|

OPTIONAL:

- For table of the US Business cycle:

http://www.nber.org/cycles.html

- Here are examples of the types of news

articles that you should better understand

after completing this chapter: :

|

Introduction

Macroeconomics vs. Microeconomics

We have defined economics as the study of

how we choose to use limited resources to

obtain the maximum satisfaction of unlimited

human wants

Macroeconomics Issues

The issues discussed in macroeconomics are:

1. full employment

2. price stability

3. economic growth

We have already discussed the importance of these topics

in reducing scarcity and receiving the maximum satisfaction

possible from our limited resources.

The Business Cycle

Over time the levels of unemployment (UE), inflation (IN)

and economic growth (EG) in an economy tend to fluctuate.

These fluctuations can be illustrated on a graph of the

business cycle.

1. Economists have given terms to the four

phases of the business cycle:

a. #1 = peak

b. #2 = recession

c. #3 = trough

d. #4 = recovery

During each phase of the business cycle the

macroeconomic issues (UE, IN, and EG) change in a

particular way:

Peak:

During the peak of the business cycle economic

activity (output) is at its highest, therefore

unemployment is very low, but inflation is high.

Recession:

During the recession economic output declines ( a

recession is defined as six months of declining

output), therefore unemployment is rising and

inflation is declining.

Trough

During the trough economic output is is at its lowest,

therefore unemployment is at its highest and inflation

at its lowest.

Recovery:

During the recovery economic output increases,

therefore unemployment is declining and inflation is

rising.

The primary causes of the changes in output reflected

in the business cycle are changes in spending. This could

be changes in consumer spending (C), government spending

(G), business spending on new capital (I), or purchases

by foreigners Xn).

Notice that even though economic activity historically

has been cyclical there is a

secular trend

upward over time (see red

arrow in the graph below). Notice the each successive

peak is higher than the previous peak.

In the twentieth century there were 20 recessions in

the United States.

The last recession of the 20th century ended in 1991

and the US, are enjoyed it longest recovery ever. . .

until March 2001 when we experienced a short recession.

In 2008 the US economy entered another reseccion where

unemployment reached around 10%

OPTIONAL: Table listing dates and length of business

cycle recessions and recoveries - http://www.nber.org/cycles.html

Outline of Chapter 6: Macroeconomic Concepts and the

role of Price "Stickiness"

1. How well is the economy doing?

a. Real GDP (real Gross Domestic Output)

(1) nominal GDP

(2) real GDP

b. Unemployment

(1) 5 Es Definition

(2) Common Definition

c. Inflation

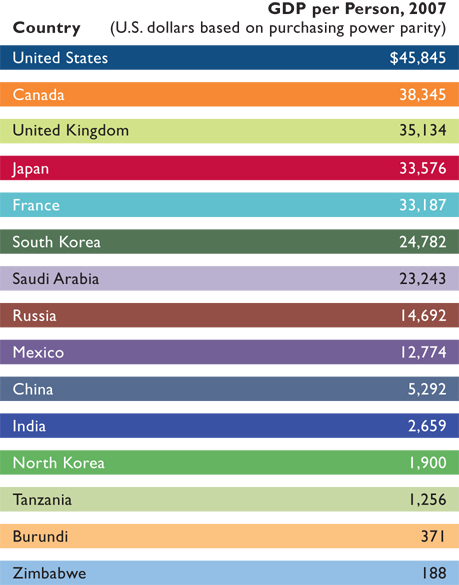

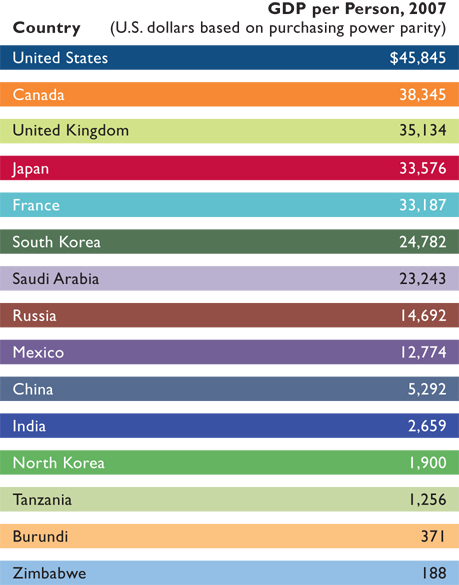

2. The Miracle of Modern Economic Growth

a. growth before the industrial revolution

(1) output growth

(2) output per capita growth

(3) result:

(a) no change in living standards

(b) little difference between living

standards

b. modern economic growth

(1) industrial revolution: output grows

faster then population

(a) not all countries

(b) even small increases in output result in

large increases oin living standards over

time

- rule of 70

- If a $10,000 GDP per capita increases by

2% a year

- how long will it take to double to

$20,000

- how long will it take to quadruple to

$40,000

- how long will it take to reach

$80,000

(c) results in vast differences inliving

standards

3. Savings, Investment, and Choosing between Present

and Future Consumption

a. Review: Production Possibilities Model:

Present Choices Future Possibilities

b. Savings

c. Investment

(1) financial investment

(2) economic investment

d. economic investment is ultimately limited by the

amount of savings, and more savings now depends on

less consumption now

e. the role of banks

4. Uncertainty, Expectations, Demand Shocks, and

Supply Shocks

a. definitions

b. demand shocks and flexible prices: producing the

full employment output

c. demand shocks and sticky prices: fluctuations in

GDP and employment

5. How Sticky are Prices?

6. Macroeconomic models and Price Stickiness

A Model of the Macro Economy: Aggregate Demand (AD)

and Aggregate Supply (AS)

We have already discussed the Supply and Demand

model to determine individual prices and quantities. That

was a microeconomic model. The key word is "individual"

product or "individual" industry.

