|

Click on the links above to learn how

to do these problems.

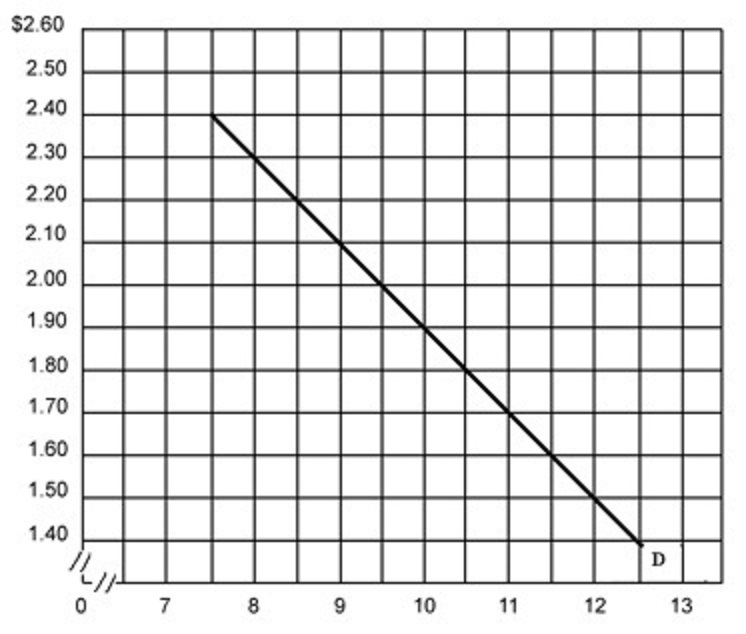

CALCULATE Ed USING MIDPOINTS

FORMULA

Calculate the price elasticity of

demand between a price of $2.40 and a price of $2.30

using the midpoints formula and interpret the

coeficient.

PRICE ELASTICITY OF DEMAND AND

TOTAL REVENUE

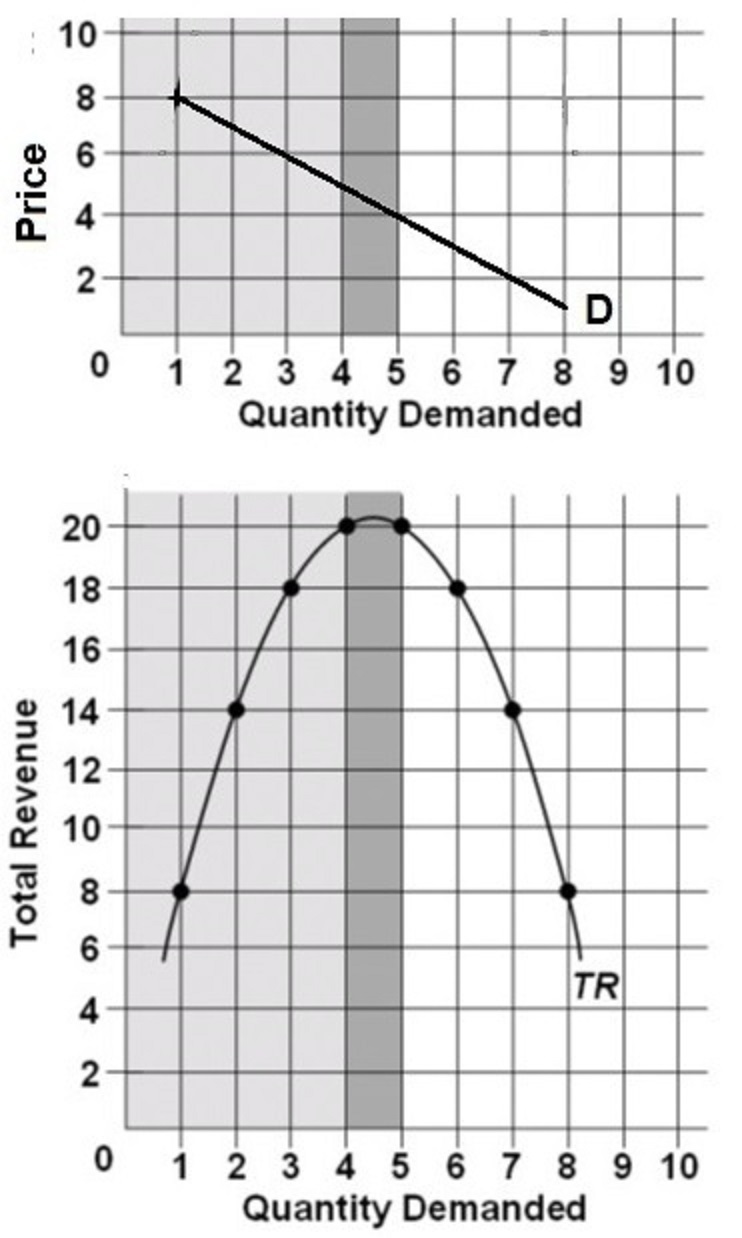

MULTIPLE CHOICE: Suppose that this

total revenue curve (see graph above) is derived from a

particular linear demand curve (see graph above). This

demand curve must be:

A. inelastic for price

declines that increase quantity demanded from 6 units to

7 units.

