OLIGOPOLY

11.2-1 Introducing Oligopoly

and the Prisoner's Dilemma (Warning: this is a long video lecture

>20 minutes)

- Outline

- Oligopoly Defined

- Game Theory: The Prisoner's Dilemma

- Nash equilibrium

- Definition of Dominant Strategy

- Conclusion

- Oligopoly Defined

- ERROR: Tomlinson mentions that a monopolistically

competitive industry has "a small number of sellers" each with

some market power; he meant to say "a LARGE number of

sellers".

- Oligopoly

- small number of sellers

- that have to consider the reactions of their

competitors;

- they interact strategically

- ME: our textbook uses the term "mutual

interdependence";

- where each firm tries to guess what its competitor's

are going to do,

- because the choices of all the firms affects each

individual firm

- there is no generally agreed upon single model of

oligopoly: there are several models each with strengths and

weaknesses

- Game Theory: The Prisoner's Dilemma

- economists tend to agree that Game Theory best describes

strategic behavior between a small number of firms

- the Prisoner's Dilemma is one of the most basic forms of

game theory and it applies quite will to the strategic behavior

of a small number of firms (i.e. oligopoly) when they are

making their pricing decisions

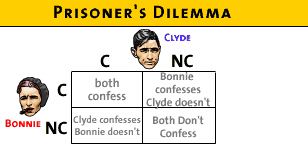

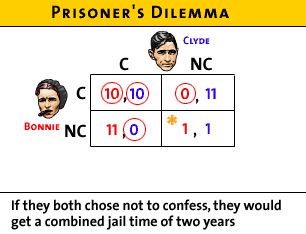

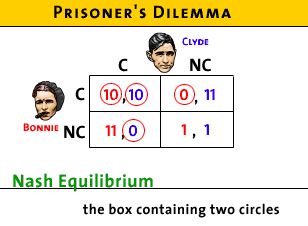

- Bonnie and Clyde: confess or not confess?

- called a "game" because the outcome depends not just on

what you do, but what your competitor does; also called

strategic interaction

- draw a matrix (table) with two players representing the

possible outcomes in each box; prisoners cannot talk to each

other and they don't know what the other will choose

- each can either confess or not confess

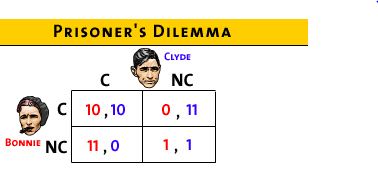

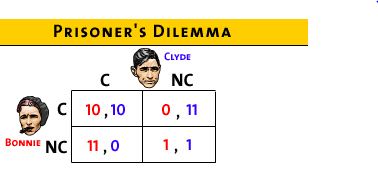

- if both confess they will get 10 years in prison

each

- if neither confess then they will get only 1 year in

jail on a lesser charge

- if Bonnie confesses and Clyde doesn't, then Bonnie is

free (no jail time) and Clyde will get 11 years in

prison

- if Clyde confesses and Bonnie doesn't, then Clyde is

free (no jail time) and Bonnie will get 11 years in

prison

- Matrix of strategies available to each player:

- Nash equilibrium

- What is the solution?

- Nash Equilibrium:

- the outcome when each player is doing the best they can

given what all other players are doing

- If Clyde confesses what is the best response for bonnie?

- The video lecture will ask you

a multiple choice question. ANSWER THE QUESTION by

selecting A, B, or C and more of the lecture will

follow

- If Clyde does not confess which is the best response for

Bonnie

- The video lecture will ask you

a multiple choice question. ANSWER THE QUESTION by

selecting A, B, or C and more of the lecture will

follow

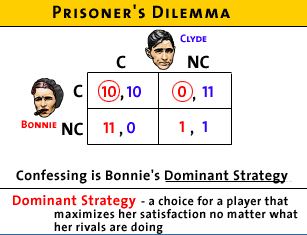

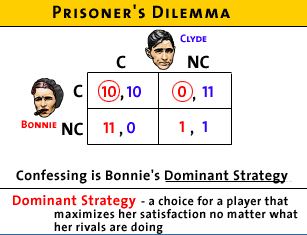

- Definition of Dominant Strategy

- In both cases, Bonnie will minimize jail time by

confessing; this is Bonnie's "dominant strategy"

- Dominant Strategy: a choice for a player that

maximizes her satisfaction no matter what her rivals are

doing

- What should Clyde do?

