ECO 211 Microeconomics: An

Introduction to Economic Efficiency

|

- Contact

Information and Office hours

Unit 1: Markets are Efficient, Except

. . . Intro to Microeconomics

Lesson 1a: The Class and the

Math

1a Day One- An Introduction to ECO

211

|

Welcome to ECO 211! My name is Mark Healy. I will

be your economics instructor for the semester. Please call me

"Mark".

Many students end up dropping or failing this

course due to the lack of basic math skills. If your math skills are

weak you should consider building them before taking this course. If

you are required to take MTH 060 or MTH 082 and have not yet done so,

do not take this economics course until you have successfully

completed one of them. The face-to-face sections will take a practice

math quiz on the first day of class. For the online section I have

posted the math quiz on our Blackboard site. Take the math quiz on

Blackboard or in class. If you score less than 14 or 15, consider

dropping ECO 211 and taking a math class first.

1a Something Interesting - Why are we

studying this?

|

Optional: a funny look at some major ideas

of economics by the "Stand-up Economist".

Principles

of economics, translated (5:20)

Syllabus

On-Campus / Syllabus

Online

5Es

online reading

Lecture

Outline

1a Assignments: Video

Lectures

|

OPTIONAL: YouTube: Principles

of economics, translated by Yoram Bauman

1a Outcomes - What you should

learn

|

basic math skills

how to find class information

Key Terms

Flash Cards - Click Here

The Class:

Required Activity, Yellow Pages,

Tomlinson Videos on Thinkwell, Video Notes, LESSONS webpage,

Pre-quiz, Clicker Quiz, Practice Exercises,

The Math:

horizontal (x) axis, vertical (y) axis, origin,

direct (positive) relationship, inverse (negative) relationship,

slope of a line, positive slope, negative slope, marginal

1a Practice Quiz (under

construction)

|

|

|

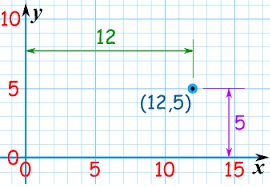

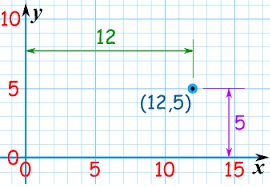

Slope = rise/run

Slope = vertical change / horizontal change

Slope = marginal value of the total

Any Point on a Graph Represents Two

Numbers

Direct Relationship

Inverse Relationship

Calculating Slope

Episode

5A: Models & Theories

[3:26 YouTube mjmfoodie]

Episode

6: Graph Review

[4:22 YouTube mjmfoodie]

NOTE: These are REVIEW videos only. In order to

learn the material you must read the assigned textbook readings,

watch the assigned lecture videos, and do problems. See the LESSONS

link on Blackboard for these assignments.

Unit 1: Markets are Efficient, Except

. . . Intro to Microeconomics

Lesson 1b: The 5Es of

Economics

1b Day One- An Introduction to ECO

211

|

The "5Es of Economics" are not from the textbook.

I borrowed the concept (with many modifications) from another

textbook many years ago. I believe it concisely explains the purpose

of economics. Also, it begins to introduce students to the economic

way of thinking. The economic problem that we all face, that all

countries face, that the world faces, is SCARCITY. Economics is the

study of how we can reduce scarcity. What I like about the 5Es model

is that it shows us that there are only five ways to reduce scarcity.

Only five. I call them the "5Es" of economics.

For each of the 5Es:

(1) learn the definition,

(2) understand examples, and

(3) most importantly, know how they reduce scarcity and help to

increase society's satisfaction.

This is where you learn that it may be good

when the price of plywood increases greatly as the result of a

hurricane. And why it might be good when Coca-Cola lays of one fifth

of its workforce. Or, that the price of gasoline may be too low.

Really!

1b Something Interesting - Why are we

studying this?

|

When a hurricane hits the coast of Florida, prices

of many necessities like food, water, hotel rooms, gasoline, and even

plywood, tend to increase. Some governments try to prevent such price

increases and call them "price-gouging".

See: http://www.csmonitor.com/1992/0910/10083.html

But economists think that such price increases

are GOOD for the people ravaged by the hurricane. WHY? Why is it GOOD

when the prices of products (like plywood) increase during a natural

disaster?

See: https://www.masterresource.org/price-gouging-law/defense-price-gouging/

ANSWER: Allocative Efficiency

Syllabus

On-Campus / Syllabus

Online

5Es

online reading (VERY

IMPORTANT!)

Ch. 3: "Efficient Allocation" pp.

58-59

Ch. 3 and 6: "Diminishing Marginal Utility" pp.

49 and 117

Ch.1, Appendix on Graphing

Lecture

Outline

1b Assignments: Video

Lectures

|

REVIEW OF GRAPHING CONCEPTS

OPTIONAL:

MATH, ALGEBRA, AND GEOMETRY FOR ECONOMICS STUDENTS

1b Outcomes - What you should

learn

|

What is "SCARCITY" as it is defined in

economics?

(What two things cause the scarcity of goods and services?

Key

Terms Flash Cards - Click Here

Key Terms:

5Es, scarcity, economic growth,

allocative efficiency, productive efficiency, equity, full

employment, marginal, law of diminishing marginal utility,

President Obama example,

1b Practice Quiz (under

construction)

|

|

|

The 5Es of Economics

Scarcity

and Exchange- EconMovies #1: Star Wars

[6:39 YouTube ACDC Leadership]

NOTE: These are REVIEW videos only. In order to

learn the material you must read the assigned textbook readings,

watch the assigned lecture videos, and do problems. See the LESSONS

link on Blackboard for these assignments.

Unit 1: Markets are

Efficient, Except . . . Intro to

Microeconomics

Lesson 1c: Scarcity and

Budget Lines

1c Introduction

|

|

So, do you agree that it is

GOOD for the people of Florida if, after a

hurricane strikes, the price of plywood (or other

products) increases from $10 a sheet to $30 a

sheet? Or, that it was GOOD when the Coca-Cola

company (or other companies) layed off 6000 workers

as they did in the year 2000 assuming that they

could still produce the same quantity, but with

fewer workers? Even if you do not agree, do you

understand that these things will reduce scarcity

and increase society's satisfaction? In chapter 5

we will learn why the prices of products like

gasoline, soda pop, and junk food, may be TOO LOW.

(Isn't this fun?)

Lesson 1c introduces our

first graphic MODEL: the budget line. For many

students microeconomics is a difficult course. I

think there are two reasons for this. First, we

will learn theories or models, rather than facts.

Facts are easy to memorize. Theories or models have

to be learned and practiced. And second, we will

express our theories or models on graphs, and many

students do not like graphs. If you want to be

successful in this course you must learn to use our

graphical models. You must be able to draw the

graphs correctly from memory, you must understand

what each line on the graph represents, and you

must know why each line has the shape that it does.

