14.8% of total imports)

- Machinery including computers: $349.1 billion (14.5%)

- Vehicles : $294.6 billion (12.2%)

- Mineral fuels including oil: $204.2 billion (8.5%)

- Pharmaceuticals: $96.4 billion (4%)

- Optical, technical, medical apparatus: $86.2 billion (3.6%)

- Furniture, bedding, lighting, signs, prefab buildings: $67.2 billion (2.8%)

- Gems, precious metals: $60 billion (2.5%)

- Plastics, plastic articles: $54.9 billion (2.3%)

- Organic chemicals: $46.1 billion (1.9%)

2007:

3. International Comparisons

Which countries export the most?

Total Exports: % of World

2009

2006

2011

- China 10.2%

- US 8%

- Germany 8%

- Japan 4.5%

- Netherlands 3.5%

- France 3.2%

- South Korea 2.5%

- Italy 2.4%

2016: https://www.worldatlas.com/articles/exports-by-country-20-largest-exporting-countries.html

2017: https://www.statista.com/statistics/264623/leading-export-countries-worldwide/

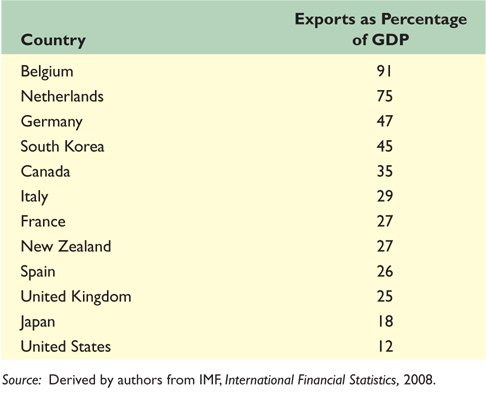

Exports as a Percentage of GDP

2008

2011

- Belgium 82%

- Netherlands 81%

- Germany 50%

- United Kingdom 32%

- Canada 31%

- Spain 30%

- New Zealand 30%

- Itasly 29%

- France 28%

- Japan 18%

- US 14%

2016: https://www.theglobaleconomy.com/rankings/Exports/

How can exports be more than 100% of its GDP?

The US leads the world in the combined volume of exports AND imports.

Summary:

Major Exporters:

- US

- Western Europe

- Japan

- China

New Participants in International Trade

- China and Hong Kong

- Singapore, South Korea, Taiwan

(combined export more than France, Britain, or Italy)- also Malaysia and Indonesia

- Eastern Europe (Poland, Hungary, Czech republic)

- maybe Russia

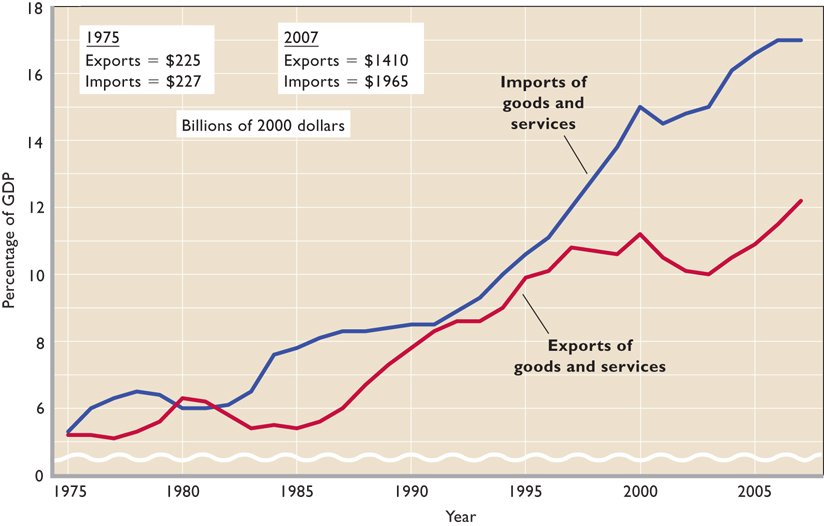

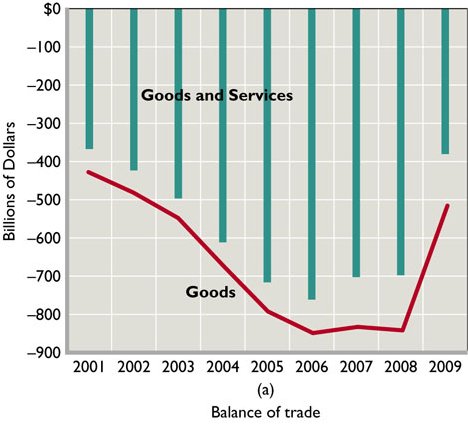

4. Growth of Trade

a. US trade as a percentage of GDP

(note the trade deficit)

b. Why has trade increased?

(1) Improvments in transportation technology (Costs)

(2) Improved Communications Technolgy (internet)

(3) General Decline in Tariffs (Structural Adjustment)