- The video lecture will ask you

a multiple choice question. ANSWER THE QUESTION by

selecting A, B, or C and more of the lecture will

follow

- Clyde will also have a dominant strategy of

confessing no matter what Bonnie does

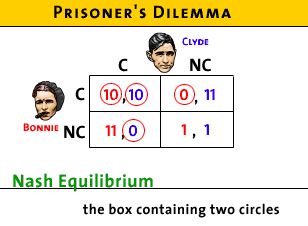

- So they will BOTH confess = Nash equilibrium

- Nash equilibrium occurs when they both give their

dominant response

- it is also a "self-enforcing agreement": when they

are each giving their best decision, neither can improve

their situation by changing their minds

- so they will not change their minds; it is an

equilibrium

- BUT is this equilibrium the BEST for Bonnie and Clyde?

- The video lecture will ask you

a multiple choice question. ANSWER THE QUESTION by

selecting A, B, or C and more of the lecture will

follow

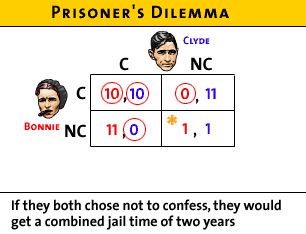

- It would be best if they would both NOT CONFESS,then

they each get only 1 year in prison rather than 10

years

- but it is not a Nash equilibrium because they can

each do better if they confess.

- they can do better because if one confesses and

the other does not then he or she will get no jail

time (0 years)

- so they will confess = Nash equilibrium

- The BEST outcome for both is not an equilibrium

outcome

- How does this apply to economics and business?

- businesses try to form trusting relationships so in a

situation like this one, no one will be tempted to

cheat

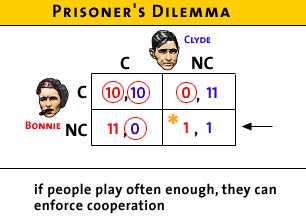

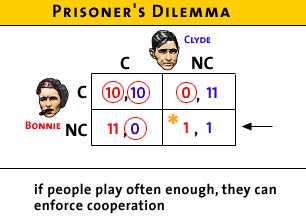

- if Bonnie and Clyde play often enough they may learn to

trust one another and both choose not to confess; they

can enforce cooperation through trust

- but if they only play once, the RATIONAL OUTCOME is for

both to confess

- this is rational even if it isn't the best

outcome

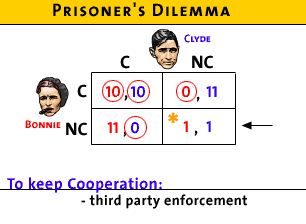

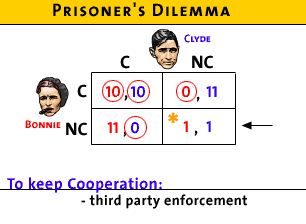

- Maybe they can enforce cooperation other ways:

- like through third party enforcement of contracts

- but more likely, if people play often enough they can

form reputations that they will not cheat; i.e. trust

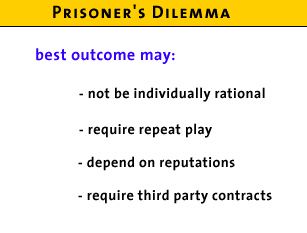

- Conclusion

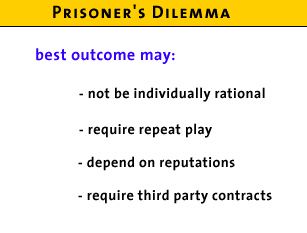

- the best outcome may not be individually rational

- it would be better for an individual business to pollute

(cheaper and therefore larger profits), but it would not

best if all businesses polluted

- how to avoid a Nash equilibrium and end up with the best

outcome instead?

- repeated play

- reputation

- contracts

- NOTE: Tomlinson discusses the next lesson when the

prisoners 'dilemma is applied to an oligopoly, I think he is

referring to:

- 10.4-1 Game Theory and Advertising and Brand Names -

Understanding Monopolistic Competition as a Prisoner's Dilemma

AND this should be titled "Understanding Oligopoly as a

Prisoner's Dilemma"

10.4-1 Game Theory and

Advertising and Brand Names - Understanding Oligopoly (Monopolistic

Competition??) as a Prisoner's Dilemma

11.2-1

should be done before doing this one

- Outline

- How to use game theory

- Dominant strategy

- Prisoner's Dilemma: Best outcomes vs. Actual

outcomes

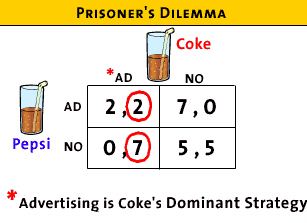

- How to use game theory to understand advertising: Coke and

Pepsi

- Assumptions:

