1. utilityThe want-satisfying power of a good or service; the satisfaction or pleasure a consumer obtains from the consumption of a good or service2. total utility / graph

The total amount of satisfaction derived from the consumption of a single product or a combination of products.3. marginal utility

a. definitionThe extra utility a consumer obtains from the consumption of one additional unit of a good or service;b. calculation

equal to the change in total utility divided by the change in the quantity consumed.MU =

TU /

Qconsumed

c. graph

1. yellow page2. textbook

d. law of diminishing marginal utility

As a consumer increases the consumption of a good or service the marginal utility obtained from each additional unit of the good or service decreases.3. MU, demand, and elasticity

a. Diminishing MU explains the law of demandb. MU and elasticity

(1) if MU declines quickly as more is consumed, then demand is less elasticExplanation:if the price declines, only A LITTLE more will be purchased since LITTLE extra utility is recieved

Demand is less elastic

(2) if MU declines slowly as more is consumed, then demand is more elastic

Explanation:if the price declines, A LOT more will be consumed since the MU of these additional units remains HIGH

Demand is more price elastic

B. Consumer Choice and the Budget Constraint: Utility Maximizing Rule (benefit-cost analysis)

1. assumptionsa. rational behavior

b. preferences are known and measurable

c. budget constraint

d. prices2. utility maximizing rule

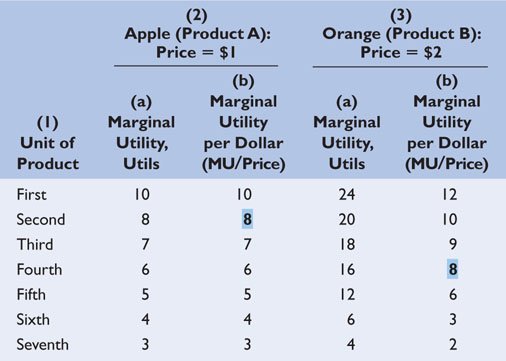

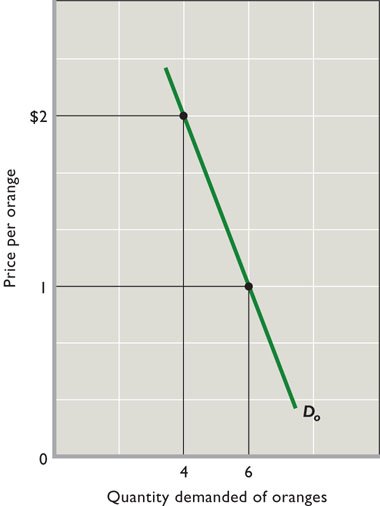

To obtain the greatest utility the consumer should allocate money income so that the last dollar spent on each good or service yields the same marginal utility.MUx/Px = MUy/Py = MUz/Pz (see below)

3. But this is really just Benefit-Cost Analysis (see Ch 1):

a. Benefit-Cost-Analysis:select all where: MB > MC

up to where: MB = MC

but never where: MB < MCb. utility maximizing rule:

MBx = MUx/PxThe MB of product X can be measured by finding the MU per dollar spent on product X

Why divide by price?

- because you cannot compare a $1 beer with a $3 steak sandwich

- dividing by price means that we are comparing a dollar's worth of beer with a dollar's worth of a steack sandwich

MCx = MUy/Py

The MC of product X can be measured by finding the MU that you are not receiving from a dollar's worth of your next best alternative (product Y)

Therefore:

MB = MCor

MUx/Px = MUy/Py = MUz/Pz

To obtain the greatest utility the consumer should allocate money income so that the last dollar spent on each good or service yields the same marginal utility.

4. example 1:

A consumer is consuming the following quantities of two goods both with a price of $1 and recieving the MU indicated:

Quantity: MU Received from the last unit: Good A (price $1)

10 60 Good B (price $1)

8 80 Is this consumer maximizing his/her utility?

If not, should they consume :

(1) more A and less B? or

(2) more B and less A?If one more of B is consumed and one less of A is consumed:

What happens to the MU of B and the MU of A?

What happens to the TU received?

What happens to the total dollars spent?

5. example 2: beer and steaks (yellow page)