For each graph be able to: DEFINE, DRAW, DESCRIBE

its shape. Be sure to study the graphs in the

textbook carefully and plot all the graphs in the

yellow pages. Finally, an easier way to view graphs

is to remember that each point on a graph

represents two numbers. Find a point on a graph,

then find the two number from the graph's

axes.

Note: not all models are

graphs. For example, the 5Es of Economics is a

model of the issues studied by

economists.

|

1c Assignments: Video

Lectures

|

|

WHAT

IS ECONOMICS: SCARCITY, THE 5Es, AND MAKING

CHOICES

BUDGET

LINES

|

1c Outcomes - What you

should learn

|

|

TOPICS

- Definition of

economics

- Economic

models

- Budget lines

- Resources (Four Factors

of Production) Why do economists use all those

graphs (models)?

OUTCOMES

- Define economics and

describe the four components of the

definition:

- social

science

- choice

- scarcity

- maximizing

satisfaction

- What are economic models

and why do economists use them?

- Explain the importance of

ceteris paribus in formulating economic

principles.

- Differentiate between

microeconomics and macroeconomics.

- Defne and draw budget

lines. Explain what happens to a budget line

when income and prices change.

- How does the budget line

illustrate the necessity of making

choices?

- Define and give examples

of the four types of resources (factors of

production) and know the payment for

each

|

1c Key Terms

|

|

Key

Terms Flash Cards - Click Here

Key Terms:

economics, economic

model, microeconomics, macroeconomics, utility,

rational choice, opportunity cost, benefit-cost

analysis (marginal analysis), ceteris paribus

(other things equal assumption), budget line,

budget constraint, factors of production,

resource, land, labor, capital, entrepreneurial

ability

|

1c Practice Quiz (under

construction)

|

|

|

1c Key Graphs

|

|

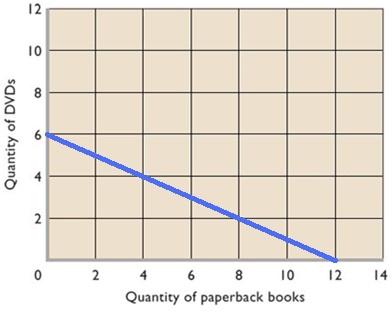

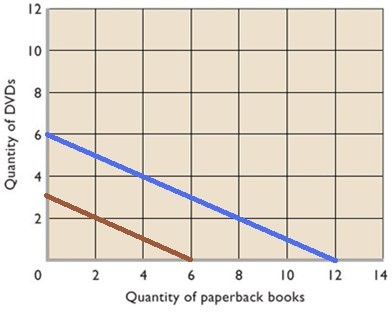

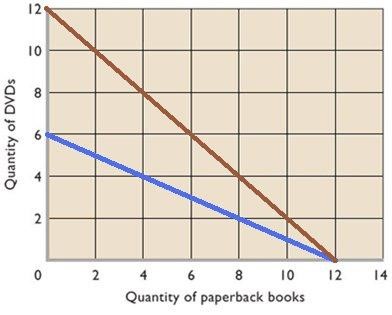

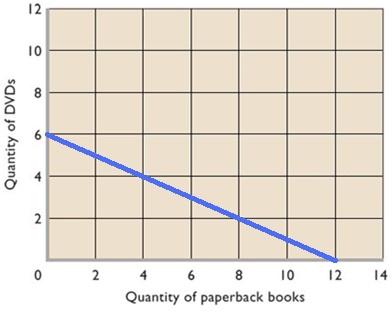

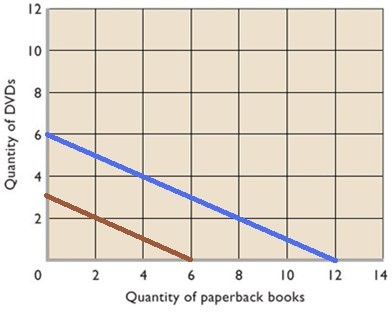

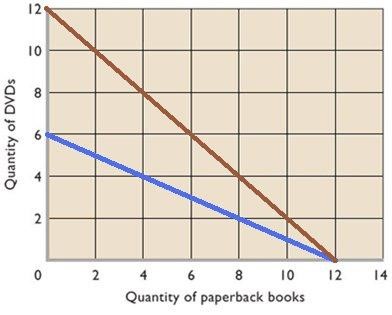

Budget Line

Budget Line: Income

Decreases

Budget Line: Price

Decreases

|

1c Review Videos

|

|

Scarcity

and Exchange- EconMovies #1: Star

Wars

[6:39 YouTube ACDC

Leadership]

NOTE: These are REVIEW videos

only. In order to learn the material you must read

the assigned textbook readings, watch the assigned

lecture videos, and do problems. See the LESSONS

link on Blackboard for these assignments.

|

|

Unit 1: Markets are

Efficient, Except . . . Intro to

Microeconomics

1d Making Choices: Production

Possibilities Curve (PPC) and Benefit Cost Analysis

(BCA)

1d Introduction

|

|

Here we will study our second

graphical model: the Production Possibilities Curve

(PPC), and we then will learn a tool for making

decisions that we will use throughout the course:

Benefit-Cost Analysis (BCA). Basically what we are

doing is setting the stage for making economic

decisions. Remember: economics is the social

science concerned with how we CHOOSE to use

our limited resources to maximize society's

unlimited wants, or, how we make

decisions.

The production possibilities

curve will show us that we must make choices and

all choices have costs. Economists call these

"opportunity costs". ALL COSTS IN ECONOMICS ARE

OPPORTUNITY COSTS. Whenever we discuss the "costs"

of doing something we will mean the complete

opportunity cost.

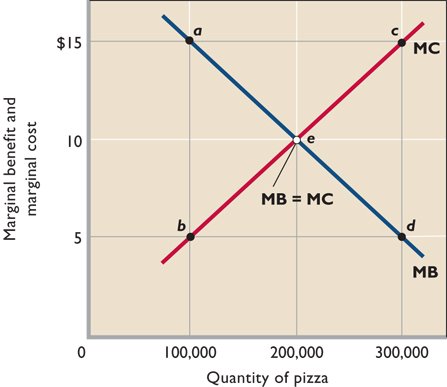

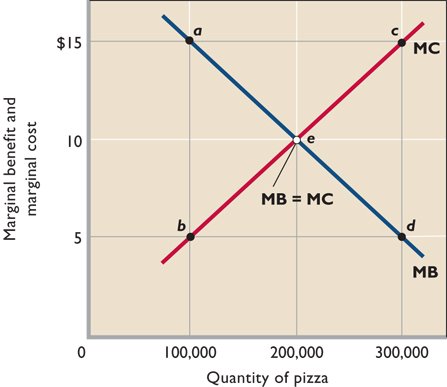

Benefit-cost analysis (BCA)

is a model that explains how to make the best

decision possible. BCA means we should select all

options where the marginal benefits (MB) are

greater than the marginal costs (MC) -- up to where

MB = MC. When the MB = MC then we have made the

best decision possible. NOTE: "marginal" means

"extra" or "additional". So to make the best

decision possible select all options where the

extra benefits that you get from the decision are

greater than the extra costs of the decision. One

more thing: to make the best decisions we look only

at MARGINAL costs and benefits and we ignore FIXED,

or SUNK, costs (i.e. ignore things that will not

change no matter what choice is made).