- two rivals: Coke and Pepsi competing for a share of the

$10 million soft drink market

- if no advertising they each have $5 million in

sales

- advertising would cost them $3 million

- if you advertise and your rival does not then you get

all customers = $10 million in sales

- if you advertise AND your rival also advertises then you

each get $5 million in sales - the same as if neither

advertise

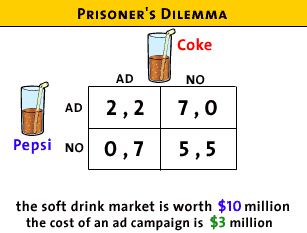

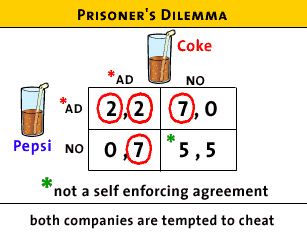

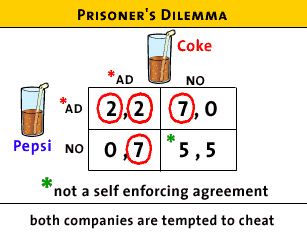

- Here is the game matrix:

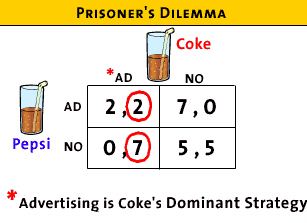

- Coke's Dominant strategy

- The video lecture will ask you a

multiple choice question. ANSWER THE QUESTION by selecting

A, B, or C and more of the lecture will follow

- if Pepsi advertises what ts the

best strategy for COKE?

- if Coke does not advertise it

will get $0 in sales

- if coke does advertise it will

get $2 million in revenue

- BEST for Coke to

advertise

- If Pepsi does NOT advertise, what

is the best strategy for COKE?

- if Coke does not advertise it

will get $5 in sales

- if Coke does advertise it will

get $7 million in revenue

- BEST for Coke to

advertise

- So, Coke has a dominant strategy

to advertise

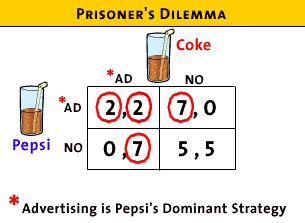

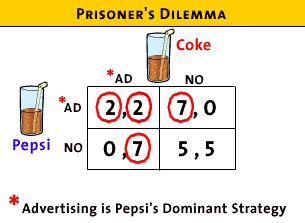

- Pepsi's Dominant strategy

- if Coke advertises what ts the

best strategy for PEPSI?

- if Pepsi does not advertise it

will get $0 in sales

- if Pepsi does advertise it will

get $2 million in revenue

- BEST for Coke to

advertise

- If Coke does NOT advertise, what

is the best strategy for PEPSI?

- if Pepsi does not advertise it

will get $5 in sales

- if Pepsi does advertise it will

get $7 million in revenue

- BEST for Pepsi to

advertise

- So, Pepsi's has a dominant

strategy to advertise

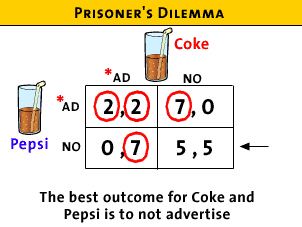

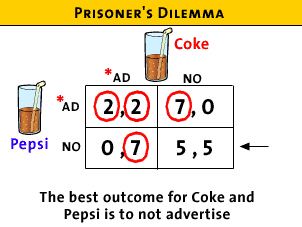

- Best outcomes vs. Actual outcomes

- Best outcome:

- for both Coke and Pepsi is for neither one to advertise

and then they each get $5 million revenue

- but this is NOT a self enforcing agreement because they

both will realize that they can now gain by advertising,

- if they agree together that they will not advertise

to achieve their best outcome ($5 million each)

