|

|||||

|

|||||

DAILY SCHEDULE OF ASSIGNMENTS: Click on date for reading and video assignments.

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

Reading: Videos: To watch 5 minute video: Outcomes / Must Know: Practice:

![]()

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

Extra

Reading: Videos: Poland: Outcomes / Must Know: Practice:

![]() (A free

registration is required for first time

users)

(A free

registration is required for first time

users)

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos

|

|

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

http://www.cnn.com/ALLPOLITICS/time/1999/12/06/free.trade.html

Questions # 1, 3, 4, 8-12, 14 Problems 1, 2, 3

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

Reading: Videos: Outcomes / Must Know: Practice:

Reading: Videos: Outcomes / Must Know: Practice: Chapter 12 Chapter 6

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos

Reading: Ch. 7: "GDP Price Index," pp. 141-142 Videos: Outcomes / Must Know: Practice:

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

Reading: Videos: Outcomes / Must Know: Practice:

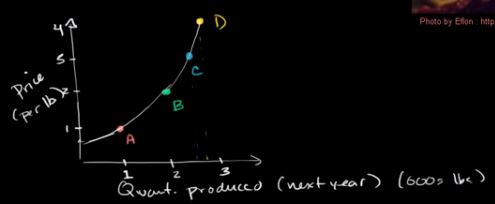

KEY GRAPHS

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

KEY GRAPHS:

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

KEY GRAPHS

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

KEY GRAPHS

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos:

VIDEO SOURCES: YouTube ACDCLeadership Macroeconomics Videos Many students like these videos. I believe that "Mr.

Clifford " began making these videos for his AP Economics

students. I have watched many, but not all, of these videos

and I usually like the way that he covers the topics. He

does go quite fast, so the videos may be better for

review than for an initial introduction to the

topics. Note that his "units" do not match our units and he

may cover more than we do in some areas but not all that we

do in other areas.

Macroeconomics

Playlists

TOPICS / LESSONS: Click on lesson number for assignments.

Unit 1: ECONOMICS and GLOBALIZATION

Unit 2: INTRODUCTION TO MACROECONOMICS

Unit 3: MACROECONOMIC POLICY