We will use BCA many times

throughout this course. In chapter 6 we will use

BCA to decide how much to buy to maximize our

satisfaction. In chapters 8-11 we will use it to

decide how much to produce to maximize profits. In

chapters 12 and 13 we use BCA to decide how many to

hire to maximize profits (Ch. 12 and

13).

Notice that economists look

at EXTRA benefits and EXTRA costs. We call this

"thinking on the margin". Students are used to

thinking about TOTAL benefits and TOTAL costs. We

do not want total benefits to equal total costs,

but we do want MB to equal MC. You probably know

that it is best if the total benefits are a lot

higher than total costs. What you will learn is

that when MB = MC, then the difference between

total benefits and total costs will be the

greatest.

Be sure you understand

BCA!

What is the connection

between the PPC and BCA? Well, when studying the

PPC you will learn the important concept of

"opportunity cost". Learn the definition well.

Since all costs in economics are opportunity costs,

then when using BCA, "marginal costs" mean the

additional opportunity costs.

|

1d Something Interesting -

Why are we studying this?

|

|

The link below discusses a

study that concludes that drivers of cars with air

bags have more accidents. Why would airbags in

cars cause more accidents (see the link below)?

After studying this lesson

you should be able to use Benefit-Cost Analysis

(MB=MC) to answer this question. When airbags were

first put in cars how did that change the extra

benefits of driving fast (MB) and the extra costs

of driving fast (MC)?

Drivers

with airbags may take more risks

A similar question for skiers

is why did the invention of avalanche airbags

cause more people to become caught in

avalanches (see below)? After studying this

lesson you should be able to use Benefit-Cost

Analysis (MB=MC) to answer this

question.

In a

March

2013 blog post

written by Utah Avalanche Center Director Bruce

Tremper . . . Tremper says airbags are providing

a false sense of security, leading more skiers

into high-consequence terrain, and thus

decreasing the effectiveness of said

airbag.

"Each gizmo we

buy to increase our safety usually cause us

to increase our level of risk at the same

time. For instance, when we added seat belts

and airbags to cars, yes fatalities

decreased, but it also allowed us to drive

faster, farther, crazier and talk on our

mobile phones at the same time. So safety

measures usually work but not nearly as well

as we would hope because people just increase

their risk (and “utility”) at the

same time. In avalanche airbag case, we will

also get more powder, more fun, and more risk

in the bargain . . . . people will increase

their exposure to risk because of the

perception of increased safety, which will

cancel out some, but not all, of the

effectiveness of avalanche airbag."

What are avalanche

airbags?

https://www.youtube.com/watch?v=h7QFRXc0R8M

|

1d Assignments:

Readings

|

|

Ch 1: Production

Possibilities Model, pp. 11-21

Ch. 1: p. 5, "Marginal

Analysis: Benefits and Costs"

Ch. 1: pp. 13-14, "Optimal

Allocation" (especially Fig 1.3),

Drivers

with airbags may take more risks

Ch 1: p. 14, "The Economics

of War" (box)

Lecture

Outline

|

1d Outcomes - What you

should learn

|

|

TOPICS

- Society's Economizing

Problem: Production Possibilities

- How to Make Choices:

Benefit-Cost Analysis

OUTCOMES

Production

Possibilities

- Construct a production

possibilities curve (PPC) when given appropriate

data; what is the production possibilities curve

(PPC) or production possibilities frontier

(PPF)?; what does it show?

- What are the assumptions

behind the PPC

- Illustrate the following

using the production possibilities curve:

- - we must make

choices

- choices have opportunity costs

- the law of increasing costs

- the effect of unemployment

- the effect of productive inefficiency

- how present choices affect future

possibilities

- the effect of international trade

- two types of "economic growth"

- it does NOT show the optimum product mix

(allocative efficiency)

- Explain WHY the PPC has

the shape that it does -- concave to the origin.

What is the law of increasing cost? Why are

there increasing costs? (Draw, Define. Describe

all graphs)

- What would the PPC look

like if there were constant costs?

- What does a point outside

the PPC represent?

- What two things (2 Es)

would a point inside the PPC

indicate?

- Summarize the general

relationship between investment and economic

growth.

- What is the difference

between? Show the difference on a PPC. What are

the two types of economic growth ("achieving the

potential" and "increasing the potential") and

how are they shown on a PPC?

- What would cause a PPC to

shift inward?

- Use a PPC to illustrate

the effect of international trade

Benefit Cost

Analysis

- define benefit cost

analysis (BCA) and use it to solve

problems

- define "marginal" and

give examples

- define marginal benefits

(MB) and marginal costs (MC)

- explain why we ignore

fixed, or sunk, costs ("Don't cry over spilt

milk.")

- know what happens if MC

increase? decrease?

- know what happens if MB

increase? decrease?

- draw MB and MC on a graph

and explain their shapes

- be able to find the

optimum choice from a table of total costs and

total benefits and from a table of marginal

costs and marginal benefits

- use BCA to explain why

Drivers

with airbags may take more

risks or why

skiers

with air bags may take more

risks

- what is a "sunk cost" (or

fixed cost) and why are they ignored when using

benefit-cost analysis?