- one can gain if they advertise (i.e. cheat) if the

other one doesn't

- so it makes sense ("individually rational") to cheat

and launch an ad campaign

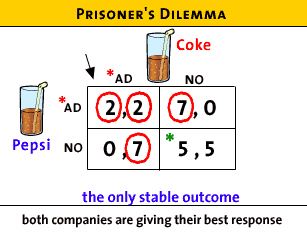

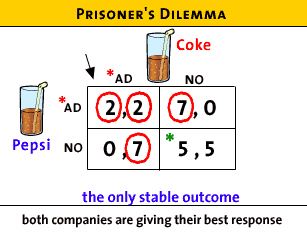

- But the actual outcome (Nash equilibrium) is that they will

both advertise and get only $2 in revenue

- because the best outcome (5,5) is not a self enforcing

agreement

- but if they both advertise, this is a self enforcing

agreement; i.e. they are BOTH giving their best response to

their rival

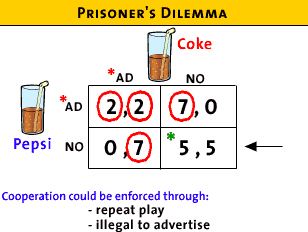

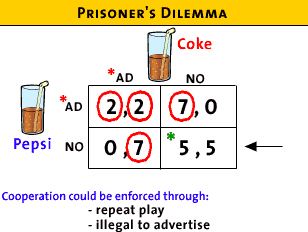

- How to get the best (5,5) outcome:

- they might learn through repeated play that if they both do

not advertise that they will both come out ahead

- or if they can get the government to outlaw soft drink

advertising (they would like and support such a law)

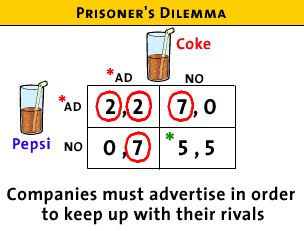

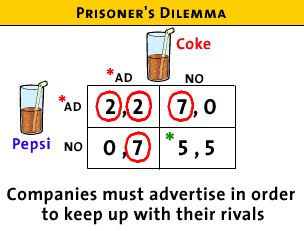

- Prisoner's Dilemma:

- advertising is like the arm's race (nuclear weapons)

- it would be best if no one advertises (or had nuclear

weapons)

- but, because of the possibility of your rival doing it, you

have to keep up

- in the end everyone's profits are reduced (2,2)

11.3-1 Understanding a Cartel as a Prisoner's Dilemma

11.2-1 should be done before doing this

one

- Outline

- Definition of a Cartel

- Prisoner's Dilemma

- Best Outcome

- Definition of a Cartel

- an oligopoly where the individual members try to act as a

monopolist

- ME: (from the textbook) a group of producers that typically

creates a formal written agreement specifying how much each

member will produce and charge. Output must be controlled—the

market must be divided up—in order to maintain the

agreed-upon price. The collusion is overt, or open to

view.

- they get together and act as one, setting the price and

quantity together, choosing the profit maximizing monopoly

quantity and price and earning monopoly profits that they

divide among themselves; i.e. they act as a monopoly

- ME: usually this is done by all member restricting quantity

and raising the price

- Problem: keeping the cartel together is a problem because

of the prisoner's dilemma

- .if one firm knows that all the others are restricting

the quantity which makes the price higher, this firm can

CHEAT and produce more and make greater profits for itself;

i.e. they have an incentive to cheat

- but if all firms or countries) cheat by producing more,

the price will drop and they will all earn lower profits

than if no one cheated

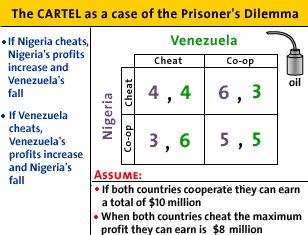

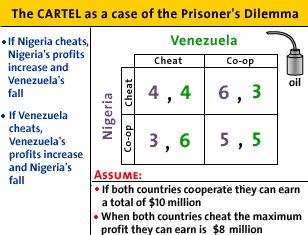

- Prisoner's Dilemma: The Cartel as a case of the Prisoner's

Dilemma

- two countries form an oil cartel, Nigeria and

Venezuela

- they each have two options: cooperate or cheat

- if they both cooperate they earn maximum profits that

are shared ($10 million total or $5 each)

- if both cheat and increase their output then the price

will fall an total profits will fall (to $8 million) and

they will each earn only $4.

- if one cheats and produces more but the other does not

an still produces less, the cheater more profits ($6) ,but

the other makes less profits ($3) and total profits will be

less ($6 + $3 = $9) because the price will be lower; i.e.

they are not earning the highest, monopoly, profit.

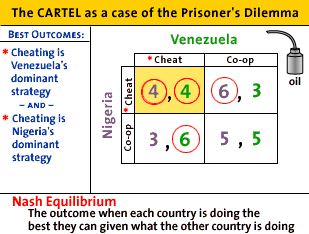

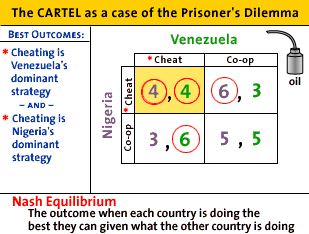

- What are Dominant Strategies?

