Price Discrimination and its Effects on Efficiency in

Monopolistic Markets (econclassroom14:51)

http://www.econclassroom.com/?p=3118

Outline:

- Define price discrimination

- Three conditions necessary for price

discrimination

- Three types (degrees) of price discrimination

- The effect of perfect price discrimination on efficiency

(graph)

Definition: Price discrimination occurs when a firm with market

power charges different prices to consumers for an identical

product.

ME: Note that the word "discrimination" does not mean

that this is a bad thing. All "discrimination" means is that

different customers are treated differently, i.e. they pay

different prices. We will find out that price discrimination may

actually be GOOD for society.

Examples:

- Movie theaters: Charge different prices based on age.

Seniors and youth pay less since they tend to be more price

sensitive.

- Gas stations: Gas stations will charge different prices in

different neighborhoods based on relative demand and

location.

- Quantity discounts: Grocery stores give discounts for bulk

purchases by customers who are price sensitive (think “buy

one gallon of milk, get a second gallon free”… the

family of six is price sensitive and is likely to pay less per

gallon than the dual income couple with no kids who would never

buy two gallons of milk).

- Hotel room rates: Some hotels will charge less for

customers who bother to ask about special room rates than to

those who don’t even bother to ask.

- Telephone plans: Some customers who ask their provider for

special rates will find it incredibly easy to get better

calling rates than if they don’t bother to ask.

- Airline ticket prices: Weekend stayover discounts for

leisure travelers mean business people, whose demand for

flights is highly inelastic, but who will rarely stay over a

weekend, pay far more for a round-trip ticket that departs and

returns during the week.

Three conditions necessary for price discrimination to occur:

- firm must have market power (therefore purely competitive

firms cannot price discriminate, but monopolies can

- firm must be able to segregate customers with different

willingnesses to pay which means with different price elasticities

of demand

- ME:

- those with a less elastic demand are charged a higher

price. So what happens to total revenue (TR)? We know that

if demand is inelastic and price goes up, TR increase.

- those with elastic demand are charged a lower price. So

what happens to TR? We know that if demand is elastic and

price goes down, TR increase.

- Our textbook defines price discrimination as "the

selling of a product to different buyers at different prices

when the price differences are not justified by

differences in cost.

- so charging more for a car in Alaska and less for one

in Detroit because it costs more to ship the car to

Alaska is NOT price discrimination

- But, since we assume that the costs (TC) are the same,

the result of price discrimination is higher TR with the same

TC, So, HIGHER PROFITS

- buyers are prevented from reselling the product to someone

else

Example: Airline tickets

ME: airlines have market power which means that they can

set their own price

ME: business travelers have a less elastic demand curve than

vacation travelers, but how can the airline know if a ticket buyer

is a business traveler or a vacation traveler? One way is to

require a Saturday night stay for customers buying round-trip

tickets. Business travelers prefer to be home on weekends and

vacation travelers tend to want to be on vacation over the

weekend

resale is prevented because your name is on the ticket and you

must have a matching ID

Three types (degrees) of price discrimination

3rd Degree: where consumers are divided into GROUPS. For

example, age groups with different price elasticities

(movies tickets are cheaper for children and more expensive for

adults), or time of purchase (people who buy early pay less

than those who buy at the last moment).

2nd Degree: where price discrimination is based on the quantity

purchased. For example, buying in bulk (large quantities)

is cheaper than buying small quantities or two-for one (or

buy two get one free). the more you buy the less you pay per

unit

1st Degree: Also called "Perfect Price Discrimination". This is

where each individual consumer pays a different price, each

consumer pays the highest price that he or she is willing to pay

based on their demand. This way there will be no consumer surplus

but a lot of producer surplus.

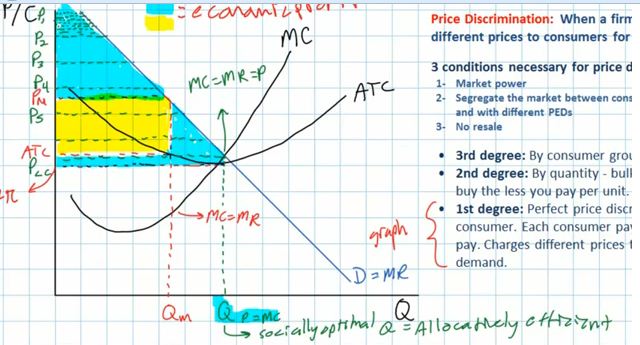

The Effect of Perfect Price Discrimination on Efficiency (graph

showing 3rd degree price discrimination)

