|

|||||

|

|||||

DAILY SCHEDULE OF ASSIGNMENTS: Click on dates below for the reading assignments, video assignments, outcomes, practice exercises, and key graphs for each lesson or chapter.

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

Reading: Macroeconomic by Campbell R.

McConnell, Brue, and Flynn, 19th edition, McGraw-Hill,

2012. Just the textbook. No textbook access codes. No

"Connect". NOTE: be sure to get the 19th

edition even though there is a 20th edition

available Videos: To watch 5 minute video: Outcomes / Must Know: Practice:

![]()

Extra Videos

The "5Es of Economics" are not from the textbook. I borrowed the concept (with many modifications) from another textbook many years ago. I believe it concisely explains the purpose of economics. Also, it begins to introduce students to the economic way of thinking. The economic problem that we all face, that all countries face, that the world faces, is SCARCITY. Economics is the study of how we can reduce scarcity. What I like about the 5Es model is that it shows us that there are only five ways to reduce scarcity. Only five. Simple.

For each of the 5Es (1) learn the defininition, (2) understand examples, and most importantly, (3) know how they reduce scarcity and help to maximize society's satisfaction.

This is where you learn that it may be good when the price of plywood increases greatly during a hurricane. And it might be good when Coca-Cola lays of one fifth of its workforce. Or, that the price of gasoline may be too low. Really.

Reading: Videos: Outcomes / Must Know: Practice:

So, do you agree that it is GOOD for the people of Florida if, after a hurricane strikes, the price of plywood (or other products) increases from $10 a sheet to $30 a sheet? Or, that it was GOOD when the Coca-Cola company (or other companies) layed off 6000 workers as they did in the year 2000 assuming that they could still produce the same quantity, but with fewer workers? Even if you do not agree, do you understand that these things will reduce scarcity and increase society's satisfaction? In chapter five we will learn why the price of gasoline, soda pop, and junk food, may be TOO LOW. (Isn't this fun?)

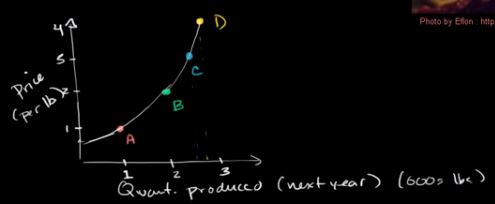

Lesson 1c introduces our first graphic MODEL: the budget line. For many students microeconomics is a difficult course. I think there are two reasons for this. First, we will learn therories or models, rather than facts. Facts are easy to memorize. Theories or models have to be learned and practiced. And second, we will express our theories or models on graphs, and many studetns do not like graphs. If you want to be successful you must learn to use our graphical models. You must be able to draw the graphs correctly from memory, you must understand what each line on the graph represents, and you must know why each line has the shape that it does: DEFINE, DRAW, DESCRIBE SHAPE. Study the graphs in the textbook carefully and plot all the graphs in the yellow pages. Finally, remember this: each point on a graph represents two numbers. It is that easy. Find a point on a graph, then find the two number from the graph's axes.

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos

Here we will study our second graphical model: the PPC, and we then will learn a tool for making decisions that we will use throughout the course: BCA. Basically what we are doing is setting the stage for making economic decisions. Remember: economics is the social science concerned with how we choose to use our limited resources to maximize society's unlimited wants, or, how we make decisions.

The production possibilities curve will show us that all decisions have costs. Economists call these "opportunity costs". ALL COSTS IN ECONOMICS ARE OPPORTUNITY COSTS. Whenever we discuss the "costs" of doing something we will mean the complete opportunity cost.

Benefit cost analysis is simple: to make the best decision we should select all options where the marginal benefits (MB) are greater than the marginal costs (MC) -- up to where MB = MC. When the MB = MC then we have made the best decision possible. NOTE: "marginal" means "extra" or "additional". So to make the best decision possible select all options where the extra benefits that you get from the decision are greater than the extra costs of the decision. One more thing: to make the best decisions we look only at MARGINAL costs and benefits and we ignore FIXED, or SUNK, costs.