- For Venezuela:

- if Nigeria cheats, then Venezuela's best response is

to cheat also and profits are 4,4.

- if Nigeria cooperates then Venezuela's best response

is to cheat and profits are 3 for Nigeria and 6 for

Venezuela

- So, Venezuela has an incentive to cheat no matter

what Nigeria does

- For Nigeria:

- if Venezuela cheats, then Nigeria's best response is

to cheat also and profits are 4,4.

- if Venezuela cooperates then Nigeria's best response

is to cheat and profits are 3 for Venezuela and 6 for

Venezuela

- So, Nigeria has an incentive to cheat no matter what

Venezuela does

- Nash Equilibrium

- since both countries have a dominant strategy to cheat

the Nash equilibrium is for both top cheat and the cartel

falls apart

- profits are $4 million each

- total profits are at the lowest of all possible

options

- ME: but this is the best outcome for consumers!

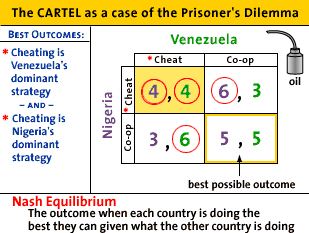

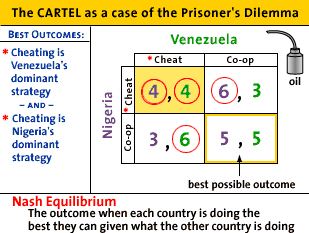

- Best Outcome

- the best outcome for the oil producing countries is to

collude (form the cartel) reduce output, and raise the price

acting like a monopolist

- this way each country would earn profits of $5 million

(5,5)

- but this is not a self enforcing agreement because they

each have an incentive to cheat and try to improve their

profits

- so this is not a Nash equilibrium (i.e. not a stable

outcome)

- So, what does this mean about cartels? Are they possible?

- Yes, if they learn through repeated play that cheating

hurts them both and that cooperating is better for them.

"Kinked Demand Curve Model" for $1.98: at: http://mindbites.com/lesson/7742-economics-kinked-demand-curve-model

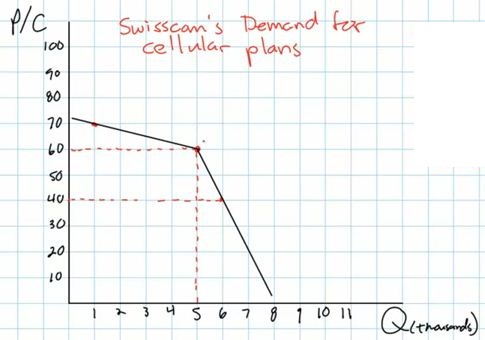

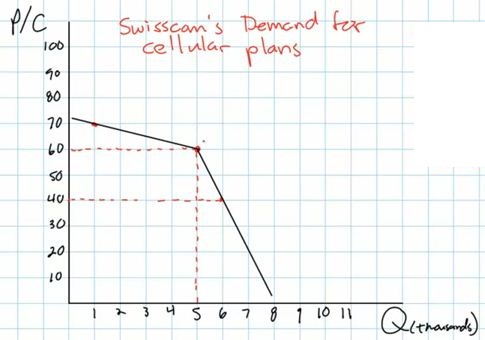

- Outline

- the kinked demand curve

- the discontinuous MR curve

- finding the profit maximizing quantity

- problems with the kinked demand model

- ME: mutual interdependence

- assume:

- that rivals ignore if one firm raises its price

- but rivals will match the price change if one firms decides

to lower its price

- result: the demand curve will be kinked

- it will be more elastic (flatter) above the original price

because if one firm lowers its price AND all of its competitors

do not, then the firm will lose A LOT of customers

- the demand will be less elastic (steeper) below the

original price because if one firm decides to lower its price

all of its competitors will ALSO lower their prices and each

would get only A FEW new customers

- what will the MR curve look like?

- as always (except pure competition) the MR will be below

the demand curve (D)

- it will be discontinuous

- how to find the profit maximizing quantity

- as always, we find the profit maximizing level of output at

the quantity where MR = MC

- It is quite likely that the MC curve will cross the MR

curve in the vertical gap

- if so, then the profit max quantity is found on the

horizontal axis directly below the gap and the price is found

off of the demand curve above

- the price would then be at the kink in the demand

curve

- Problems

- one problem with the model is that it does not tell us how

the kink in the demand curve got where it is in the first

place

- also there are not many good real world examples

- But, logically it does make sense.