- "Don't cry over spilt

milk " If you are deciding whether or not to

come to class today, why does it not matter that

you have already paid tuition? Why is the fact

that you have paid tuition irrelevant when

trying to decide whether to attend class today

or skip?

|

1d Key Terms

|

|

Key

Terms Flash Cards - Click Here

Key Terms:

PPC:

production possibilities, necessity of choice,

law of increasing costs, concave to the origin,

opportunity cost, constant cost, benefit-cost

analysis (marginal analysis), economic growth,

consumer goods, capital goods, shrinking PPC,

nonproportional growth

BCA:

marginal costs (MC), marginal benefits (MB),

MB=MC Rule, sunk (fixed) costs

|

1d Practice Quiz (under

construction)

|

|

|

1d Key Graphs

|

|

The Production Possibilities

Curve (PPC)

PPC: Unemployment to Full

Employment and Productive

Inefficiency to Efficient

PPC and Economic

Growth

Benefit Cost

Analysis

|

|

Unit 1: Markets are

Efficient, Except . . . Intro to

Microeconomics

Lesson 2a: Market Economies

and Trade

2a Introduction

|

|

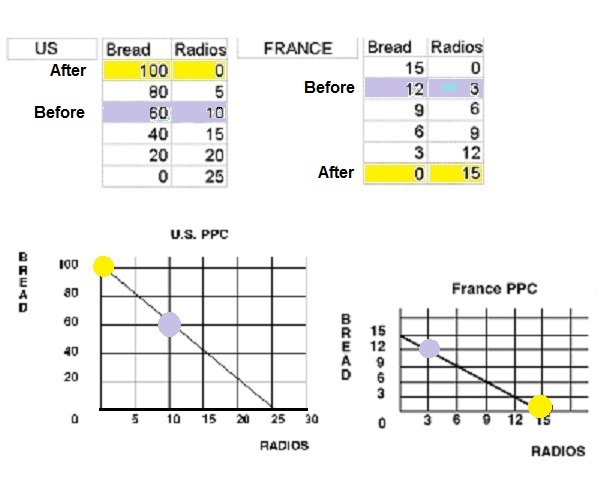

One reason why I use our

textbook is because they have a chapter on market

economies and they used to have a chapter on

command economies (now just a small section). In

this lesson we find out for the first time that

competitive market economies are efficient, both

allocatively and productively. This is the result

of the "invisible hand" of capitalism. This is a

general theme for the whole course that we will

discuss again in chapters 3, 5, and 8-13. Many

textbooks simply assume that students know what a

capitalist economy (market economy) is because we

live in one here in the United States. But, I

learned long ago that students do not understand

the characteristics of captialism nor the benefits

of, or the problems with, market economies. All

over the world countries are moving away from

command economies toward a market economy. Why? We

will learn it is because market economies are

better at achieving allocative and productive

efficiency, and economic growth, but they do seem

have a problem with equity and at times full

employment.

One characteristic of a

market economy is a limited role for governement.

Periodically we will discuss just WHAT IS the

economic role of government? What should the

government do, or not do? This is where Republicans

and Democrats seem to have a fundamental

disagreement, but I think they agree more than they

believe. Remember this: the economic goal of

society is to maximize its satisfaction (reduce

scarcity as much as possible). And they do this by

achieving the 5Es. The economic role of government

then ALSO should be to achieve the 5Es. We will

return to this issue of the economic role of

government at different times thoughout the

course.

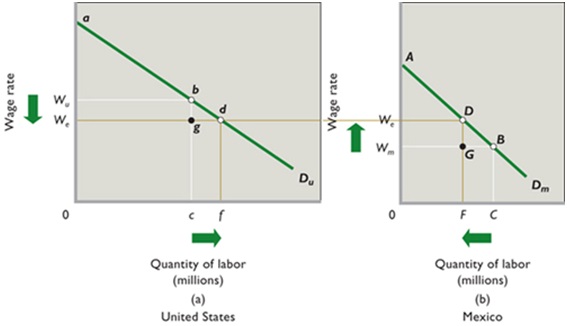

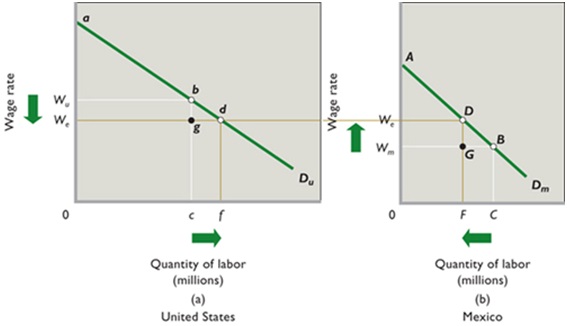

Our first discussion of this

economic role for government will be FREE TRADE.

Should the United States have free trade with other

countries like Mexico and China, or should the

government impose trade restrictions? We will

examine this question by using the production

possibilities model that we learned in chapter

1.

|

2a Something Interesting -

Why are we studying this?

|

|

Read the first four

paragraphs of The

Mystical Power of Free Trade.

After studying this lesson

you should understand:

- why "society

benefits from allowing its citizens to buy what

they wish--even from foreigners." (i.e. free

trade helps society),

- and why "people resist this

conclusion, sometimes violently"

|

2a Outcomes - What you

should learn

|

|

TOPICS

- How Countries Make

Economic Choices: Economic Systems

- Market

Economies

- Command

Economies

- Capitalism and the Five

Fundamental Questions

- Capitalism and Efficiency

(the invisible hand)

- The Gains from

Trade

OUTCOMES

- Pure Laissez-faire

economic system

- Centrally Planned

Economy

- mixed economic

systems

- The Bolshevik

Revolution

- Contributing factors to

the collapse of the Soviet Union

- characteristics of the

market system

- the important role of

profits and losses

- property

rights

- the "invisible hand" of

capitalism

- the coordination

problem

- the incentive

problem

- be able to draw and

explain the Circular Flow Model

- Why are market economies

more efficient than command economies both

allocatively and productively?

- What is the "invisible

hand" of capitalism

- How does trade increase

productive efficiency and therefore

output?

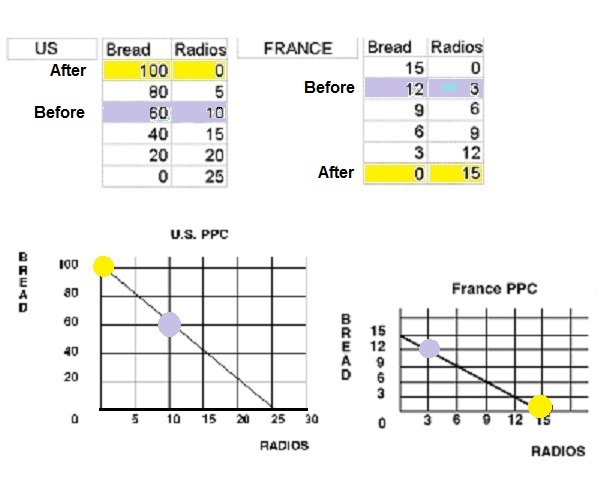

- calculate how

specialization and trade increases output using

the production possiblilities tables and graphs

of two different countries

- straight line PPCs

(constant costs)

- absolute

advantage

- comparative

advantage

- calculate comparative

advantage

- specialization and

trade

- calculate the gains from

specialization and trade

|

2a Key Terms

|

|

Key

Terms Flash Cards - Click Here

Key Terms:

economic system,

command system (centrally planned, socialism),

market system (capitalism, laissez-faire), mixed

economic system, Bolshevik revolution, self

interest, private property, freedom of

enterprise and choice, competition, market,

specialization, consumer sovereignty, dollar

votes, invisible hand, creative destruction,

coordination problem, incentive problem,

circular flow diagram, product market, resource

market, opportunity cost, absolute advantage,

comparative advantage, gains from trade, free

trade.