Notice that economists look at EXTRA benefits and EXTRA costs. We call this "thinking on the margin". Students are used to thinking about TOTAL benefits and TOTAL costs. We do not want total benefits to equal total costs, but we do want MB to equal MC. You probably know that it is best if the total benefits are a lot higher than total costs. What you will learn is that when MB = MC, then the difference between total benefits and total costs will be the greatest.

What is the connection between the PPC and BCA? Well, when studying the PPC you will learn the important concept of "opportunity cost". Learn the definition well. Since all costs in economics are opportunity costs, then when using BCA, "marginal costs" mean the additional opportunity costs.

Reading: Videos: Outcomes / Must Know: Practice:

Extra

Reading: Videos: Poland: Outcomes / Must Know: Practice:

![]() (A free

registration is required for first time

users)

(A free

registration is required for first time

users)

Extra Videos

If the price of pizza goes up, what happens to the demand for pizza? NOTHING happens to the demand for pizza if the price changes!

The next three modules introduce the demand and supply model for explaining how prices arise and change in a market economy. Learn these modules well. Do the assigned problems. Draw the graphs in the yellow pages and while you are reading and studying. DRAW GRAPHS! Get used to using the graphs to help you answer questions. If you are avoiding drawing the graphs you will do poorly and not get the practice that you need to learn the concept.

So why doesn't the demand for pizza change if the price changes? Because economists have a different definition of "demand". Demand is NOT the quantity that we buy. If the price of pizza goes up we will buy less, but that is not what "demand" means in economics. Economists tend to be precise with their definitions and sometimes their definitions are different than the more commonly used definitions. Things like "scarcity", "investment", "cost", "demand", and "supply", have different definitions in economics than what you may already know. Learn our definitions! Demand is not how much we buy. Demand has a different definition in economics. "Demand" means the "demand graph".

Remember, that econmists use models (like the supply and demand model) to simplify the real world. They do this by isolating certain variables from all the clutter found in reality. Then by changing one variable at a time economists can see what effect it will have. In this module we will learn the economic definition of DEMAND and plot the demand graph. Then, we will look at one variable at a time to see what effect they have on the demand curve.. We call these variables the "non-price determinants of demand". They are: Pe, Pog, I, Npot, T. LEARN THEM! LEARN THEM WELL! Know how each one effects the demand curve. Be sure to do the yellow pages. If you will not learn how the non-price determinants of demand affect the demand curve you may as well drop the course now. Do the Yellow Pages and other Practice Activities until you understand the concept well.

Reading: Videos: AC Demand and Supply Explained 1 of 2 (6:42) AC Demand and Supply Explained 2 of 2 (4:56) AC Micro 2.1 Supply and Demand Curves- Basic Economic

Concepts (4:42) AC Micro 2.2 Supply and Demand (Economics) (2:01) AC Micro 2.3 Shifting Supply and Demand: Econ Concepts

in 60 Seconds Practice (2:50) AC Micro 2.4 Double Shifts in Supply and Demand: Econ

Concepts in 60 Seconds (2:33) EconMovies: Episode 4: Indiana Jones (Demand, Supply,

Equilibrium, Shifts) (7:02) Outcomes / Must Know: Practice:

Extra Videos

|

|

If the price of pizza goes up what happens to the SUPPLY of pizza? NOTHING! A change in the price of a product does not affect its supply, or its demand. When the price goes up the QUANTITY SUPPLIED will increase, but the supply does not change. Learn the difference between "supply" and "quantity supplied". "Supply" does NOT MEAN the quantity available for sale. Supply has a different definition in economics. "Supply" means the "Supply graph".

So what would cause the supply graph, or supply itself. to change? Those things that cause supply to change are called the "non-price determinants of supply". They are: Pe, POG, Pres, Tech, Tax, Nprod. See the Yellow Pages.