B. elastic for price declines that increase quantity

demanded from 6 units to 7 units.

C. inelastic for price declines that increase quantity

demanded from 4 units to 3 units.

D. elastic for price increases that reduce quantity

demanded from 8 units to 7 units.

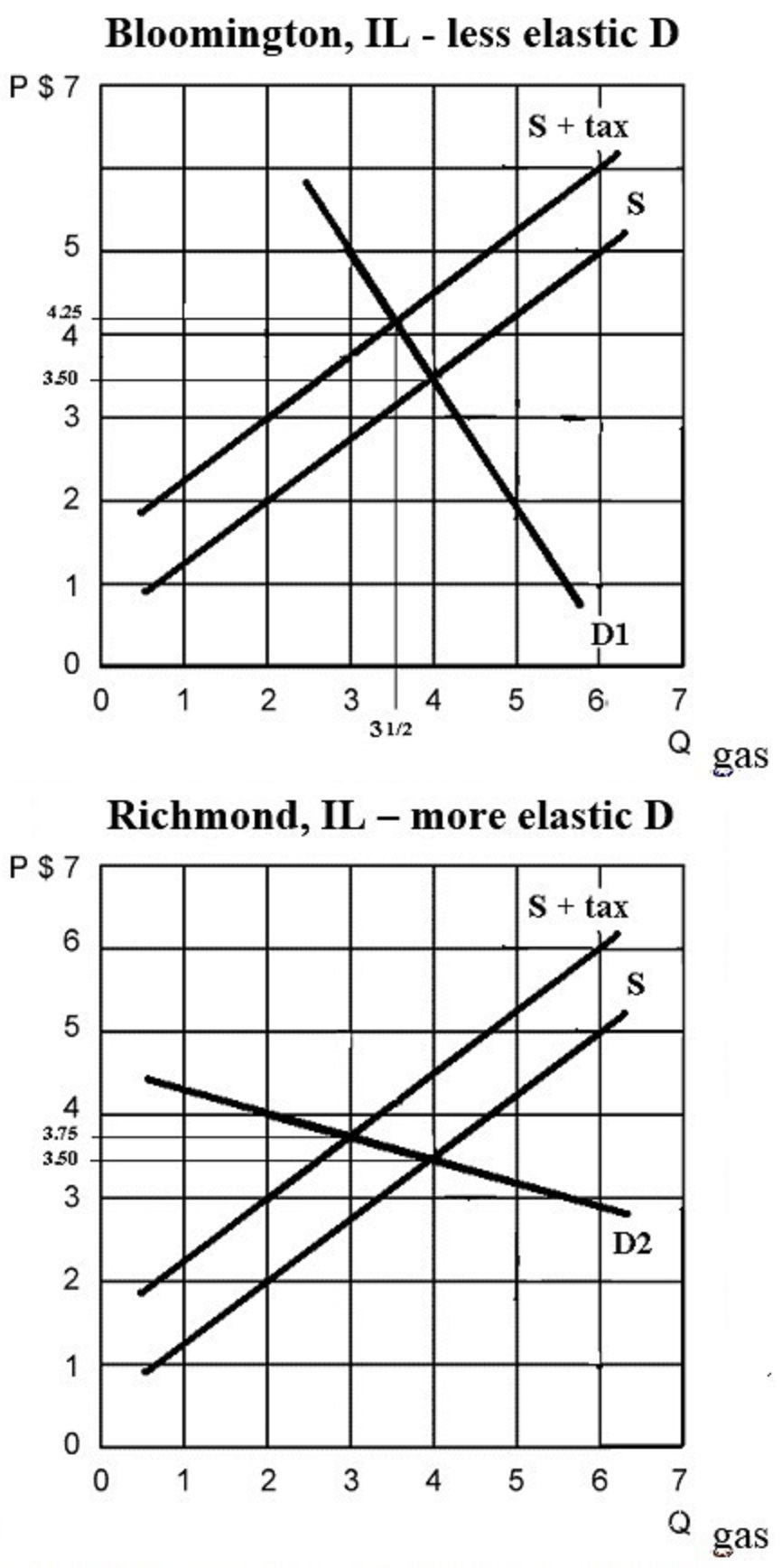

ELASTICITY AND INCIDENCE OF EXCISE

TAXES

See the graphs above. Compare the

following when demand is more elastic (like in

Richmond, IL on the Wisconsin border), and less

elastic (like in Bloomington IL in the center of the

state):

(1) incidence of the

excise tax

(2) effect on allocative efficiency

(3) effect on government revenue

|