|

2a Practice Quiz (under

construction)

|

|

|

2a Key Graphs

|

|

Comparative Advantage and the

Gains from Trade

Circular Flow Model of

Capitalism

|

|

Unit 1: Markets are

Efficient, Except . . . Intro to

Microeconomics

Lesson 3a:

Demand

3a Introduction

|

|

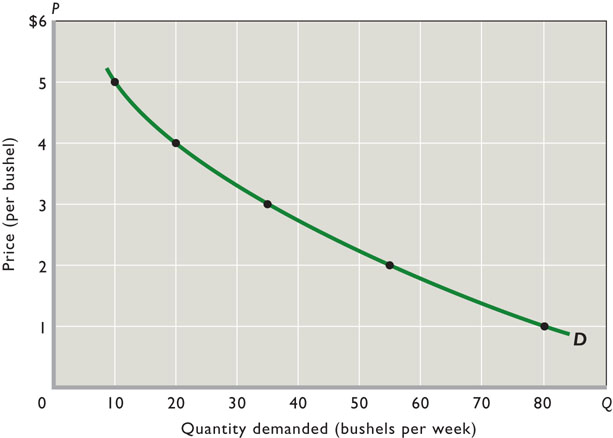

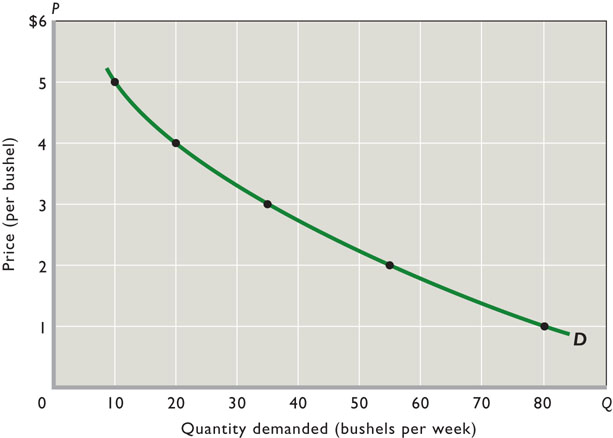

If the price of pizza goes

up, what happens to the demand for pizza? . . . . .

. . . . . . . . . . . . . . NOTHING! Nothing

happens to the demand for pizza if the price

changes!

The next three lessons

introduce the demand and supply model for

explaining how prices arise and change in a market

economy. Learn these lessons well. Do the assigned

problems. Draw the graphs in the yellow pages and

while you are reading and studying. DRAW GRAPHS!

Get used to using the graphs to help you answer

questions. If you are avoiding drawing the graphs

you will do poorly and not get the practice that

you need to learn the concept. Be sure to LABEL the

axes of every graph that you draw.

So why doesn't the demand for

pizza change if the price changes? Because

economists have a different definition of "demand".

Demand is NOT the quantity that we buy. If the

price of pizza goes up we will buy less, but that

is not what "demand" means in economics. Economists

tend to be precise with their definitions and

sometimes their definitions are different than the

more commonly used definitions. Things like

"scarcity", "investment", "cost", "demand", and

"supply", have different definitions in economics

than what you may already know. Learn our

definitions! Demand is not how much we buy. Demand

has a different definition in economics. "Demand"

means the "demand graph".

Remember, that econmists use

models (like the supply and demand model) to

simplify the real world. They do this by isolating

certain variables from all the clutter found in

reality. Then by changing one variable at a time

economists can see what effect it will have. In

this lesson we will learn the economic definition

of DEMAND and plot the demand graph. Then, we will

look at one variable at a time to see what effect

they have on the demand curve. We call these

variables the "non-price determinants of demand".

They are: Pe, Pog, I, Npot, T (P,P,I,N,T). LEARN

THEM! LEARN THEM WELL! Know how each one affects

the demand curve. Be sure to do the yellow pages.

|

3a Something Interesting -

Why are we studying this?

|

|

What is that Campbell's Pork

and Beans can doing on the display for VanCamp's

Pork and Beans (see below)?

After studying this lesson

you will be able to draw a graph

illustrating what happened to the demand for

Campbell's Pork and Beans when a customer took a

can out of their shopping cart and placed it on

this display of VanCamp's Pork and Beans that were

on sale.

Which non-price determinant

of demand explains why that Campbell's soup can is

there?

|

3a Outcomes - What you

should learn

|

|

TOPICS

- Definition of

demand

- Changes in Demand vs.

Changes in Quantity Demanded

- Non-price determinants of

demand and they affect the demand

curve

OUTCOMES

- define demand

(note: it has a DIFFERENT DEFINITION in

economics)

- If the price of pizza

goes up, why does the demand for pizza stay the

same?

- be able to correctly draw

and label a demand graph

- why do economists employ

the ceteris paribus assumption when

creating a demand curve?

- what is the law of

demand?

- why is the demand curve

downward sloping (three

explanations)

- list the non-price

determinants of demand (Pe. Pog, I, Npot, T) or

(P, P, I, N, T ) and understand how they affect

the demand schedule and curve. This is VERY

IMPORTANT. BE ABLE TO DO THIS! See the

3a/3b/3c yellow pages.

- explain the difference

between the a "change in the quantity demanded"

and a "change in demand"

- what is an "increase in

demand" and a "decrease in demand" and show how

they affect the demand schedule and the demand

curve

- what is "market

demand"?

- what is that Campbell's

Pork and Beans can doing on the display for

VanCamp's Pork and Beans (see picture at left)?

Which non-price determinant of demand explains

why that Campbell's soup can is there? Draw a

supply and demand graph illustrating what

happened in the market for Campbell's Pork and

Beans when VanCamp's were put on

sale.

|

3a Key Terms

|

|

Key

Terms Flash Cards - Click Here

Key Terms:

demand, quantity

demanded, law of demand, market demand,

horizontal summation, income effect,

substitution effect, diminishing marginal

utility, change in demand, change in quantity

demanded, increase in demand, decrease in

demand, non-price determinants of demand, normal

good, inferior good, substitute good,

complementary good (complement), independent

goods

|

3a Practice Quiz (under

construction)

|

|

|

3a Key Graphs

|

|

The Demand Curve

Changes in Demand

Market Demand (horizontal

summation of indievidual demand curves)

|

3a Review Videos

|

|

- Demand

and Supply Explained- Econ

2.1

[6:20 YouTube ACDC Leadership]

NOTE: These are REVIEW videos

only. In order to learn the material you must read

the assigned textbook readings, watch the assigned

lecture videos, and do problems. See the LESSONS

link on Blackboard for these

assignments.

|

|

Unit 1: Markets are

Efficient, Except . . . Intro to

Microeconomics

Lesson 3b:

Supply

3b Introduction

|

|

If the price of pizza goes up

what happens to the SUPPLY of pizza? . . . . . . .