Remember, the goal of chapter 3 is to learn a model that will haelp us understand why prices are what they are and why they change. In the next lesson we will put demand and supply together and use the model (graph) to find the prices of products. Then, and more importantly, we will see ehat causes prices to change. If you hear on the.news or read in your news ap that the price of gasoline is going down, we will be able to explain WHY. The causes of changes in prices of products are the five non-price determinants of demand (Pe, Pog, I, Npot, T) and/or the six non-price determinants of supply (Pe, POG, Pres, Tech, Tax, Nprod.). Whenever you hear that the price of something is changing think of these 11 possible causes.

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos

We are going to learn two very important things in this lesson.

First, we will put demand and supply together and learn how to use the model to to see why products have the prices that they do and why those prices change. We will put demand and supply together and use the model (graph) to find the prices of products. Then, and more importantly, we will see what causes prices to change. If you hear on the news or read in your news app that the price of gasoline is going down, we will be able to explain WHY. The causes of changes in prices of products are the five non-price determinants of demand (Pe, Pog, I, Npot, T) and/or the six non-price determinants of supply (Pe, Pog, Pres, Tech, Tax, Nprod.). Whenever you hear that the price of something is changing think of which of these 11 possible causes have changed, draw the graph and shift the appropriate demand and/or supply graph, and the graph will show the price changing.

Second, we learn that in a competitive market economy the interaction of demand and supply will determine what the prices of products will be and how much people will buy at that price. Then, we will ask: Is this the allocatively efficient quantity and price? Our goal is to show that in a competitive market the price will change until allocative efficiency is achieved. In chapter 2 we learned that markets are efficient. That they will produce the quantity of goods that maximizes the society's satisfaction. Here will will show the allocativley efficient price and quantity on a graph. Competitive markets are efficient.

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

http://www.cnn.com/ALLPOLITICS/time/1999/12/06/free.trade.html

Questions # 1, 3, 4, 8-12, 14 Problems 1, 2, 3

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

Questions # 1, 3, 4, 8-12, 14 Problems 1, 2, 3

Extra Videos

In lesson 3c we learned that competitive markets are efficient and we learned two models to show that markets are efficient: (1) MSB = MSC, and (2) maximum consumer plus producer surplus. You must understand these models to understand chapter 5. In chapter 5 we learn that SOMETIMES markets are NOT efficient.

When are product markets not efficient?

In this lesson we also will begin our look at the role of the government in a market economy. This would be a good time to review chapter 2. In chapter 2 we learned that there is a limited role for government in market economies. We learned in lesson 3c that markets are efficient, so there is little need for the government. In this lesson we will see what happens if the government interferes in markets. We will learn that sometimes governments will set prices (price ceilings and price floors), rather than letting the market set the price. In other words: SOMETIMES GOVERNMENTS CAUSE ALLOCATIVE INEFFICIENCY. (This is the plywood after a hurricane example discussed in the 5Es reading.)

Then we will begin to look at examples of when the markets on their own fail to achieve allocative efficiency and examine what the government can do to correct these market failures. SOMETIMES MARKETS BY THEMSELVES ARE INEFFICIENT and the government may try to modify the market to help it achieve allocative efficiency. There are three MARKET FAILURES that we will look at in chapter 5. A "market failure" occurs when the market fails to achieve allocative efficiency. In lesson 5a we look at the market failure cause by negative externalities - when the supply curve does not include all of the costs to society of producing and consuming the product. Then in lesson 5b we look at the market failures of positive externalities and public goods.

We will assume that businesses will always produce the profit maximizing quanitity since that is their goal - to maximize profits. The profit maximizing quantity is also the equilibrium quantity that we studied in chapter 3, when the Qs = Qd. This is WHAT WE GET. We get whatever they produce and they will produce the quantity that gives them the biggest profits. The goal of business is not to be efficient. Their goal is to maximize their profits. If a business can make larger profits by being inefficient then they will be inefficient. Or if they can make larger profits by being efficient they they will be efficient. The main point is that efficiency is not their goal, rather maximizing profits is their goal.