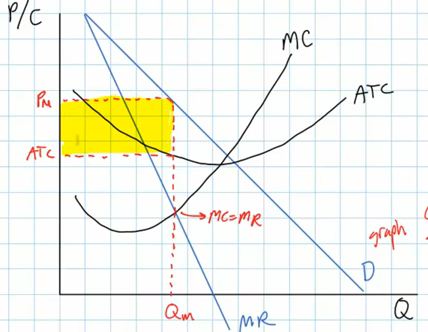

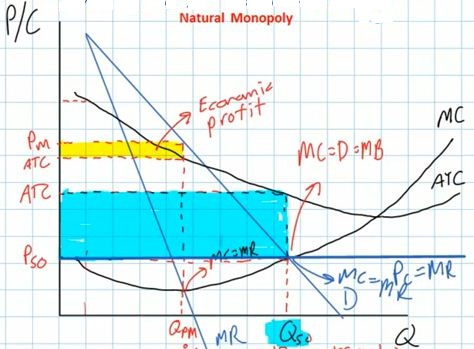

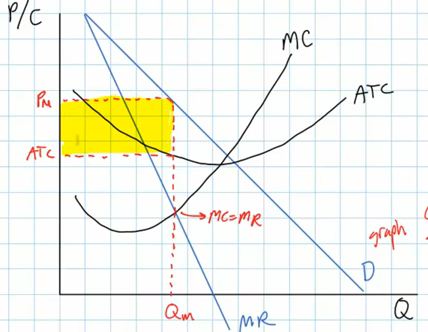

REVIEW: Graph of a "single-price" monopolist maximizing

profit. "Single-price" means that there is no price discrimination

So, if this monopolist did not price discriminate they would

produce quantity Qm and charge price Pm. (They will produce the

quantity where MR=MC.) ME: and at Qm, P > MC so the

monopolist is not allocatively efficient.

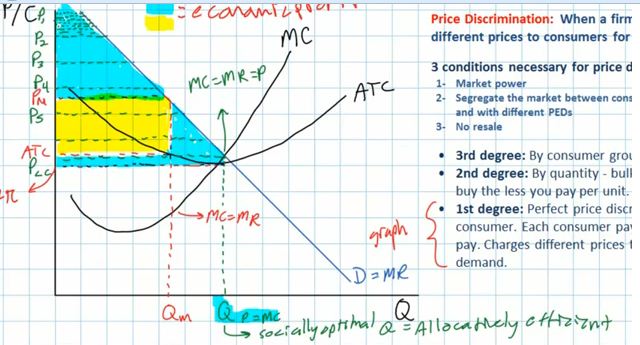

PRICE DISCRIMINATION: But notice that the demand curve goes

above Pm, meaning that there are customers willing to pay more

than Pm. What would happen if the monopolist could charge these

customers more since they are willing to pay more? What happens

is: if the monopolist can charge each customer the highest

price that they are willing to pay, then MR will be the same as

price (or demand). D = MR or P = MR

So, what quantity will the perfectly price discriminating

monopolist produce to maximize profits? This is always where

MC=MR. Always.

On the graph, if P = MR then MR = MC where P = MC. You

should remember that this is the formula used to find

allocative efficiency (the socially optimal quantity)

Results of perfect price discrimination:

- more will be produced than a single-price monopolist

(Qp=MC on the graph below)

- some consumers will pay higher prices than they would if

there was no price discrimination (Pm), but other consumers

will pay lower prices

- profits will be greater (the blue plus the yellow areas

on the graph below)

- AND MOST IMPORTANTLY the perfectly price discriminating

monopolist will produce the allocatively efficient quantity!

Conclusion:

- 1st degree price discrimination is almost impossible and

therefore very uncommon.

- 2nd and 3rd degree price discrimination are more

common

- but, 2nd and 3rd degree price discrimination do not

achieve the same increase in output as perfect price

discrimination and therefore do not achieve the same level

of allocative efficiency, but they are still better than a

single-price monopolist.

