OUTLINE -- CHAPTER 7

Measuring the Economy

For Online Lecture see: http://www.harpercollege.edu/mhealy/eco212i/lectures/ch7-18.htm

Lectures

7a Measuring the Economy: GDP

I. Introduction

A. Macroeconomics Issues1. UE

2. IN

3. EGB. Measuring the Economy's Performance = Measuring Economic Growth

1. real domestic output

2. price level

II. Measuring Real Domestic Output: Gross Domestic Product (GDP)

Populations:

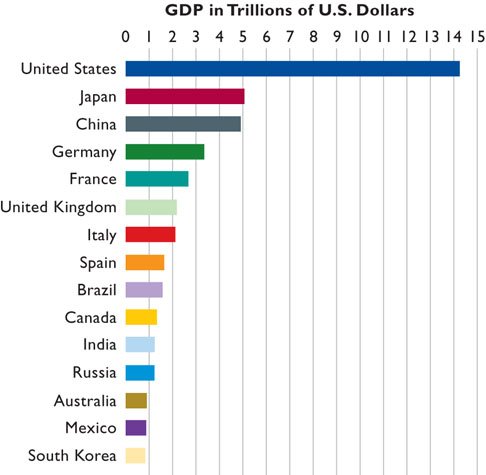

2007

NOTE: 2009data

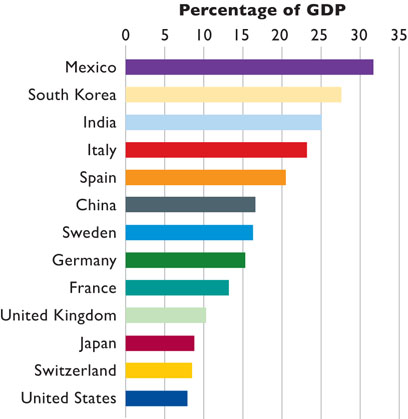

Note, that if you wish to COMPARE countries you should use GDP PER CAPITA which is GDP divided by the country's population (GDP per person).

- Even though the United States has the world's largest GDP, it is not the highest GDP per capita.

- For a table of GDP per capita see: http://www.nationmaster.com/graph/eco_gdp_percap-economy-gdp-per-capita

A. Definition: GDP

1. definition: GDP is the total market value of a final goods and services produced in the economy in one year2. market value: unit of measure for real domestic output (a monetary measure)

3. final goods: avoid double counting

a. final goods

b. intermediate goods4. produced in one year

a. secondhand sales are not included

b. financial transactions not included

REVIEW:

Which of the following are actually included in this year’s GDP? Explain your answer in each case.

a. Interest on an AT&T bond.b. Social security payments received by a retired factory worker.

c. Unpaid services of a family member in painting the family home.

d. The income of a dentist.

e. The money received by Smith when she sells her economics textbook back to the bookstore.

f. The monthly allowance a college student receives from home.

g. Rent received on a two-bedroom apartment.

h. The money received by Josh when he resells his current-year-model Honda automobile to Kim.

i. The publication of a college textbook.

j. A 2-hour decrease in the length of the workweek.

k. The purchase of an AT&T corporate bond.

l. A $2 billion increase in business inventories.

m. The purchase of 100 shares of GM common stock.

n. The purchase of an insurance policy.

C. Shortcomings of GDP (YELLOW PAGE)

GDP is often used a a measure of Economic Well-Being in a country, but there are problems:

Problems with using GDP to Measure the Standard of Living:

1. non-market transactions are not included in GDP

2. leisure increases the standard of living but it isn't counted

3. improved product quality often isn't accounted for in GDP

4. GDP does not account for the composition of output

5. GDP does not account for the distribution of output

6. increases in GDP may harm the environment and decrease the standard of living

7. the underground economy produces goods and services but they are not included in GDP

8. GDP does not account for a possible future decline in output due to resource depletion.

9. Noneconomic Sources of Well-Being like courtesy, crime reduction, etc., are not covered in GDP.

10. We must use per capita GDP to compare the living standards of different countries.1. GDP doesn’t measure some very useful output because it is unpaid (homemakers’ services, parental child care, volunteer efforts, home improvement projects). Called non-market transactions

2. GDP doesn’t measure improvements in product quality unless they are included in the price.

3. GDP doesn’t measure improved living conditions as a result of more leisure.

4. GDP makes no value adjustments for changes in the composition of output. Nominal GDP simply adds the dollar value of what is produced; it makes no difference if the product is a semiautomatic rifle or a jar of baby food.

5. GDP makes no value adjustments for changes in the distribution of income. Per capita GDP may give some hint as to the relative standard of living in the economy; but GDP figures do not provide information about how the income is distributed.