Kinked Demand Model

(econclassroom.com 14:06)

http://www.econclassroom.com/?p=3144

Preview:

- In this lesson we take a graphical approach to oligopoly, and

seek to explain why prices tend not to fluctuate up or down

in oligopolistic markets.

- Why do some oligopolies have very little incentive to decrease

their prices, and also a strong incentive not to raise their

prices?

- What emerges is a kinked demand curve, highly elastic at

prices above the current equilibrium and highly inelastic at

prices below the current equilibrium. Along with this kinked

demand curve comes a kinked marginal revenue curve, with a

vertical section. The implication is that even as an oligopolist's

costs rise and fall in the short-run, its level of output and

price tends to remain stable.

Review - Oligopolies:

- few firms

- mutual interdependence

- Mutual interdependence exists when firms consider their

rivals' reactions while adjusting prices and outputs.

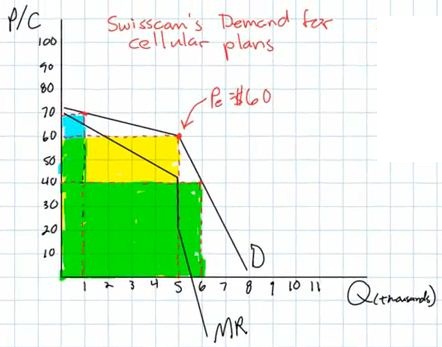

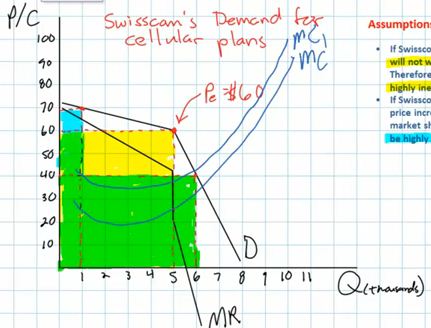

Assumptions about oligopoly

pricing behavior (kinked demand model)

- before changing its price an oligopolist will try to predict

what its competitors will do if they do change their price

- ASSUME: competitors will match price decreases - if one

firm lowers its price the competitors will lower their prices

- This make sense because the competitors will not want to

lose a lot of customers to a competitor that lowers it price,

so they will decrease their price too.

- therefore, the demand curve is inelastic, if all

firms lower their prices they will not gain very many

customers, i.e. the % change is quantity demanded will be small

= inelastic

- ASSUME: competitors ignore price increases - if one

firm raises its price the competitors will not raise their prices

- This makes sense because competitors could gain a lot of

customers if they kept their prices low when one firm raises

theirs

- therefore, the demand curve will be elastic, if one firm

raises its price and the other firms do not, the one firm will

lose a lot of customers, i. e. the % change in quantity

demanded will be large = elastic

So what does the demand curve

look like with these assumption?

- demand below the going price will be inelastic (steeper); a

small increase in quantity if the price is decreased

- demand above the going price will be elastic (flatter); a

large decrease in quantity if the price is increased

- so the demand curve will be "kinked", or bent.

So why are firms reluctant to

change their prices?

- since demand is inelastic below the going price, if a firms

lowers its price (and its competitors do not) then its total

revenues will decrease; a big drop in price but a little increase

in quantity causes TR to decline

- since demand is elastic above the going price, if a firm

raises its price (and all its competitors raise their prices too)

then its total revenues will decrease; a little increase in price

but a large decrease in quantity causes TR to decline

- Therefore, prices in an oligopolistic market are "sticky";

i.e. they tend not to change because if a firms raises, or lowers

its price, its total revenues will fall

So what does the MR curve look

like?

- We know that when the demand curve is downward sloping, the MR

curve is below it

- the MR diminishes at twice the rate that demand does

therefore, we end up with two MR curves, one somewhat flat under

the elastic portion of the kinked demand curve and one more steep

under the inelastic portion of the demand curve, and a vertical

portion of the MR curve connecting the two

So what will oligopolists do if

their costs change? Will they change their prices and quantities?

- maybe not

- in other markets

- if variable costs rise, the MC will rise and the profit

maximizing level of output (where MR=MC) will decrease,

and

- if variable costs fall, the MC will fall and the profit

maximizing level of output (where MR=MC) will increase

- but in the kinked demand model, if the MC crosses MR in the

vertical section, a change in costs will not change the profit

maximizing level of output or the profit maximizing price. the

price and quantity where MR = MC will stay the same even if MC

rises or falls

ME:

- Most economic textbook and online video lectures do not

include the ATC curve in their kinked demand model. I am not sure

why. And they often include 2 MC curves to show that changes in

costs do not change the profit maximizing quantity or price.