In macroeconomics we study the whole, or "aggregate",

economy. Our new AGGREGATE supply and AGGREGATE demand

model looks similar to the supply and demand model, but

they are NOT the same! We are now discussing the whole

economy, so AD is the demand for all products in an

economy and AS is the supply of all products.

|

Supply and Demand for an INDIVIDUAL

product

|

AGGREGATE Supply and AGGREGATE

Demand

|

|

|

|

Aggregate Demand

Definition

Aggregate demand is the demand of all products in an

economy - OR the relationship between the Price Level and

the level of aggregate output (real GDP) demanded.

Be able to define:

- Aggregate Demand

- Real Domestic Output (RDO) which can be measured

by real GDP

- real GDP

- Price Level

Graphically: down-sloping -- why?

Economists have three explanations of why the AD

curve is downward sloping from left to right. They are:

- the real-balances (wealth) effect

- the interest-rate effect

- the foreign purchases effect

We want to understand why if the Price Level increases

the amount of aggregate output (real GDP) demanded

decreases. Why is the AD curve downward sloping from left to

right?

Price Level

Amount

of output demanded Amount

of output demanded

We always want to understand why the graphs that we use

in economics have the shapes that they do? Are their shapes

realistic?

The real-balances (wealth) effect:

When the average level of prices in the economy

increases, why do consumers, governments, business and

foreigners purchase less?

One reason is the wealth effect. When the price level

in the economy increases what happens to the real value,

or the purchasing power, of financial assets (of money

you have saved) and why do we then buy less?

Price Level

real value of financial

wealth ?

real value of financial

wealth ?  Amount of output demanded

Amount of output demanded

Well, when the

Price Level

real value of financial

wealth

real value of financial

wealth

Amount of output demanded

Amount of output demanded

because they now have less real wealth.

The interest-rate effect:

When the average level of prices in the economy

increases, why do consumers, governments, business and

foreigners purchase less?

Another reason is the interest rate effect. When the

price level in the economy increases what happens to the

interest rates and why do we then buy less ?

Price Level

interest rates ?

interest rates ?

Amount of output demanded

Amount of output demanded

Well, when the

Price Level

interest rates

interest rates

Amount of output demanded

Amount of output demanded

because people will buy less of those things for

which they have to borrow money.

The foreign purchases effect :

When the average level of prices in the economy

increases, why do consumers, governments, business and

foreigners purchase less?

The third reason is the foreign purchases effect. When

the price level in the US economy increases what happens

to the relative prices of foreign products and why are

fewer American products purchased ?

Price Level

relative price of foreign

products ?

relative price of foreign

products ?  Amount of output demanded

Amount of output demanded

Well, when the

US Price Level

relative price of foreign

products

relative price of foreign

products

Amount of US output demanded

Amount of US output demanded

because people will now buy more of the now

relatively cheaper foreign products.

Changes in AD

Just like with supply and demand in the individual

product market, there are determinants that will shift the

AS and AD curves. These determinants are the REAL WORLD

EVENTS that cause the graphs to shift. remember, that our

goal is to better understand what causes the business cycles

-- or what causes UE, IN, and EG to change.

Increase in AD

(shifts to the right)

|

Decrease in AD

(shifts to the left)

|

|

|

|

In the following discussion the double arrow ( )

means "causes". It is important that you get the

cause-effect in the correct order. The direction of the

arrow matters )

means "causes". It is important that you get the

cause-effect in the correct order. The direction of the

arrow matters

Just like with demand in the individual product market,

there are determinants of AD that, if they change, will

shift the AD curve. They are:

- change in consumer spending (C)

C

AD

AD

C

AD

AD

- change in Investment spending (I)

(Note: "Investment" does NOT mean buying stocks and

bonds. Investment occurs when business buy capital.

Remember that capital is NOT money. Capital is a

manufactured resources. capital is something that is

produced that is used to produce something else. So if I

buy 100 shares of Stock in Microsoft, that is NOT and

investment, but if a carpenter buys a hammer, or if

Microsoft builds a new office building, THAT is an

"investment".)

I

AD

AD

I

AD

AD

- change in Government purchases (G)

G

AD

AD

G

AD

AD

- change in Net Exports (Xn)

Xn

AD

AD

Xn

AD

AD

- change in Money Supply (S)

MS

Interest Rates

Interest Rates  I

I

AD

AD

MS

Interest Rates

Interest Rates  I

I

AD

AD

- change in Taxes (T)

T

C

C

AD

AD

T

C

C

AD

AD

- change in Saving (S)

S

C

C

AD

AD

S

C

C

AD

AD

Summary of the determinants of AD:

But what causes these things to change? Well, economists

have identified some determinants of the main components of

spending: C, I, G, and Xn.