6. GDP does not include output from the Underground Economy. Illegal activities are not counted in GDP (estimated to be around 8% of U.S. GDP). Legal economic activity may also be part of the “underground,” usually in an effort to avoid taxation.

2007-2009

7. GDP and the environment:

- The harmful effects of pollution are not deducted from GDP (oil spills, increased incidence of cancer, destruction of habitat for wildlife, the loss of a clear unobstructed view).

- GDP does include payments made for cleaning up oil spills and the cost of health care for cancer victims.

- Resource depletion could result in lower future output

8. Noneconomic Sources of well-being like courtesy, crime reduction, etc., are not covered in GDP.

9. GDP does not account for a possible future decline in output due to resource depletion.

10. Per-capita income should be used to compare the economic well-being of different countries.

Which country has a higher GDP, Switzerland or India? Which has a higher level of economic well-being:

- Switzerland:

- GDP: $239.3 billion (2003)

- Population: 7,450,867 (2003)

- GDP per capita: $32,700 (2003)

- India:

- GDP: $3.033 trillion (2003)

- Population: 1,065,070,607 ( 2003)

- GDP per capita: $2,900 (2003)

GDP per capita = GDP / population

REVIEW:

Do each of the following cause GDP to OVERSTATE the economic well-being of a country or UNDERSTATE it?

1. non-market transactions (Does GDP OVERstate or UNDERstate economic well-being?)

not included so, GDP UNDERstates well-being.

2. improved product quality (Does GDP OVERstate or UNDERstate economic well-being?)

not accounted for, so GDP UNDERstates well-being.

3. more leisure (Does GDP OVERstate or UNDERstate economic well-being?)

not accounted for, so GDP UNDERstates well-being.

4. the composition of output (Does GDP OVERstate or UNDERstate economic well-being?)

if "bad" things are being produced, then GDP OVERstates well-being.

5. the distribution of income (Does GDP OVERstate or UNDERstate economic well-being?)

an unequal distribution of income would result in GDP OVERstating the well-being of most of a country's population

6. the underground economy (Does GDP OVERstate or UNDERstate economic well-being?)

not accounted for, so GDP UNDERstates well-being

7. GDP and the environment (Does GDP OVERstate or UNDERstate economic well-being?)

harmful effects of pollution and costs of pollution reduction are not deducted from GDP, so GDP OVERstates well-being.

8. Non-economic sources of well-being (Does GDP OVERstate or UNDERstate economic well-being?)

not accounted for, so GDP UNDERstates well-being

9. Resource depletion (Does GDP OVERstate or UNDERstate economic well-being?)

GDP overstates well-being since when we are depleting the resources our GP is high, but in a future with fewer resources GDP will be lower

10. per-capita income (Does GDP OVERstate or UNDERstate economic well-being?)

GDP OVERstates well-being in countries with large populations and UNDERstates well-being in countries with small populations

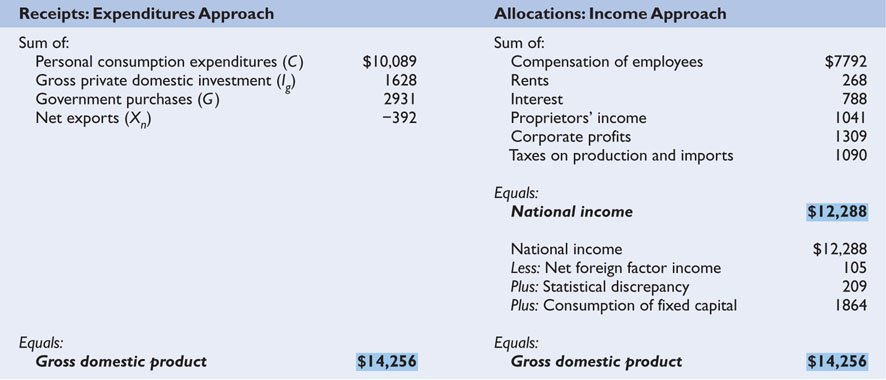

III. Measuring GDP - How do they get those numbers?

A. Introduction -- circular flow model1. two approaches to measuring GDP - spending and incomea. expenditures (spending) approach

b. income approach

- Arrow # 3 is real GDP. This is output produced by business and sold in the product markets.

- To measure this we can measure arrow #4 which are the expenditures spent on this output.

- We can also measure arrow #1 which is the income earned by households when they sell their resources (arrow #2) to businesses.