- here is a graph of the oligopoly kinked demand model with the

ATC curve and only one MC:

- Profit maximizing quantity and price: Q = f; P = d

- Allocatively efficient quantity and price: Q = h; P =

c

- Productively efficient quantity and price: Q = g; P =

a

Oligopolies, Duopolies,

Collusion, and Cartels (Khan Academy 8:26)

http://www.khanacademy.org/finance-economics/microeconomics/v/oligopolies--duopolies--collusion--and-cartels

Introduction

- oligopoly

- "oli" means "few"

- "polies" means "sellers"

- sometimes oligopolies act more like monopolies and sometimes

they act more like competitive markets

Collusion (acting more like a

monopoly)

- if they coordinate their pricing and production decisions they

are acting more like a monopoly

- this is called collusion

- this is often illegal

- if they do it formally (like written agreements) then we call

it a cartel

- example of a cartel: OPEC (the Organization of Petroleum

Exporting Countries)

- 12 countries

- control 79% of the world's oil reserve (2012)

- and 44% of the world's oil production (2012)

- attempt to act like a monopoly

- one problem with collusion is that individual firms (or

countries as in OPEC) have an incentive to CHEAT: i.e. they might

be able to make more money if the say that they are going to

charge a high price like the rest of the firms, but then they

lower their price a take customers away from all the other

firms

Oligopolies that are More

Competitive

- Example: Coca-Cola vs.Pepsi

- Coke and Pepsi compete on price and on marketing

- a duopoly is an oligopoly with only two major

firms

- examples of oligopolies that compete (act more like pure

competition):

- Coca-Cola and Pepsi (duopoly)

- Boeing and Airbus (large passenger jet manufacturers -

duopoly)

- Airlines

- most cities have only a few airlines

- their products are very similar (standardized?)

- credit card (Visa, Mastercard, Discover American

Express)

- governments try to assure that oligopolies compete rather than

collude because collusion is inefficient (like monopolies) and

when they compete they are more efficient (more like pure

competition) with a larger consumer plus producer surplus (total

surplus).

SUMMARY

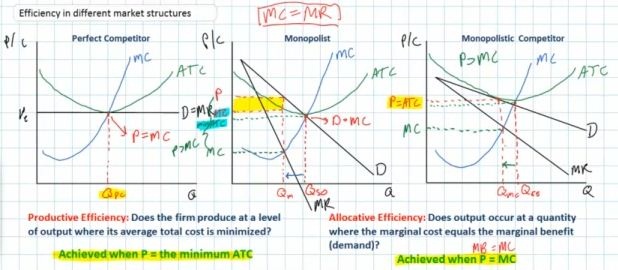

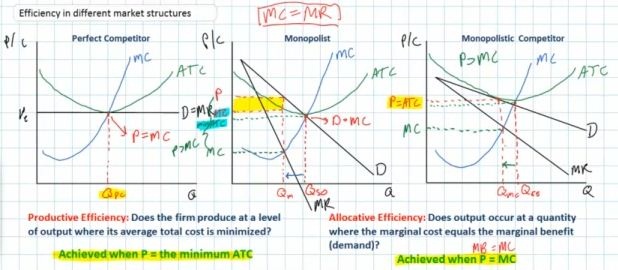

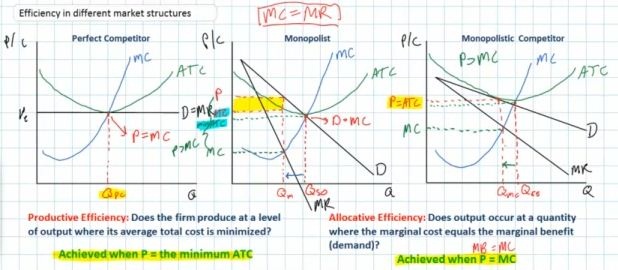

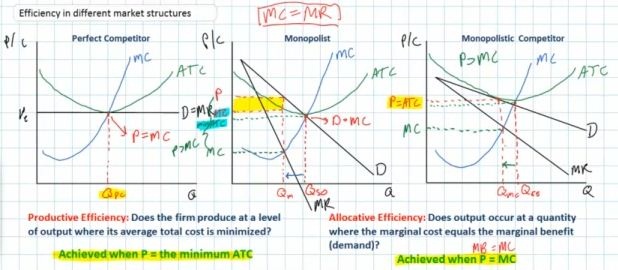

Determining the Efficiency

of Firms in Different Market Structures (econclassroom.com

18:23)

http://www.econclassroom.com/?p=4456

Introduction

- two types of efficiency

- productive efficiency

- producing at the level of output where its ATC is

minimized

- is the price equal to the minimum ATC

- ME: quantity where MC=ATC

- allocative efficiency

- producing at the level of output where the MB = MC

- achieved where P=MC (or D=MC)