. . . NOTHING!

A change in the price of a

product does not affect its supply, or its demand.

When the price goes up the QUANTITY SUPPLIED will

increase, but the supply does not change. Learn the

difference between "supply" and "quantity

supplied". "Supply" does NOT MEAN the quantity

available for sale. Supply has a different

definition in economics. "Supply" means the "Supply

graph".

So what would cause the

supply graph, or supply itself, to change? Those

things that cause supply to change are called the

"non-price determinants of supply". They are: Pe,

Pog, Pres, Tech, Tax, Nprod (P,P,P,T,T,N). See the

Yellow Pages.

Remember, the goal of chapter

3 is to learn a model that will help us understand

why prices are what they are and why prices change.

In the next lesson we will put demand and supply

together and use the model (graph) to find the

prices of products. Then, and more importantly, we

will see what causes prices to change. If you hear

on the news, or read in your news app, that the

price of gasoline is going down, we will be able to

explain WHY. The causes of changes in prices of

products are the five non-price determinants of

demand (Pe, Pog, I, Npot, T) and/or the six

non-price determinants of supply (Pe, Pog, Pres,

Tech, Tax, Nprod.). Whenever you hear that the

price of something is changing think of these 11

possible causes.

|

3b Something Interesting -

Why are we studying this?

|

|

Read the short news article

below on the declining price of gasoline (Dec.

2015). Paragraph 10 states "Plunging oil prices are

the main factor driving down the price at the

pump."

Gas

falls below $2 a gallon

[http://money.cnn.com/2015/12/20/news/economy/aaa-2-dollar-gas/index.html]

After studying this lesson

you should be able to:

(1) list the non-price

determinants of supply

(2) select the determinant that is the cause of the

decline in gasoline prices discussed in the news

article, and

(3) graph the effect that the change in the

determinant will have on the supply curve for

gasoline.

|

3b Outcomes - What you

should learn

|

|

TOPICS

- Definition of

supply

- Changes in Supply vs.

Changes in Quantity Supplied

- Non-price determinants of

supply and how they affect the supply

curve

OUTCOMES

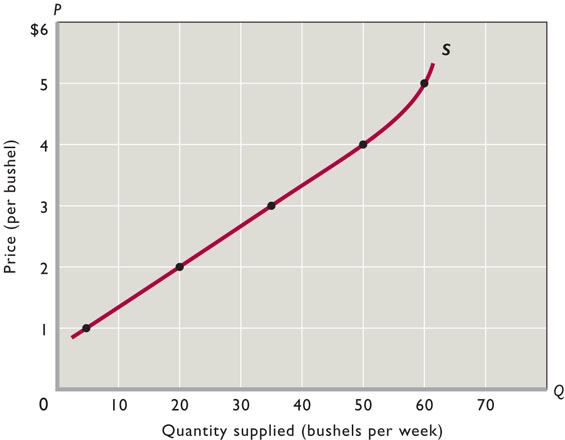

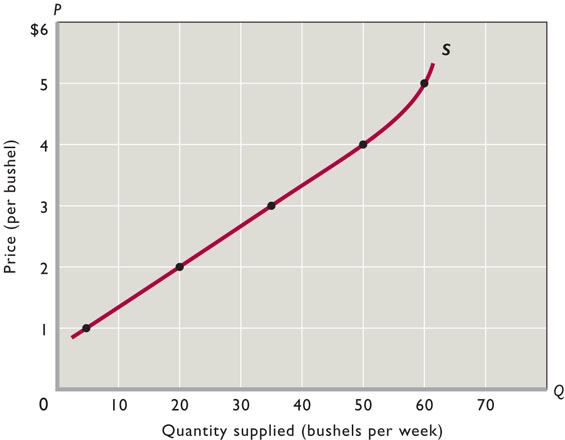

- define supply (note: it

has a DIFFERENT DEFINITION in

economics)

- be able to correctly draw

and label a supply graph

- if the price of pizza

goes up why does the supply not

change?

- why do economists employ

the ceteris paribus assumption when creating a

supply curve?

- what is the law of

supply?

- why is the supply curve

upward sloping (two explanations)

- list the non-price

determinants of supply (Pe, Pog, Pres, Tech,

Taxes, Nprod) or (P,P,P,T,T,N) and understand

how they affect the supply schedule and curve.

This is VERY IMPORTANT. BE ABLE TO DO THIS!

See the 3a/3b/3c yellow pages.

- explain the difference

between the a "change in the quantity supplied"

and a "change in supply"

- what is an increase in

supply and a decrease in supply and show how

they affect the supply schedule and the supply

curve

- what is "market

supply"?

- Read the following and

answer these questions:

- Which determinant has

changed?

- Will it affect S or D

of gasoline?

- Will the S or D of

gasoline increase or decrease? Shift to the

right or to the left?

"According to the

Lundberg Survey, the average price for

regular gasoline dropped 3.99 cents over the

three weeks up to July 11 to $3.6699 per

gallon. . . . Lundberg explained that the

average gasoline price continues to decrease

because refiners, enjoying the lower crude

oil prices in the market, are passing down

the savings to the consumers. "

From: http://www.techtimes.com/articles/10378/20140714/average-price-of-gasoline-in-u-s-drops-four-cents-now-at-3-67-a-gallon.htm

|

3b Key Terms

|

|

Key

Terms Flash Cards - Click Here

Key Terms:

supply, quantity

supplied, market supply, law of supply, change

in supply, change in quantity supplied, increase

in supply, decrease in supply, non-price

determinants of supply

|

3b Practice Quiz (under

construction)

|

|

|

3b Key Graphs

|

|

The Supply Curve

Changes in Supply

|

3b Review Videos

|

|

- Demand

and Supply Explained (2 of 2) - Econ

2.2

[4:54 YouTube ACDC

Leadership]

NOTE: These are REVIEW videos

only. In order to learn the material you must read

the assigned textbook readings, watch the assigned

lecture videos, and do problems. See the LESSONS

link on Blackboard for these

assignments.

|

|

Unit 1: Markets are

Efficient, Except . . . Intro to

Microeconomics

Lesson 3c: Market Equilibrium

and Efficiency

3c Introduction

|

|

We are going to learn two

very important things in this lesson.

First, we will put demand and

supply together and learn how to use the model to

to see why products have the prices that they do.

Then, and more importantly, we will see what causes

prices to change.