Determinants of C, I, G, and Xn:

C = consumer spending (and saving)

1. consumer wealth

Wealth

C

C

AD

AD

Wealth

C

C

AD

AD

2. consumer expectations

Expected future Income

C today

C today

AD today

AD today

Expected future Income

C today

C today

AD today

AD today

3. consumer indebtedness

Consumer Debt

C

C

AD

AD

Consumer Debt

C

C

AD

AD

4. taxes

T

C

C

AD

AD

T

C

C

AD

AD

I = investment spending

1. interest rates (money supply)

MS

Interest Rates

Interest Rates  I

I

AD (memorize this, it will help in

future chapters)

AD (memorize this, it will help in

future chapters)

MS

Interest Rates

Interest Rates  I

I

AD

AD

|

I know the textbook does not mention

"money supply", but it will in unit 3. So,

we might as well learn it now.

|

2. profit expectations on investment projects

profit expectations

I

I

AD

AD

profit expectations

I

I

AD

AD

3. business taxes

Business Taxes

I

I

AD

AD

Business Taxes

I

I

AD

AD

4. technology

technology

I

I

AD

AD

5. degree of excess capacity

excess (unused) plant capacity

I

I

AD

AD

excess (unused) plant capacity

I

I

AD

AD

G = government purchases

Xn = net export spending

- net income abroad

Income in Foreign Countries

Xn

Xn

AD

AD

Income in Foreign Countries

Xn

Xn

AD

AD

- exchange rates

value of the US dollar

Xn

Xn

AD

AD

value of the US dollar

Xn

Xn

AD

AD

Aggregate Supply (AS)

Definition

Aggregate Supply is the supply of all products in an

economy - OR the relationship between the Price Level and

the level of aggregate output (real GDP) supplied.

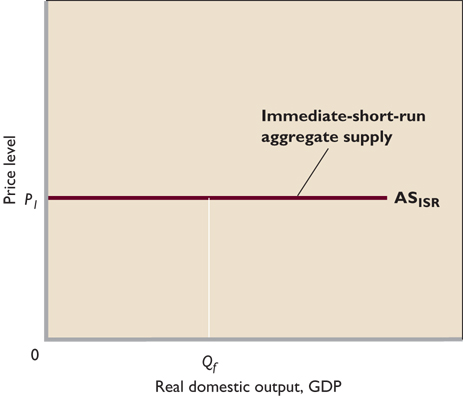

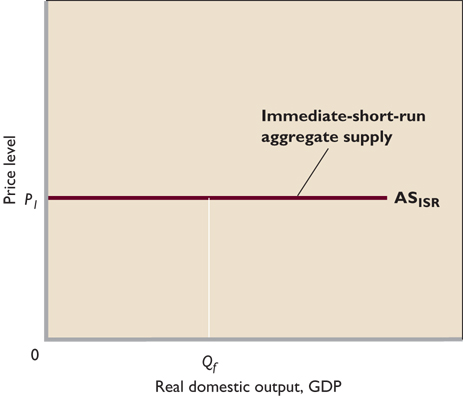

Immediate Short-Run AS

Assumption: both input prices and output

prices are fixed (do not have time to chnge)

How long it is depends on the type of firm

Input price can be fixed in the immediate short run

and in the short run by contracts. for example labore

unions sign two year contracts and their wages won't

change until the end of the contract.

Output prices are fixed only in the immediate short

run. Usually this is because firms set their prices

for their customers and then agree not to change them

for awhile.

Result:

How much is supplied then depends only on

how much is spent (aggregate spending) and the AS

curve is horizontal.

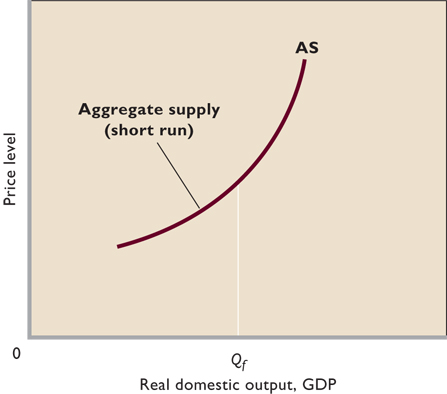

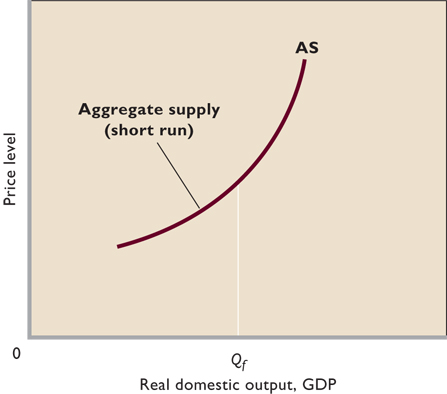

Short Run AS

Assumtion: input prices are fixed, or highly

inflexible, as explained above, but output prices can

change.

Note that not all input prices are completely

fixed, some can change a bit.

Graph is upward sloping because if the price level

increases (i.e. people are willing to pay more for

products), this will increase profits of firms

(because revenues are higher, but imput prices are

fixed). So at the higher price level and therefore

higher profits, businesses will produce more.

Why is the graph "curved" upwards will be explained

below.