The allocatively efficient quantity is what society wants. We learned at the end of chapter 3 that allocative efficiency occurs at the quantity where MSB = MSC. This is WHAT WE WANT. We want to maximize our satisfaction and we learned in chapter one that this occurs when we achieve the 5 Es. Allocative efficiency is one of the 5 Es.

When the profit maximizing quantity equals the allocatively efficient quantity then markets are efficient . This means that profit maximizing businesses are producing the quantity that maximizes society"s satisfaction. WHAT WE GET = WHAT WE WANT. This is the INVISIBLE HAND of capitalism that was discussed in chapter 2. It's as if there is an invisible hand guiding businesses to not only make decisions that maximize profits, but also to maximize society's satisfaction. As if they don't even know it is happening.

When markets fail to achieve allocative efficiency, the profit

maximizing quantity (WHAT WE GET or the equilibrium quantity from

chapter 3) is not the same as the allocatively efficient quantity

(WHAT WE WANT or the quantity where MSB=MSC). Since one of the

economic goals of government is to help the economy achieve

efficiency, governments often get involved to correct for market

failures. If the market produces too much (negative externalities;

allocative inefficiency; overallocation of resources) the government

tries to get it to produce less. If the market produces too little

(positive externalities and public goods; allocative inefficiency;

underallocation of resources) the government tries to get it to

produce more. Reading: Videos: Outcomes / Must Know: Practice:

We have learned that competitive markets are usually efficient. This is one of the benefits of a market economy or capitalism (chaprter 2) . But sometimes even markets can be allocatively inefficient. In lesson 5a we learned that when negative externalities exist, a market will produce too much of a good or service (an overallocation of resources) and therefore the government should tax the product (like gasoline taxes) to get consumers to buy less, i.e. without the tax the price of gasoline is too low.

In this lesson we will look at two other market failures, but this time the market produces too little (and underallocation of resources) because the demand curve for the product does not include all of the benefits. This occurs when there are positive externalities and when there are "public goods" Be careful - remember - economists often change the definitions of words. A public school or a public park are not public goods according to our definition. Since markets produce too little when there are negative externalities or public goods, the goal of government is to increase production.

In microeconomics we discuss another market failure: the lack of competition. If a market is not competitive, like when it is a monopoly, then profit maximizing businesses will produce less than the efficient amount. The invisible hand of capitalism does not work well if the market is not competitive.

Reading: Videos: Outcomes / Must Know: Practice:

Reading: Videos: Outcomes / Must Know: Practice: Chapter 12 Chapter 6

Key Graph:

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

![]() MS

MS![]()

![]() interest

rates

interest

rates![]()

![]() I

I![]()

![]() AD]

AD]

Key Graphs:

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

Key Graphs and Figures:

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

http://www.huffingtonpost.com/vicky-ramirez/africa-maps_b_5104777.html

Reading: Videos: Outcomes / Must Know: Practice:

KEY GRAPHS

Money Demand

Increase in the money supply

Decrease in the money supply

Investment Demand

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

KEY GRAPHS:

Easy (Expansionary) Money Policy:

Tight (Contractionary) Money Policy:

Extra Videos:

|

Reading:

|

Videos: |

|

Outcomes / Must Know:

|

Practice:

|

KEY GRAPHS

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

KEY GRAPHS

Extra Videos:

Reading: Videos: Outcomes / Must Know: Practice:

Extra Videos:

VIDEO SOURCES: YouTube ACDCLeadership Macroeconomics Videos Many students like these videos. I believe that "Mr.

Clifford " began making these videos for his AP Economics

students. I have watched many, but not all, of these videos

and I usually like the way that he covers the topics. He

does go quite fast, so the videos may be better for

review than for an initial introduction to the

topics. Note that his "units" do not match our units and he

may cover more than we do in some areas but not all that we

do in other areas.

Macroeconomics

Playlists

TOPICS / LESSONS: Click on lesson number for assignments.

Unit 1: ECONOMICS and GLOBALIZATION

Unit 2: INTRODUCTION TO MACROECONOMICS

Unit 3: MACROECONOMIC POLICY