B. Expenditures Approach

- GDP = SUM P x Q

- GDP =

P this year x Q this year

- GDP equals the sum of the prices times quantities of everything produced in a year

GDP = C + I + G + Xn 1. personal consumption expenditures (C)

a. durable goods

b. nondurable goods

c. services2. gross private domestic investment (Ig)

a. includes:1) all final purchases of machinery, equipment, and tools by businesses

2) all construction (including factories, stores, etc. AND residential construction)

3) changes in inventories (positive and negative)4) does NOT include stocks, bonds., etc., (financial investments)

b. gross vs. net domestic investment (In)

I net = I gross - depreciationc. net investment and economic growth

1) expanding economy

2) static economy

3) declining economy

3. government purchases (G)

4. net exports (Xn)a) Xn - X - M

b) why subtract M?

2009 data

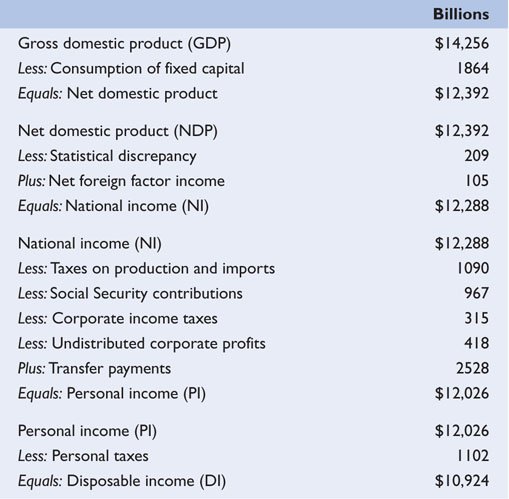

C. Income Approach --calculating national income (NI)

Using flow #1 to measure GDP (output)

NI = Wages + Rents + Interest + Corp. Profits + Prop. Income 1. circular flow: expenditures = income?

a. depreciation: consumption of fixed capital

b. indirect business taxes2. resource payments and taxes on production and imports

a. compensation of employees (wages)

b. rent

c. interest

d. profit1) proprietor's income

2) corporate profits

- corporate income taxes

- dividends

- undistributed corporate profits

e. taxes on production and imports

includes sales taxes, excise taxes, business property taxes, license fees, customs dutiesto account for expenditures that are diverted to the government (government income)

3. National Income to GDP

NI + net foreign factor income + Depreciation (CCA) + statistical discrepancy = GDP a. net foreign factor income

1) national income = income to Americans2) GDP includes domestic income = income earned in the US

b. depreciation (consumption of fixed capital)

4. Other Social Accounts

a. net domestic product (NDP) b. national income (NI) = income EARNED c. personal income (PI) = income RECEIVED d. disposable income (DI) = SPENDABLE INCOME

D: REVIEW:

1.

Use the data below to calculate the GDP of this economy using the expenditures approach. All figures are in billions.

Personal consumption expenditures

$400

Government purchases

128

Gross private domestic investment

88

Net exports

7

Net foreign factor income earned in the U.S.

0

Consumption of fixed capital

43

Indirect business taxes

50

Compensation of employees

369

Rents

12

Interest

15

Proprietors' income

52

Corporate income taxes

36

Dividends

24

Undistributed corporate profits

22

ANSWER:

From the table we get:

GDP = C + I + G

+

Xn

GDP = 400 + 128 + 88 + 7 GDP = C + I + G + Xn = 400 + 128 + 88 + 7 = $ 623

2.

Use the data below to calculate the GDP of this economy using the income approach. All figures are in billions.

Personal consumption expenditures

$400

Government purchases

128

Gross private domestic investment

88

Net exports

7

Net foreign factor income earned in the U.S.

0

Consumption of fixed capital

43

Indirect business taxes

50

Compensation of employees

369

Rents

12

Interest

15

Proprietors' income

52

Corporate income taxes

36

Dividends

24

Undistributed corporate profits

22

NI = Wages + Rents + Interest + Corp. Profits + Prop. Income From the table we get:

NI = Wages + Rents + Interest + Corp. Profits + Proprietor's Income NI = 369 + 12 + 15 + 82 + 52 NI = Wages + Rents + Interest + Corp. Profits + Prop. IncomeCorporate profits are used for three different purposes:

- Corporate income taxes = 36

- Dividends = 24

- Undistributed corporate profits = 22

Corporate profits then equal 36 + 24 + 22 = 82 . On the exams I will give you "corporate profits".

NI = 369 + 12 + 15 + 82 + 52 = $ 530

GDP = C + I + G + Xn = 400 + 128 + 88 + 7 = $ 623

As you can see, National income does not equal GDP. There are some expenditures (that are included in the expenditures approach) that are not income (therefore not included in the income approach). They are indirect business taxes ( 50), depreciation (43), and net foreign income factor ( 0 ), But, again, you won't have to do this in this course.

3.

Below is a list of domestic output and national income figures for a given year. All figures are in billions. The ensuing questions ask you to determine the major national income measures by both the expenditure and income methods. Answers derived by each approach should be the same.

a. Using the above data, determine GDP and NDP by the expenditure method.b. Calculate National Income (NI) by the income method.