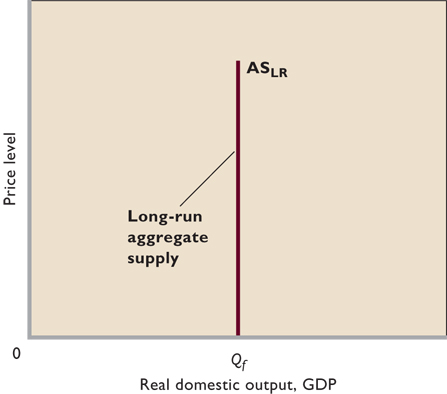

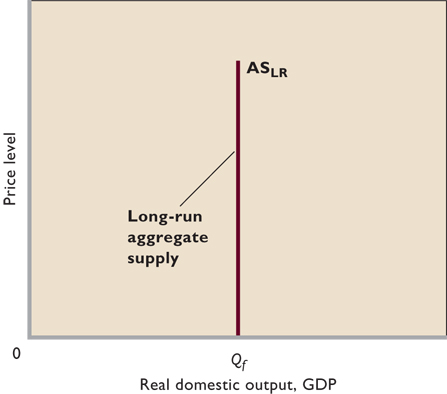

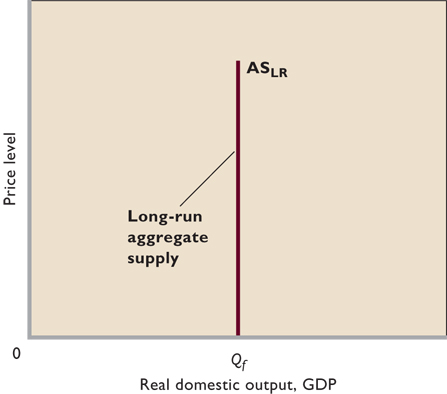

Long Run AS

Assumption: both input and output prices are

flexible.

AS graph is vertical meaning that in the long run

the economy will produce the full employment level of

output no matter what the price level is. Why?

If people are willing to buy more by

paying more you would think that firms will want to

produce more. But if in order to produce more they

must also pay more for resources (since all are

already being used and they will have to pay more

to draw them away from other firms) then input

prices will rise and there is no increase in

profits to encourage firms to produce more.

A combined (simplified model)

The textbook says

"The immediate-short-run aggregate supply curve,

theshort-run aggregate supply curve, and the long-run

agregate supply curve are all important. . . . But our

focus in the rest of this chapter and the several

chapters that immediately follow will beon the short-run

aggregate supply curve. . . . our emphasis on the

short-run agregate supply curve stems fromour interest in

understanding the business cycle in the simplest possible

way. It is a fact that real-world economices typically

manifest simultaneous changes in both their price levels

and their levels of real output."

Graphically

Graphically, we would expect the AS curve to be

upward sloping. If businesses can get a higher price for

their products (higher price level) then they will want

to produce MORE. So the AS curve should be upward

sloping.

But, remember that the price level is the

average level of ALL prices in the economy, therefore, if

the price level increases, the price of resources will

also increase. Higher resource prices will encourage

businesses to produce LESS. So maybe the AS curve should

be downward sloping????

Some economists graph the AS curve like in the graph

below to handle this problem:

Shape

We can identify three different parts, or

ranges, to the AS curve:

1. Keynesian (horizontal) range

2. classical (vertical) range

3. intermediate (up-sloping) range

In the Keynesian or horizontal range the level of

output in the economy is low. Very little is being

produced so there are a lot of resources NOT being used.

Businesses are therefore able to produce more output

without having to pay more for the additional resources.

Since many resources are unemployed, businesses will not

have to pay a higher price to employ them. Therefore,

they can produce more without having to raise the price

(note how the price level is constant (does not increase)

in the Keynesian range of the AS curve.

In the Classical or vertical range of the AS curve

there are no more resources available. ALL are being

used. So all businesses together cannot produce any more

since there are no more resources to use. But, if some

businesses try to produce more by enticing resources away

from other businesses with higher resource prices (higher

wages for example) they will have to raise their prices

to cover the higher costs - BUT the amount produced in

the whole economy will stay the same since no additional

resources are being available. So, the AS curve is

vertical indicating no additional output even at higher

price levels.

In the intermediate range the AS curve begins to rise

slowly as a few resources begin to run out and at higher

levels of output the AS curve becomes steeper as the

economy runs out of even more resources, until it is

vertical when all resources are being used and it is not

possible to produce any more output.

Aggregate Supply and Full Employment

If we want to use the AS-AD model to better

understand the macroeconomic issues of UE, IN. and EG,

then we need to be able to locate the "full employment

level of output" - the amount of GDP that can be produced

if all resources are being used.

You would think that this would occur where the AS

curve is vertical, but what do we really mean by "full

employment"? Does this mean all resources, including

labor, working everyday day for as many hour as is

physically possible? Or does it mean "full employment"

under "normal" conditions where people work maybe 40

hours a week? They retire at age 65 and don't begin to

work until age 18 or 22? If this is our definition of

"full employment", then it would be possible to produce

more than the full employment level of output by having

people work 50, 60, 70, 80, or even more hours a week.

People could never retire and just keep working until

they die, etc. If this happened then MORE would be

produced. But this isn't really what we mean when we say

"full employment". Therefore, it is possible to produce

more than the "normal" full employment level of

output.

The graph below shows how we can illustrate this level

of output under normal conditions of full employment.

Note that at levels of output beyond the full

employment level (beyond RDO-FE) the price level

increases dramatically resulting in high inflation,

therefore some people define the full employment level of

output as the amount of output that can be produced and

still maintain low inflation.