- effects:

- more is produced

- consumer surplus is transferred to the producers in

the form of higher revenues and profits

- Is price discrimination good for society? it depends:

- YES - it is better for the monopolist because they

get higher profits

- YES - it does improve allocative efficiency

- NO - if you are one of the customers who has to

pay an even higher price

- YES - if you are one of the customers who gets the

product at a lower price, and if there were no price

discrimination, you would not get the product at

all

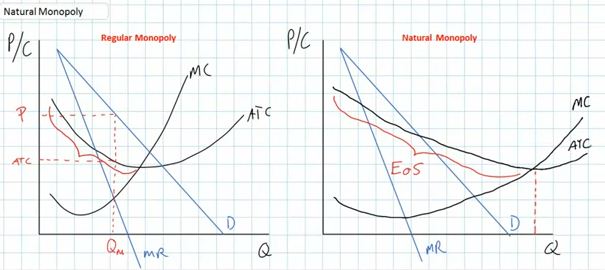

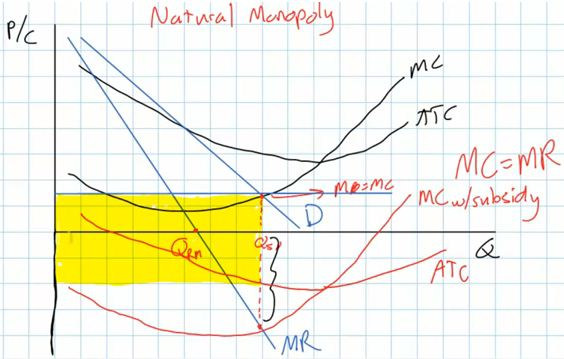

Natural Monopoly and the need for Government Regulation

http://www.econclassroom.com/?p=3115

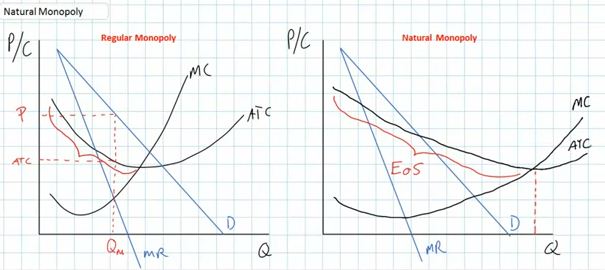

What is a "Natural Monopoly"?

- Monopoly where the long run ATC curve has economies of scale

over a very large range of output

- You can identify the graph of a natural monopoly because

the demand (D) curve crosses the ATC curve when the ATC is still

downward sloping

- this means that one very large company can produce every thing

that is demanded AT AT LOWER AVERAGE COST than if there were

several competing firms

- Examples:

- providing water to homes in a city

- electrical utilities

- natural gas

- If there were many companies each serving only a few customers

the ATC (costs per unit of output) would be higher

- it would make more sense to have only one company provide the

product because then the costs per unit (ATC) would be lower. That

is why this is called a "natural" monopoly.

- this is because there are very high fixed costs (TFC). Think

of all the costs of running water pipes to every house in a city.

These are all fixed costs. And since the TFC are very very high,

then the TC will be very high, and the only way to get ATC to be

low is to have a large amount of output (Q)

- ATC = TC / Q

- if TC are very high because of very high TFC then:

- ATC is high if: ATC = high TC / low Q

- but, ATC would be low if : ATC = high TC / large Q

Compare graphs:

- graph of a regular monopoly

- graph of a natural monopoly (EoS - Economies of Scale)

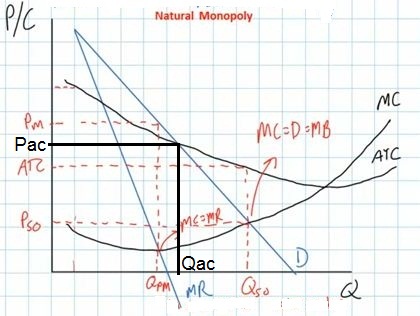

So, Society is better off (lower costs) if only one firm produces

the product, BUT:

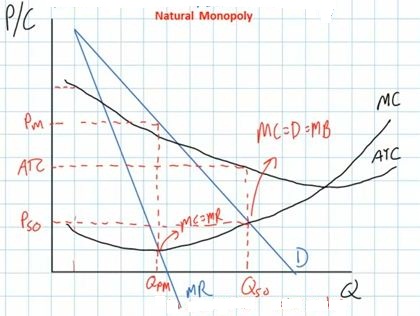

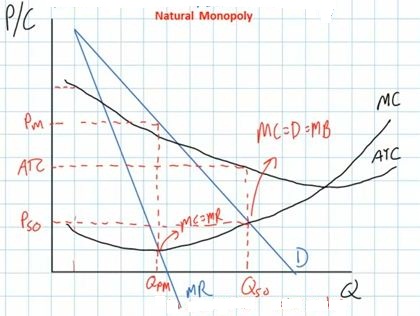

- what will a profit maximizing monopolist do is such a

case?

