|

Get this right: THE FED DOES NOT SET

INTEREST RATES. I know you will read in the news that the

"Fed has increased interest rates". But the Fed does NOT

change interest rates. Banks set their own interest rates,

BUT the Fed can cause banks to raise or lower their

rates.

Also, the Fed does not change the

money supply (MS). As we learned in the previous lesson

(15a) banks create money and therefore banks change the

money supply, NOT THE FED. But you may ask, didn't we say in

lesson 12c that the Fed changes the MS? Yes we did, but we

didn't say how they do it. We will do that here.

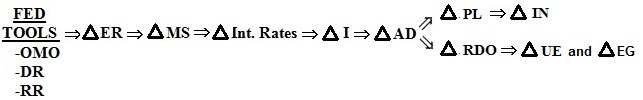

We will learn that the Fed has three

tools to control the MS: open market operations (OMO), the

discount rate (DR), and the required reserve ratio (RR). The

Fed uses these three tools to change the excess reserves

(ER) of banks. And, as we learned in the previous lesson

(15a) if banks have more ER they can make more loans and

increase the money supply (MS) and if banks have fewer ER

they make less loans and decrease the MS.

Finally, as we learned in lesson 12c,

when the MS changes this causes interest rates to change.

When interest rates change then this causes Investment (I)

to change (and also consumption [C]). When

Investment (I) changes it causes aggregate demand (AD) to

change. When AD changes it causes a change in the price

level (PL) and real domestic output (RDO). When the PL

changes it causes a change in inflation (IN) and when RDO

changes it causes a change in unemployment (UE) and economic

growth (EG).

To understand how monetary policy

(MP) works you need to get the CAUSE and EFFECT order

correct. What CAUSES what? The " "

symbol below means CAUSES. Notice that is an arrow pointing

only in one direction meaning that what comes before CAUSES

what comes after. For example: not studying "

symbol below means CAUSES. Notice that is an arrow pointing

only in one direction meaning that what comes before CAUSES

what comes after. For example: not studying  lower grades.

lower grades.

Memorize the following. Practice

writing it until you get it correct.

|