Changes in AS

Increase and decrease in AS

Increase in AS

(shifts to the right)

|

Decrease in AS

(shifts to the left)

|

|

|

|

Determinants of AS

Just like with supply in the individual product

market, there are determinants of AS that, if they

change, will shift the AS curve. They are:

a. change in input prices

price of resources

AS

AS

price of resources

AS

AS

1) labor

2) land (OPEC)

[OPTIONAL: http://news.bbc.co.uk/hi/english/business/the_economy/newsid_300000/300492.stm]

3) capital

4) entrepreneurial ability

b. changes in the productivity of resource

productivity

AS

AS

productivity

AS

AS

Be sure to know the difference between:

1) Productivity

- output per unit of resource

2) production

- the quantity produced

3) productive efficiency

- producing at a minimum cost (5 Es)

c. legal-institutional environment

business taxes and gov't red tape

AS

AS

business taxes and gov't red tape

AS

AS

1) business taxes and subsidies

2) government regulation (red-tape)

Summary of the Determinants of AS

Macroeconomic Equilibrium

Equilibrium

You can use the AS-AD graph to find the

equilibrium price level and the equilibrium level of

output. We can then figure out what happens to US, IN and

EG. The equilibrium level of output ant he equilibrium

price level will occur where the two lines cross.

In this economy the level of real domestic output

(real GDP) will move toward RDO1 and the price level will

move toward PL1.

Changes in AD and the Macroeconomic Issues

The reason we have developed the AS-AD model is to better

understand UE, IN, and EG.

Employment

If the equilibrium level of output is below the full

employment level as in the graph above the result is

unemployment.

Inflation

Demand-pull inflation is inflation caused by an

increase in AD. As you can see on the graph below, if

there is an increase in AD the price level increases.

Inflation is the rate of increase in the price level.

A decrease in AD will cause the level of output to

decline indicating higher unemployment.

But what happens to the price level when AD decreases?

Normally we would expect the price level to decline from

PL to PL' on the graph below if AD decreases, but can you

remember a time when the price level (the average level

of ALL prices in the economy) decreased? It doesn't

happen very often. Business are more willing to raise

their prices (causing more inflation) than they are to

decreases their prices (causing deflation). Economists

call this the ratchet effect. Like a ratchet that

only works in one direction, prices more easily move in

one up than down. Sometimes it is said that prices are

"sticky downwards".

On the graph then, if AD decreases instead of going

from "a" to "b" (less output and a lower price level),

the economy goes from "a" to "c" since prices are sticky

downwards and tend not to decrease. Therefore the price

level stays the same (at PL), but the level of output

drops even more (from RDO-FE to RDO2 instead of only to

RDO1).

The causes of the ratchet effect are listed below. For

several reasons businesses are reluctant to lower prices

even when faced with lower aggregate demand.

a) Wage contracts often mean that

businesses have to increase their costs even if AD

decreases.

b) If businesses lower wages so that they can lower

their prices, this may have an adverse effect on

morale and productivity

c) If businesses lower wages so that they can lower

their prices, they may lose some of best workers in

which they have invested much in

training

d) To lower their prices business would like to

decrease their labor costs (wages), but they may not

be able to because of the minimum wage

laws.

e) Some firms may fear price wars meaning if

they lower their price, then their competitors will

match their price decrease or even lower their prices

even more.

f) Finally, businesses may have monopoly

power, giving them more control over their prices

and they may choose to take smaller profits rather

than lowering their prices.

Changes in AS and the Macroeconomic Issues

A decrease in AS would decrease output and raise the

price level. This would result in more unemployment and more

inflation. We call this inflation "cost-push" inflation. It

is inflation caused by a decrease in AS.

Stagflation

A decrease in AS results in "stagflation". Stagflation

is a decrease in output (an increase in unemployment)

accompanied by an increase in inflation - a STAGnant

economy with inFLATION. It is caused by a decrease in

AS.

An increase in AS would increase output and lower the

price level. This would result in less unemployment and

less inflation.

Economic Growth

What about economic growth? Our textbook

discusses three definitions of economic growth

- Increasing our POTENTIAL OUTPUT (chapter 1; the

5Es definition)

- Increasing Output, (chapter 8)

- Increasing Real GDP per capita (chapter

8)

(1) Increasing our POTENTIAL OUTPUT

I like to call this increasing our ABILITY to

produce. This is the definition we used in the

5 Es

lesson. This is the most fundamental definition of

economic growth. It is the type of economic growth

used on our 5 Es diagram.

We can increase our ABILITY to produce goods and

services (or increase our POTENTIAL GDP) if we

get:

- more resources

- better resources, and

- better technology

Since this increases maximum output that we are

able to produce it shifts the PPF outward. On the

graph below, economic growth would cause the PPF to

move from PP1 to PP2.

This doesn't necessarily mean that the economy IS

producing more, just that it CAN produce more. To

achieve our new potential levels of output we also

need full employment and productive efficiency. It

could be possible to have this type of economic growth

so that we CAN produce the quantities represented by

point E, but if there is unemployment and productive

inefficiency we would be at a point beneath this new

curve (maybe point C). So we may get new resources or

new technology so we CAN produce more (point E on

PP2), but if we don't use the new resources (i.e. we

have unemployment) or if we don't use the new

technology (i.e. we have productive inefficiency) , we

may remain on PP1 (point C).

In the AS-AD model INCREASING OUR POTENTIAL OUTPUT

is represented by in INCREASE IN AS.

Notice that when AS increases, the full employment

level of output increase from RDO-FE1 to RDO-FE2. This

is an increase in our potential level of output.

In the 5 Es lecture we said that economic growth is

caused by:

- more resources

- better resources, or

- better technology

An increase in the production possibilities curve

is caused by having more resources, better resources,

or better technology.