- the demand curve represents the MB that consumers

receive from the consumption of a good

- also called the socially optimal quantity

-

Perfect Competition Long Run

Equilibrium

- very many firms producing standardized (identical) products

with no barriers to entry

- demand perfectly elastic (firm is a price taker) since there

are very many firms producing identical products and no individual

firm has any market power

- D=P=MR

- equilibrium price is established in the market (supply and

demand in the market)

- zero (normal) economic profits in long run equilibrium because

of no barriers to entry so ATC touches demand at the lowest point

of the ATC curve

- quantity produced is where MR=MC (Qpc)

- productive efficiency is achieved

- equilibrium quantity (Qpc) is where ATC is at a minimum

(P=minimum ATC)

- produce the quantity where MC=ATC

- if they produce at any other quantity then the ATC will be

greater than the price and they will earn economic losses and

will go out of business in the long run

- allocatively efficiency is achieved

- at the profit maximizing quantity (Qpc) the P=MC

- MSB=MSC

- this is the socially optimal quantity

Monopoly Long Run

Equilibrium

- single firm in the industry since entry is blocked

- producing a unique product

- downward sloping demand since the monopolist has market power

since it produces a unique product that no other firms produce and

the demand (or P) is greater then the MR

- D=P>MR

- long run profits likely shown on graph as the ACT is below the

demand (P) curve because entry is blocked (yellow rectangle)

- quantity produced is where MR=MC (Qm)

- productive efficiency is NOT achieved

- equilibrium quantity (Qm) is NOT where ATC is at a minimum

(P>minimum ATC)

- they do NOT produce the quantity where MC=ATC

- at the profit maximizing level of output (Qm) the actual

ATC is higher than the minimum ATC

- since there is no competition the firm does not need to

produce in the least cost manner; without competition the firm

can charge a much higher price and produce at a higher ATC and

earn greater profits

- allocative efficiency is NOT achieved

- equilibrium quantity (Qm) is NOT at the quantity where P=MC

(Qso)

- at the profit maximizing level of output (Qm), P>MC

- meaning that there is an underallocation of resources; too

little is being produced

- monopolists can restrict output to increase the price and

earn greater profits

- at the socially optimal (alloc. eff.) quantity (Qso),

profits are not maximized so the monopolist will not produce

this quantity

Monopolistic Competition Long

Run Equilibrium

- many firms in the industry producing similar products

- some market power (price making power) because of product

differentiation

- downward sloping demand for the individual firms but more

elastic since there are many substitutes and the demand (or P) is

greater then the MR

- D=P>MR

- zero (normal) economic profits in long run equilibrium because

of few barriers to entry so ATC is tangent to the demand

curve

- quantity produced is where MR=MC (Qmc)

- productive efficiency is NOT achieved

- equilibrium quantity (Qmc) is NOT where ATC is at a minimum

(P>minimum ATC)

- they do NOT produce the quantity where MC=,ATC

- at the profit maximizing level of output ATC is higher than

the minimum

- allocative efficiency is NOT achieved

- equilibrium quantity (Qmc) is NOT at the quantity where

P=MC

- at the profit maximizing level of output (Qmc),

P>MC

- meaning that there is an underallocation of resources; too

little is being produced

- as long as firms have some market power (i.e. the demand is

downward sloping) they will maximize profits by producing a

quantity that is less than the socially optimal quantity

(Qso)

Summary

- imperfect competition (monopoly, monopolistic competition, and

oligopoly) is a form of market failure; the market fails to

achieve efficiency as we saw in this lesson

- ME: we studied market failure when we studied externalities in

chapter 5; when externalities exists markets fail to achieve

efficiency

- ME: in chapter 2 where we studied the economic functions of

government, one of the functions was to try to maintain

competition ;i.e. to correct markets when they fail to achieve

efficiency; we also studied this in chapter 18 when we discussed

antitrust laws and monopoly regulation

- since most industries are imperfectly competitive, does this

mean that the most markets are market failures?

- if we just look at the graphs we would have to answer

"yes", "technically speaking"

- but there are also some benefits to imperfectly competitive

markets that also have to be considered:

- the great degree of product differentiation provides

society with a lot of benefits that may make up for some of

the underallocation of resources (customer service,

innovation, product development); variety is good