If you hear on the news or

read in your news app, that the price of gasoline

is going down, we will be able to explain WHY. The

causes of changes in prices of products are the

five non-price determinants of demand (Pe, Pog, I,

Npot, T) and/or the six non-price determinants of

supply (Pe, Pog, Pres, Tech, Tax, Nprod.). Whenever

you hear that the price of something is changing

think of which of these 11 possible causes have

changed, draw the graph and shift the appropriate

demand and/or supply graph, and the graph will show

the price changing.

Second, after we learn that

in a competitive market economy the interaction of

demand and supply will determine what the prices of

products will be and how much people will buy at

that price, we will ask: Is this the allocatively

efficient quantity and price? Our goal is to show

that in a competitive market the price will change

until allocative efficiency is achieved. In chapter

2 we learned that markets are allocatively

efficient. This means they will produce the

quantity of goods that maximizes the society's

satisfaction. After studying chapter 3 we will bew

able to show the allocatively efficient price and

quantity on a graph.

Competitive markets are

efficient.

|

3c Something Interesting -

Why are we studying this?

|

|

Read the first few paragraphs

of Hybrid

Car Prices Increasing Due To High Gas

Prices.

In lesson 3a you learned how

the non-price determinants of demand (Pe, Pog, I,

N, T) affect the demand curve.

In lesson 3b you learned how

the non-price determinants of supply (Pe, Pog,

Pres, Tech, Tax, Nprod) affect the supply

curve.

After studying this lesson

you will be able to use these determinants and the

supply and demand graphs to explain why prices

change.

For example you will

understand why: "It's becoming almost an annual

tradition: As fuel prices rise in the spring, so do

the prices of hybrid cars. "

|

3c Outcomes - What you

should learn

|

|

TOPICS

- Market

Equilibrium

- Market Equilibrium and

Changes in D and S

- Market Equilibrium and

Allocative Efficiency

- MSB=MSC

- maximum consumer plus

producer surplus

OUTCOME

Equilibrium

- what are the two

assumptions of a competitive equilibrium?

- there are many buyers

and sellers in the market

- who have no influence

over the price; i.e. they are price

takers

- define equilibrium;

define market equilibrium

- what happens if the price

is below the equilibrium price? If it is above

it?

- how to find the

equilibrium price and quantity on a supply and

demand schedule and graph

- define "shortage" and

"surplus" and explain using a supply and demand

graph

- what is the "bidding

mechanism"?

- the three (or four) steps

to finding a new equilibrium when a non-price

determinant changes and how to use

them

- what happens to the

equilibrium price and quantity if (1) demand

increases, (2) demand decreases, (3) supply

increases, and (4) supply decreases.

- what happens if both

supply and demand change

Markets and

Efficiency

- be able to use two models

to show why competitive market economies achieve

allocative efficiency

- MSB=MSC

- maximum consumer plus

producer surplus

- define consumer surplus

and shade it in on a supply and demand

graph

- define marginal social

benefit and explain why it is often measured by

the demand curve

- define producer surplus

and shade it in on a supply and demand

graph

- define marginal social

cost and explain why it is often measured by the

supply curve

- define deadweight loss

and be able to locate it on a supply and demand

graph if too much or too little is

produced

- explain why allocative

inefficiency occurs where MSB > MSC causing

an underallocation of resources (too little

produced); show on graph using the MSB=MSC model

and show the deadweight loss on the consumer and

producer surplus model

- explain why allocative

inefficiency occurs where MSB < MSC causing

an overallocation of resources (too much

produced); show on graph using the MSB=MSC

model

- be able to find WHAT WE

GET and WHAT WE WANT on the MSB=MSC model

graph

|

3c Key Terms

|

|

Key

Terms Flashcards - Click Here

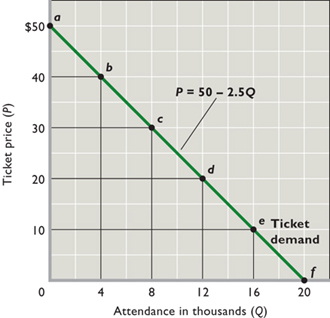

Market Equilibrium

equilibrium, market

equilibrium, bidding mechanism, surplus,

shortage, scalping,

Efficiency

productive

efficiency, allocative efficiency, marginal

social benefits, marginal social costs, "what we

get", "what we want", profit mximizing quantity,

underallocation of resources, overallocation of

resources, consumer surplus, producer surplus,

deadweight loss

|

3c Practice Quiz (under

construction)

|

|

|

3c Key Graphs

|

|

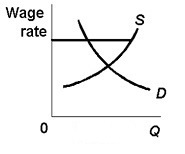

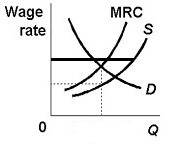

Market Equilibrium

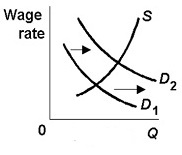

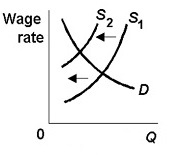

Changes in Demand and Supply

and the Effects on Equilibrium P and Q

Market Equilibrium is

Efficient

|

|

Unit 1: Markets are

Efficient, Except . . . Intro to

Microeconomics

Lesson 5a: Government

Interference in Markets and Market Failures (Negative

Externalities)

5a Introduction

|

|

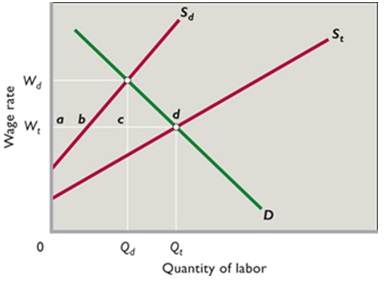

In lesson 3c we learned that

competitive markets are efficient and we learned

two models to show that markets are efficient: (1)

MSB = MSC, and (2) maximum consumer plus producer

surplus. You must understand these models to

understand chapter 5. In chapter 5 we learn that

SOMETIMES markets are NOT efficient.

When are product markets not

efficient?

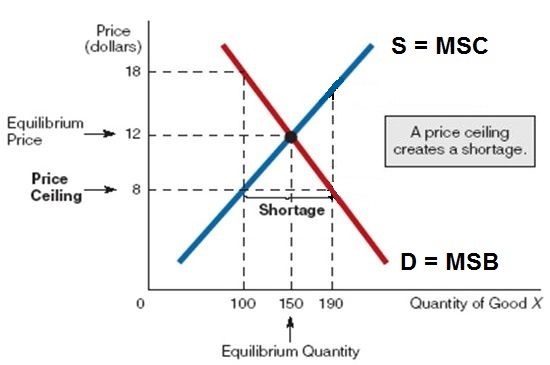

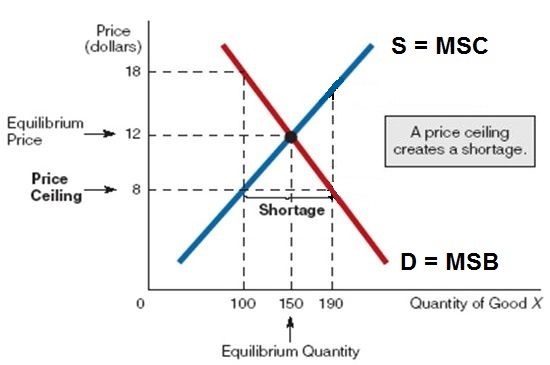

1. when the

government sets the price (price ceilings and

price floors - lesson 5a, chapter 3, pp 61-64

)

2. when the supply curve does

not include all of the costs of producing or

consuming the product (negative externalities -

lesson 5a, chapter 5)

3. when the demand curve does not include all of

the benefits of consumption (positive

externalities - lesson 5b, chapter 5)

4. when the products are "public goods" (lesson

5b, chapter 5).