An increase in AS is caused by:

- a decrease in the price of resources

- an increase in productivity

- lower business taxes and government red

tape

These are all really the same thing.

(2) Increasing Output (increasing real GDP)

The most commonly used definition of economic

growth is simply producing more. (Later we will call

this INCREASING REAL GDP.) When an economy increases its

output it is often said to have achieved economic growth.

But if by producing more we are simply ACHIEVING OUR

POTENTIAL, then we could also say that it is REDUCING

UNEMPLOYMENT or ACHIEVING PRODUCTIVE EFFICIENCY. On our

production possibilities graph this would be represented

by moving from point D to a point on the curve.

On our AD-AS model we could illustrate this type of

growth (achieving our potential) by an increase in

AD.

Notice that output increase from RDO-EQUIL to RDO',

but the full employment level of output, which is our

potential level of output, does not change (RDO-FE).

If AD increases so that the new equilibrium is at the

full employment level of output, it is analogous to going

from a point inside the production possibilities curve to

a point on the curve.

(3) Increasing Real GDP per capita

This means increasing output per person. GDP per

capita is calculated by dividing output by the

population.

SUMMARY OF THE TYPES OF ECONOMIC GROWTH

|

ECONOMIC GROWTH

Increasing output by INCREASING THE

POTENTIAL

(Called "economic growth" on our 5Es model)

|

ECONOMIC GROWTH

Increasing output by ACHIEVING THE

POTENTIAL

(Called "reducing unemployment" on our 5Es

model)

|

|

|

|

Using the AS / AD Model

Now that we have introduced the AS / AD model, let's

learn how to use it. The exam 2 extra credit essay

question will be a lot like these examples.

EXAMPLE 1

Read this short article from cnnfn.com.

Analyze the article by:

(1) Identifying the determinants of AD and/or AS

that have changed.

This is important. It all begins with a CHANGE in one of

the determinants of AD or AS. You MUST memorize these

determinants and know which ones shift the AD curve and

which shift the AS curve!

(2) Then graph the changes on the AS-AD model.

Next, you must know which way the determinants will shift

the curve.

(3) Finally use your graph to discuss has happened to

UE, IN, and EG.

|

|

German

GDP grows 0.7%

|

|

Export

increase lifts economy; OECD raises

estimate of growth rate

|

|

May

30, 2000: 7:08 a.m. ET

|

|

|

LONDON (CNNfn) - German first-quarter

gross domestic product increased 0.7

percent from the previous three-month

period, as expected, helped by demand

for exports, the Federal Statistics

Office said on Tuesday.

The German economy, Europe's biggest,

expanded by 3.3 percent in the first

quarter of 2000 compared to the same

period a year ago, the strongest annual

rate of growth since the first quarter

of 1998.

The quarter-over-quarter growth rate

matched the 0.7 percent pace recorded

in the three months ended Dec. 31,

aided by a decline in the euro that has

made exports cheaper. Economists now

predict full-year growth of more than 3

percent.

"It's a very good start to the year

2000 and clearly indicates the upswing

is intact and growth is accelerating,"

said Manuela Preuschl, an economist at

Deutsche Bank in Frankfurt.

The Organization for Economic

Cooperation and Development Tuesday

raised its forecast for German economic

growth, predicting GDP would rise 2.9

percent this year and 3 percent in

2001, as exports remain strong and tax

cuts boost domestic demand.

In the first quarter, exports grew 15.3

percent from a year earlier while

imports rose 11.9 percent. Gross

investment in plant and equipment

increased 5.7 percent. The pace of

growth in private consumption weakened

to 0.9 from a year earlier, compared

with 2.2 percent in the fourth quarter

of 1999.

--from staff and wire reports

|

|

Original AS/AD graph:

Determinants that are mentioned in the article:

"German

first-quarter gross domestic product increased 0.7

percent from the previous three-month period, as

expected, helped by demand for exports, the

Federal Statistics Office said on Tuesday."

So: Xn

AD AD

ALSO:

"The

Organization for Economic Cooperation and Development

Tuesday raised its forecast for German economic

growth, predicting GDP would rise 2.9 percent this

year and 3 percent in 2001, as exports remain strong

and tax cuts boost domestic demand."

So:

Taxes Taxes

C

C    AD AD

Draw the changes on the graph:  AD

AD

What happened to UE, IN, and EG as a result of these

changes?

Since equilibrium RDO increased from RDOequil

to RDO' we can conclude that unemployment (UE)

decreased and economic growth (EG) increased. The

price level rose slightly from PL to PL' so maybe

inflation (IN) increased a little.

EXAMPLE 2

Read this short article from http://news.bbc.co.uk.

Analyze the article by identifying the determinants of AD

and/or AS that have changed. Then graph the changes

on the AS-AD model. Finally use your graph to discuss has

happened to UE, IN, and EG.

[http://news.bbc.co.uk/hi/english/business/the_economy/newsid_300000/300492.stm]

Again, be sure to follow the same three steps:

(1) Identifying the determinants of AD and/or AS

that have changed.

This is important. It all begins with a CHANGE in one of

the determinants of AD or AS. You MUST memorize these

determinants and know which ones shift the AD curve and

which shift the AS curve!

(2) Then graph the changes on the AS-AD model.

Next, you must know which way the determinants will shift

the curve.

