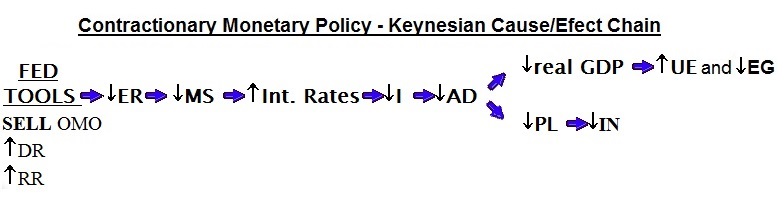

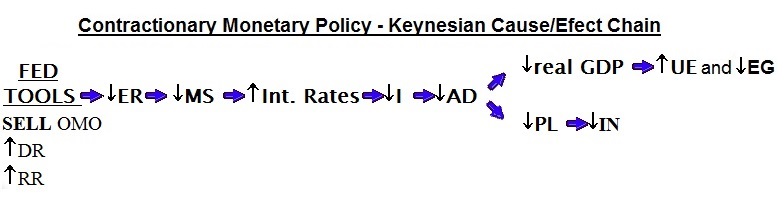

1. occurs when the Fed tries to increase money supply by

expanding excess reserves in order to stimulate the economy.

2. GOAL: to reduce unemployment

3. The Fed will enact one or more of the following

measures.

a. The Fed will buy securities.

b. The Fed may reduce reserve ratio, although this is

rarely changed because of its powerful impact.

c. The Fed could reduce the discount rate, although

this has little direct impact on the money supply.

4. Expansionary or easy money policy: The Fed takes steps to

increase excess reserves, banks can make more loans increasing the

money supply, which lowers the interest rate and increases

investment which, in turn, increases GDP by a multiple amount

of the change in investment.

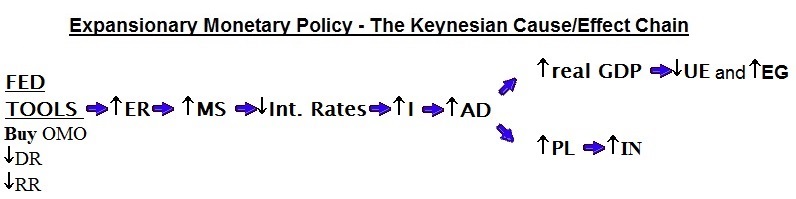

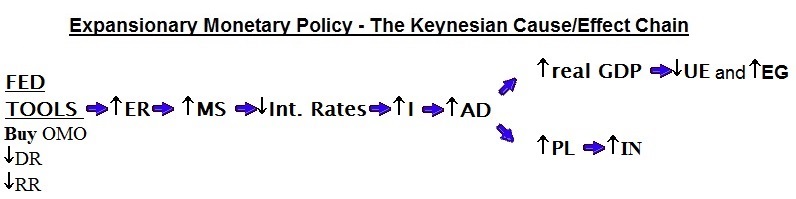

1. occurs when Fed tries to decrease money supply by

decreasing excess reserves in order to slow spending in the

economy during an inflationary period.

2. GOAL: to reduce inflation

3. The Fed will enact one or more of the following

policies:

a. The Fed will sell securities.

b. The Fed may raise the reserve ratio, although this

is rarely changed because of its powerful impact.

c. The Fed could raise the discount rate, although it

has little direct impact on money supply.

4. Contractionary or tight money policy is the reverse of an

easy policy: Excess reserves fall, the money supply decreases,

which raises interest rate, which decreases investment, which, in

turn, decreases GDP by a multiple amount of the change in

investment.