- they would produce the profit maximizing quantity, where MR =

MC

- and this is NOT the allocatively efficient quantity

- like other monopolists, a natural monopolist will charge a

higher price (Pm) and produce a lower quantity (Qpm) than the

socially optimum (alloc. eff.) price of Pso and quantity of

Qso

- Result: allocative inefficiency; an underallocation of

resources

- ME: so WHAT WE GET (Qpm) is less than WHAT WE WANT (Qso)

To really benefit society, natural monopolies need to be regulated

by the government

- This means that the government should use price controls and

subsidies to achieve allocative efficiency, Qso

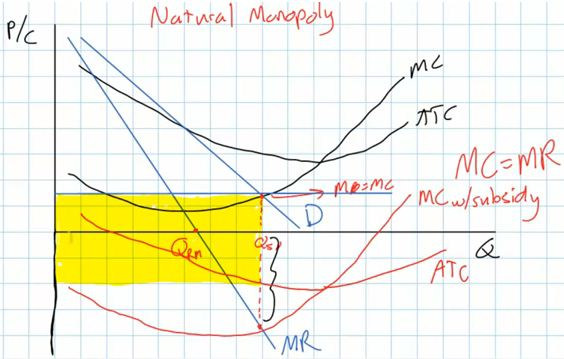

- But what price should the government select?

- if the government puts on a price ceiling at the

allocatively efficient price of Pso

- the monopolist would then produce the allocatively

efficient quantity of Qso because the ceiling price becomes the

firm's MR and then MR = MC at Qso

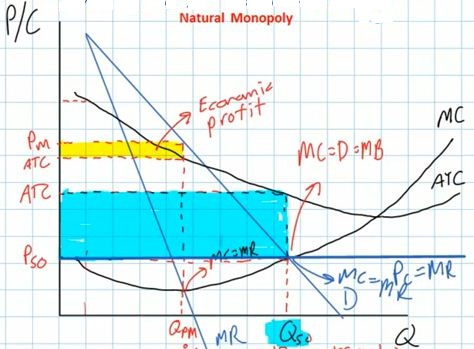

- BUT, we can see that at Qso the ceiling price is less than

the ATC and the monopoly would be earning losses equal to the

blue rectangle on the graph below

- in the long run, businesses cannot operate at a loss and

they will go out of business. This would not be good for

society.

- What can the government do to prevent natural monopolies from

going out of business because to the price ceiling?

- they can use BOTH a price ceiling AND a subsidy to help the

monopoly produce the socially optimum quantity.

- ME: our textbook does NOT use the subsidy graph shown in

the video lecture (see below)

- ME: our textbook says that there are two solutions to the

problem of natural monopolies earning a loss at the

allocatively efficient price:

- provide a subsidy to cover their losses

- but this may be politically unpopular. Would you

support higher taxes to give money to Commonwealth Edison

electric company?

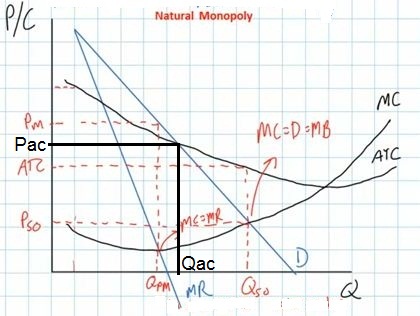

- the other solution that is used a lot in the united

states is AC pricing, where the government does not set a

price ceiling at the allocatively efficient price (Pso), but

rather they put the price ceiling at a prise where D=ATC

(where the demand curve crosses the ATC curve).

- If the price is Pac then the firm will produce Qac

- is the allocative efficient? NO, but it is closer to

Qso

- will the firms earn profits or losses? They will earn

normal profits (profits = zero) and they will be able to

stay in business. (Remember: economic costs include the

explicit costs AND the implicit cost which means that

investors are earning a return on their investment

approximately equal to their next best alternative.)