(3) Finally use your graph to discuss has happened to

UE, IN, and EG.

|

Wednesday,

March 24, 1999 Published at 10:34 GMT

Business:

The Economy

OPEC

slashes oil production

Oil

producers finally agree to restrict

output

Ministers

from oil producing countries have agreed to cut

global production by 7% to bolster depressed oil

prices.

The

members of the Organisation of Petroleum

Exporting Countries (OPEC) and others meeting in

Vienna have agreed to a reduction in output of

2.1m barrels a day until April next

year.

Saudi

Oil Minister Ali al-Naimi said the new

restrictions were aimed at lifting oil prices

back to $18 a barrel within a year.

. . .

. . .

Inflation

fears

However,

this would hit consumers hard, perhaps

rekindling inflation.

The oil price has increased 30% in the last

month on the belief that OPEC would finally

agree to cap output. Oil has risen from its low

in December of below $10 a barrel, for Brent

crude for May delivery, to $13.75 as the

decision was announced.

. . .

. . . .

|

Original AS/AD graph:

Currently the economy of the United States is

operating at the full employment level of output as shown

in the graph below:

Determinants that are mentioned in the article:

"The

oil price has increased 30% in the last month on the

belief that OPEC would finally agree to cap output.

Oil has risen from its low in December of below $10 a

barrel, for Brent crude for May delivery, to $13.75 as

the decision was announced."

So the determinant that has changed is the Price of

Resources:

Price of resources

AS

AS

Draw the changes on the graph:  AS

AS

What happened to UE, IN, and EG as a result of these

changes?

Since equilibrium RDO decreased from RDO1 to

RDO' we can conclude that UE increased and EG decreased.

The price level will rise from PL1 to PL' indicating

inflation. With output down and prices up, this increase

in oil prices may result in stagflation.

EXAMPLE 3

Is an increase in exports good for an economy? Most

students will quickly answer "yes" to this question, as

would most newspaper writers. But WE know better. It

depends.

Currently the economy of the United States is operating

at the full employment level of output as shown in the graph

below:

An increase in exports will do what to the graph above?

An increase in exports will increase AD.

GRAPH IT!

The result: INFLATION! So is an increase in exports good

for THIS economy? NO.

But, if initially the economy is experiencing high

unemployment like in the graph below:

Then, an increase in exports would increase AD and move

the economy closer to the full employment level of output

with only a little inflation. See graph:

This would of course be good for the economy. So is an

increase in exports good for an economy? - - It depends.

EXAMPLE 4

Now you try it. Read this short article from cnn.com.

Analyze the article by identifying the determinants of AD

and/or AS that have changed. Then graph the changes

on the AS-AD model. Finally use your graph to discuss has

happened to UE, IN, and EG.

Remember to:

(1) Identify the determinants of AD and/or AS

that have changed.

This is important. It all begins with a CHANGE in one

of the determinants of AD or AS. You MUST memorize

these determinants and know which ones shift the AD

curve and which shift the AS curve!

(2) Then graph the changes on the AS-AD model.

Next, you must know which way the determinants will

shift the curve.

(3) Finally use your graph to discuss has happened

to UE, IN, and EG.

MORE EXAMPLES / REVIEW:

For more exercises see: http://www.harper.cc.il.us/mhealy/eco212i/lectures/asad/adasprac.htm

Macroeconomic Policies

Now that we have this handy tool, let's use it to discuss

government policies (NOTE: when I use the term "policies", I

always mean "government policies"). What is the role of the

government in a market economy? In a market economy

(capitalist economy) the government has a limited role, but

some people believe that the government should try to help

the economy maintain full employment and low inflation. We

have discussed in the 5 Es lesson that unemployment results

in greater scarcity since some resources are not being used

so less will be produced. Government policies may be able to

help the economy achieve full employment and therefore

reduce scarcity.

In a previous chapter we discussed the five economic

functions of governments in capitalist economies. Here we

will begin our discussion of how to "promote stability".

|

Economic Functions of Government in a

Market (Capitalist) Economy

- Providing the legal structure

- Maintaining competition

- Redistributing income

- Reallocating resources

- negative externalities

- positive externalities

- public goods and services

- Promoting

stability

|

Stabilization Policies

Definition: government policies design to reduce

unemployment (UE) and/or inflation (IN). All the policies

discussed here can be classified as stabilization

policies.

There are two major types of stabilization

policies:

- demand-management policies

- supply-side policies

Demand-Management Policies

Definition: Policies design to shift the AD

curve in order to reduce unemployment or to reduce

inflation.

Tools -- Some of the determinants of AD can be

manipulated by the government to achieve these goals.

There are two types of demand-management policies

depending upon WHO conducts the policy:

- fiscal policy is undertaken by the

president and the congress, and

- monetary policy is undertaken by the

Federal Reserve Board (often called the "fed").

FISCAL POLICY

There are two types of fiscal policy:

- expansionary fiscal policy

- contractionary fiscal policy

The goal of expansionary fiscal policy is to reduce

unemployment. Therefore the tools would be an increase in

government spending and/or a decrease in taxes. This

would shift the AD curve to the right increasing real GDP

and decreasing unemployment, but it may also cause some

inflation.

The goal of contractionary fiscal policy is to reduce

inflation. Therefore the tools would be an decrease in

government spending and/or an increase in taxes. This

would shift the AD curve to the left decreasing

inflation, but it may also cause some unemployment.

MONETARY POLICY

There are two types of monetary policy

- easy money

- tight money

The goal of an easy policy is to reduce unemployment.

