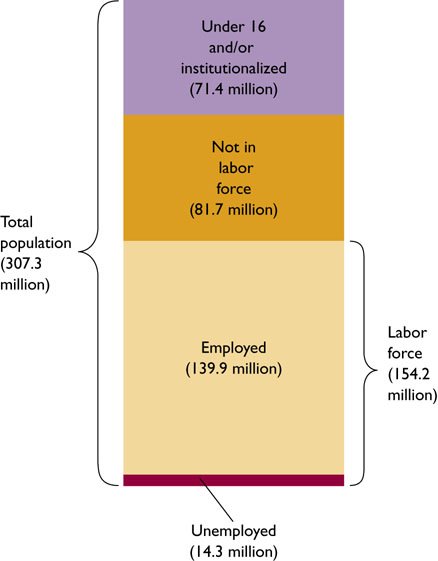

1. UE

2. IN

3. EG

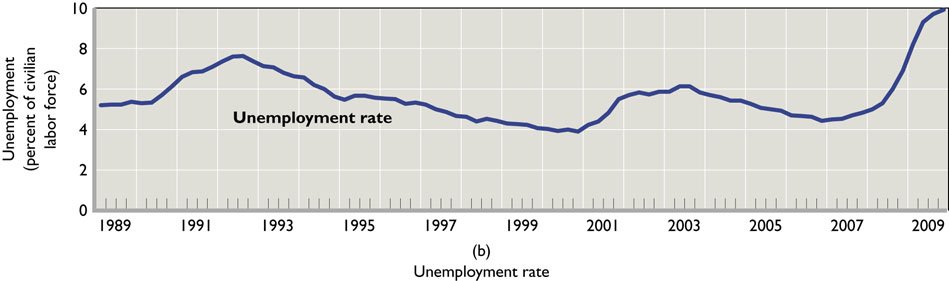

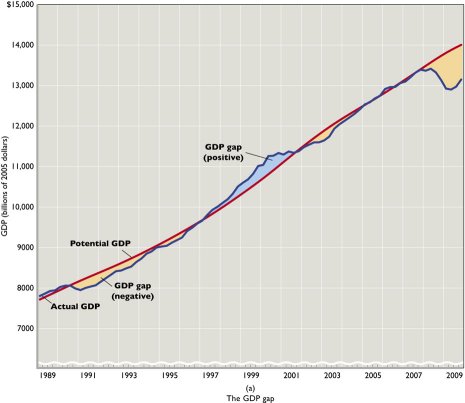

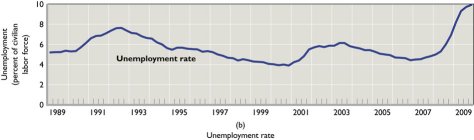

B. Review: The Business Cycle (graph)

C. Review: Maximizing Satisfaction (5Es)

D. Why Business Cycles? (Causation at First Glance)

- From Chapter 6:

- fluctuations are caused by "shocks"; unexpected events that people and firms may have trouble adjusting to

- and price stickiness in the short run prvents markets form adjusting quickly resulting in changes in output and employment

- Why are there shocks? (20th: pp. 197-198; 19th: pp.

172-173; "Causation: A First Glance")

- irregular innovations

- unexpected productivity changes

- monetary factors

- political events

- financial instability (rapid asset price increases and decreases)

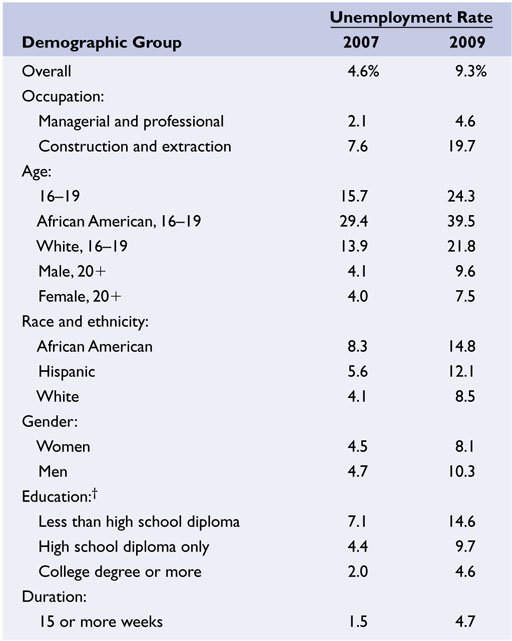

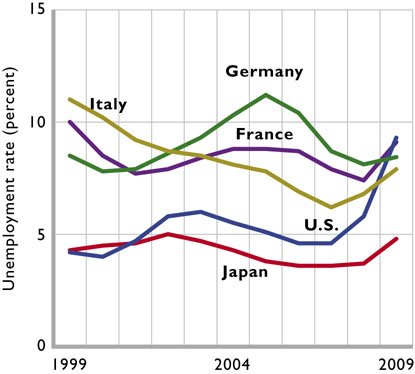

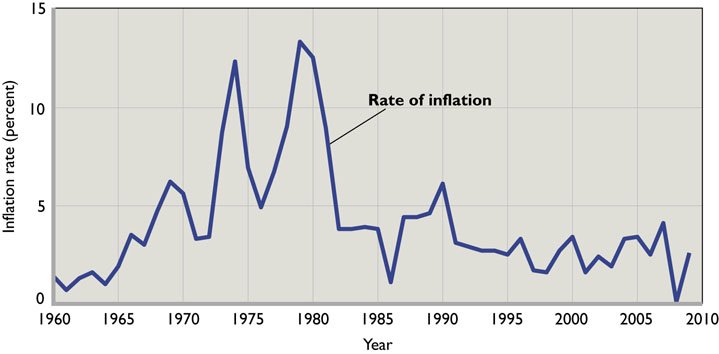

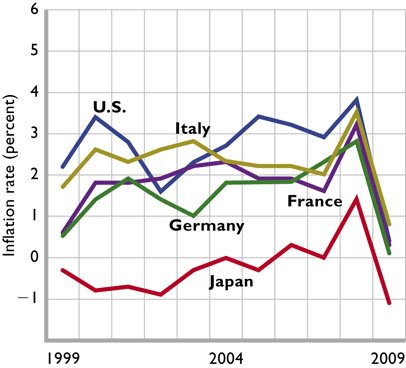

- Recession of 2007-2009

- housing prices

- Most agree that the level of aggregate spending is important, especially changes on capital goods and consumer durables.