Personal consumption expenditures..............

Net foreign factor income earned

Transfer payments...........................

Rents

Consumption of fixed capital (depreciation).......

Social security contributions

Interest.......

Proprietors’ income

Net exports..........................................

Dividends (part of corporate profits)

Compensation of employees.............

Indirect business taxes

Undistributed corporate profits (part of profits)....

Personal taxes

Corporate income taxes (part of corporate profits)....

Corporate profits

Government purchases........

Net private domestic investment

Personal saving...........$245

4

....12

14

....27

20

....13

33

.....11

16

....223

18

....21

26

....19

56

......72

33

.......20ANSWERS:

a. Using the above data, determine GDP and NDP by the expenditure method.

GDP = $388

GDP = C + Igross + G + Xn

Igross = Inet + depreciation = 33 + 27 = 60

GDP = 245 + 60 + 72 + 11 = 388NDP = $361

NDP + C + Inet + G + Xn

NDP = 245 + 33 + 72 + 11 = 361or

NDP = GDP - depreciation

NDP = 388 - 27 = 361b. Calculate National Income (NI) by the income method.

NI = $339

NI = wages + rents + interest + profits

profits = corporate profits + proprietor's income

profits = 56 + 33 = 89

NI = 223 + 14 + 13 + 89 = 339

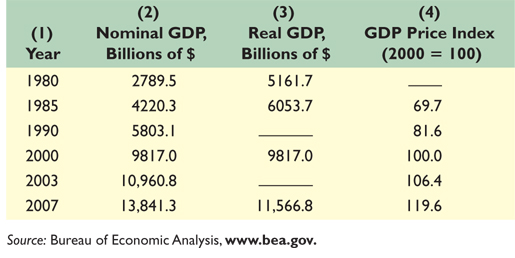

III. Nominal vs. Real GDP

Why?GDP is a monetary measure; market value ($) is used as the unit of measurebut the value of the dollar CHANGES

it would be similar to comparing your height with someone else's height but you are each using different measure of feet and inches.A. Definitions

1. nominal GDP

- nominal GDP = SUM P specific year x Q specific year

- specific year's prices times specific year's quantities

Nominal GDP = SUM (this year's prices x this year's quantities) =

P this year x Q this year

Therefore, if nominal GDP increases is it because we are producing more (Q this year ) or is it because the Price Level increased (

P this year ) ?

In fact it is possible for nominal GDP to INCREASE even though the quantity produced has DECREASED. How?

Nom. GDP =

P this year x Q this year

Nom. GDP =

P this year

x Q this year

So if we know that nominal GDP has increased, we still do not know if we are producing more (and reducing scarcity) or if the price level has just increased.

2. real GDP

- real GDP = SUM P base year x Q specific year

- specific year's quantities x base years prices

Real GDP = SUM (base year's prices x this year's quantities) =

P base year x Q this year

By using the same price level (base year prices) we remove the effects of a higher price level (inflation) and if REAL GDP increases we know that the economy is producing more and scarcity is being reduced

B. GDP Price Index (GDP deflator)

1. definitiona price index is a measure of the price of a specified collection of goods and services, called a "market basket", in a given year as compared to the price of an identical (or highly similar) collection of goods and services in a reference year (called the "base year")2. calculating a GDP price index

price index in a given year = (price of mkt basket in specific year / price of same mkt basket in base year) x 1003. calculating real GDP

real GDP = (nominal GDP / Price index) x 100

REVIEW

The following data show nominal GDP and the appropriate price index for several years.

Compute real GDP for each year. In which year(s) was there a recession (decline in real GDP)?. All GDP are in billions.

Nominal Price level

Year GDP index Real GDP

1 $117 120 ___

2 124 104 ___

3 143 85 ___

4 149 96 ___

5 178 112 ___

6 220 143 ___

The answers are below:

ANSWERS:

Nominal Price level

Year GDP index Real GDP

1 $117 120 $ 98

2 124 104 119

3 143 85 168

4 149 96 155

5 178 112 159

6 220 143 154

YEAR NOMINAL GDP PRICE INDEX

(2000 = 100)CALCULATE REAL GDP 1964

$ 663.6

22.13

|

1974

1500.0

34.73

|

1984

3933.2

67.66

|

1994

7072.2

90.26

|

2004

11,685.9

109.46

|

ANSWER

YEAR NOMINAL GDP PRICE INDEX

(2000 = 100)CALCULATE REAL GDP 1964

$ 663.6

22.13

$2,998.6

1974

1500.0

34.73

$4,319.0

1984

3933.2

67.66

$5,813.2

1994

7072.2

90.26

$7,835.4

2004

11,685.9

109.46

$10,755.5

: (inflating); (inflating); (inflating); (inflating); (deflating).