Therefore the tool would be an increase in the money

supply. This would shift the AD curve to the right

decreasing unemployment, but it may also cause some

inflation.

MS

¯ Interest Rates

¯ Interest Rates  I

I

AD

AD

The goal of a tight money policy is to reduce

inflation. Therefore the tool would be a decrease in the

money supply. This would shift the AD curve to the left

decreasing inflation, but it may also cause some

unemployment.

MS

Interest Rates

Interest Rates  I ¯

I ¯

¯

AD ¯

AD

"Supply-Side Economics"

Supply-Side economic policy occurs when the government

tries to increase the AS curve. this will reduce both

unemployment and inflation.

There are three determinants of AS:

a. change in input prices

price of resources

AS

AS

b. changes in the productivity of resource

productivity

AS

AS

c. legal-institutional environment

business taxes and gov't red tape

AS

AS

Supply-Side Policies

Supply-side policies try to increase

productivity. Often this includes less government

regulations. Also, in the 1980s President Reagan

decreased marginal income tax rates as a supply-side

policy (sometimes called "Reaganonmics"). The idea was

that people will work more if they can keep more of

their income

We have said that decreasing income taxes will

INCREASE AD. But here we said that it may also

INCREASE AS. Which is it? both may be true, but the

effect on AD is probably quicker. In this class a tax

cut will increase AD, UNLESS we mention that is is a

"supply-side" tax cut. Then we will increase the AS

curve.

REVIEW

More on the Long-Run Aggregate Supply

Definition: Short-run and long-run.

For macroeconomics the short-run is a period in which

wages (and other input prices) do not respond to price

level changes because workers may not be fully aware of

the change in their real wages due to inflation (or

deflation) and thus have not adjusted their labor supply

decisions and wage demands accordingly or employees hired

under fixed wage contracts must wait to renegotiate

regardless of changes in the price level.

In the long run the aggregate supply curve is vertical

at the economy's full-employment output. The curve is

vertical because in the long run resources prices adjust

to changes in the price level, leaving no incentive for

firms to change their output.

Why is the long run aggregate supply curve vertical?

Let's see what happens first in the short run

(assuming wages do not change), and then see what happens

when wages do change. (Note: when wages change the short

run aggregate supply curve will change - this is the

price of resources determinant.)

INFLATION

Let's begin by seeing what happens if there is

demand-pull inflation. If AD increases it will in the

short run increase the price level and increase real

output. On the graph below this can be illustrated as an

increase of AD from AD1 to AD2 and the equilibrium point

moves from "a" to "b". So the price level rises from P1

to P2 and output increases from Qf to Q2. (Note that Qf

is the "full employment level of output.) Earlier we

discussed how an economy can produce more than the full

employment level of output.

What happens when workers see that prices are rising

but their wages are staying the same? Remember, by

definition, in the short run wages do not change, but

they can in the long run. An economy can temporarily

produce more than the full employment level as people

work more than they want to, but in the long run they

will demand higher wages. When wages increase this will

be an increase in the price of resources and the the

short run AS curve will decrease, shift to the left. On

the graph below this is a movement from AS1 to AS2 and

the economy moves from point "b" to point "c". This

causes the price level to rise from P2 to P3 and the

level of output decrease back to the full employment

level (from Q2 to Qf). The long run result is that the

level of output in the economy has stayed at Qf and the

price level has risen. The long run aggregate supply

curve is therefore vertical (the blue line below).

What happens in the long run if in the short run there

is cost-push inflation? Cost push inflation is caused by

increases in the cost of production at each price level

maybe caused by the increase in the price of a key

resource. This shifts the short run supply to the left on

the graph below from AS1 to AS2. the result is that the

economy moves from point "a" to point "b" and there is a

recession (unemployment increases) and inflation. Earlier

we called this "stagflation". What should the government

do?

If government attempts to maintain full

employment by using expansionary fiscal or monetary

policy to increase AD (from AD1 to AD2 on the graph

above) an "inflationary spiral" may occur. If

government doesn't do anything when there is cost push

inflation, a recession will occur with high

unemployment and a loss of real output.

RECESSION

When aggregate demand shifts leftward a recession

occurs. Let's see what will happen in the short run

and in the long run. If prices and wages are

downwardly flexible, the price level will fall form P1

to P2 when AD decreases from AD1 to AD2. With the

price level falling the real wages of workers (i.e.

the purchasing power of their wages) increases. It's

as if they are being paid more. Since businesses are

selling less and getting less, but workers are getting

more, business owners will want to reduce the wages of

their workers restoring their purchasing power to what

it was before the recession started. This decrease in

wages will cause an increase in the short run AS

(price of resources determinant) and the economy will

move from point "b" to point "c". So, in the long run

(remember that "long run" means that wages have time

to change) the economy is back at the full employment

level of output but the price level is lower. Again,

the long run aggregate supply curve is vertical.

This is the most controversial application of this

new "extended" AD-AS model. The key point of dispute

is how long it would take in the real world for the

necessary price and wage adjustments to take place to

increase AS and bring the economy back to full

employment. If policy makers think that it will take a

long time to move back to full employment then they

may want to enact some expansionary fiscal or monetary

policy. BUT, if the prices and wages change quickly,

then the government does not have to do anything. If

there is a recession they can just wait a short time

and the economy will quickly adjust back to full

employment.

Economic Growth and the Long Run Aggregate Supply

Now we can add another graph to illustrate

economic growth

|