5. when there is not competition (monopolies and

oligopolies - chapters 10 and 11)

In this lesson we also will

begin our look at the role of the government in a

market economy. This would be a good time to review

chapter 2. In chapter 2 we learned that there is a

limited role for government in market economies. We

learned in lesson 3c that markets are efficient, so

there is little need for the government. In this

lesson we will see what happens if the government

interferes in markets. We will learn that sometimes

governments will set prices (price ceilings and

price floors), rather than letting the market set

the price. In other words: SOMETIMES GOVERNMENTS

CAUSE ALLOCATIVE INEFFICIENCY. (This is the plywood

after a hurricane example discussed in the 5Es

reading in lesson 1b.)

Then we will begin to look at

examples of when the markets on their own fail to

achieve allocative efficiency and examine what the

government can do to correct these market failures.

SOMETIMES MARKETS BY THEMSELVES ARE INEFFICIENT and

the government may try to modify the market to help

it achieve allocative efficiency. There are three

MARKET FAILURES that we will look at in chapter 5.

A "market failure" occurs when the market fails to

achieve allocative efficiency. In lesson 5a we look

at the market failure caused by negative

externalities - when the supply curve does not

include all of the costs to society of producing

and consuming the product. Then in lesson 5b we

look at the market failures caused by positive

externalities and public goods.

We will assume that

businesses will always produce the profit

maximizing quanitity since their goal is to

maximize profits. The profit maximizing quantity is

also the equilibrium quantity that we studied in

chapter 3, when the Qs = Qd. This is WHAT WE GET.

We get whatever they produce and they will produce

the quantity that gives them the biggest profits.

The goal of business is not to be efficient. Their

goal is to maximize their profits. If a business

can make larger profits by being inefficient then

they will be inefficient. Or if they can make

larger profits by being efficient they they will be

efficient. The main point is that efficiency is not

their goal, rather, maximizing profits is their

goal.

The allocatively efficient

quantity is what society wants. We learned at the

end of chapter 3 that allocative efficiency occurs

at the quantity where MSB = MSC. This is WHAT WE

WANT. We want to maximize our satisfaction and we

learned in chapter 1 that this occurs when we

achieve the 5 Es. Allocative efficiency is one of

the 5 Es.

When the profit maximizing

quantity equals the allocatively efficient quantity

then markets are efficient . This means that profit

maximizing businesses are producing the quantity

that maximizes society's satisfaction. WHAT WE GET

= WHAT WE WANT. This is the INVISIBLE HAND of

capitalism that was discussed in chapter 2. It's as

if there is an invisible hand guiding businesses to

not only make decisions that maximize their

profits, but also to maximize society's

satisfaction. As if they don't even know it is

happening.

When markets fail to achieve

allocative efficiency, the profit maximizing

quantity (WHAT WE GET or the equilibrium quantity

from chapter 3) is not the same as the allocatively

efficient quantity (WHAT WE WANT or the quantity

where MSB=MSC). Since one of the economic goals of

government is to help the economy achieve

efficiency, governments often get involved to

correct for market failures. If the market produces

too much (negative externalities cause allocative

inefficiency because of an overallocation of

resources) the government tries to get it to

produce less. If the market produces too little

(positive externalities and public goods causing

allocative inefficiency resulting in an

underallocation of resources) the government tries

to get it to produce more.

|

5a Outcomes - What you

should learn

|

|

TOPICS

- Price

Ceilings

- Price Floors

- Negative

Externalities

OUTCOMES

Price ceilings and

floors

- define price ceiling and

give examples

- how do price ceilings

affect allocative efficiency (too little

being produced; underallocation of

resources), explain using the MSB=MSC model

and the consumer and producer surplus (dead

weight loss) model

- what other effects do

price ceilings have?

- what happens if the

government sets a price ceiling rate that is

lower than the equilibrium?

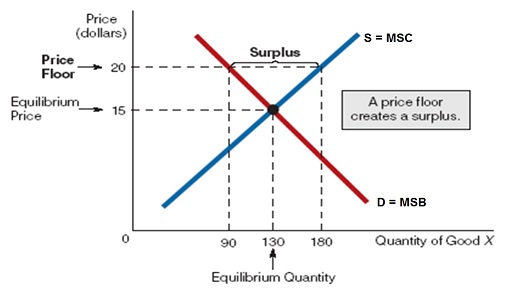

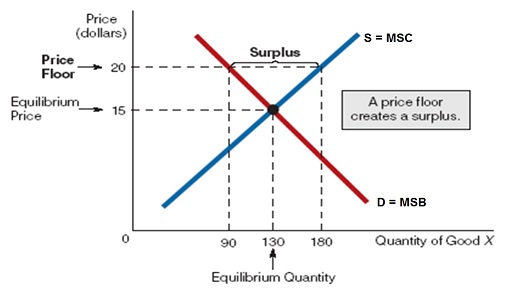

- define price floor and

give examples

- explain the efficiency

effects of a price floor using the MSB=MSC

model and show on a graph (too much being

produced; overallocation of

resources)

- what happens if the

government sets a price floor that is higher

than the equilibrium?

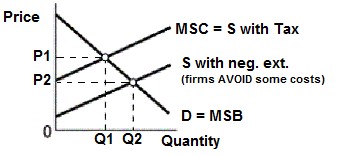

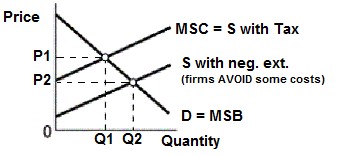

Market Failure: negative

externalities (also called external costs or

spillover costs)

- what is a market

failure?

- what is an

externality?

- define negative

externalities (external costs or spillover

costs)

- give examples of negative

externalities

- use the MSB=MSC model to

show the effects (overallocation) on allocative

efficiency of negative externalities

- what can the government

do to correct the market failure caused by

negative externalities and show the effects of

these policies on the MSB=MSC model

- Supply is usually equal

to MSC, but when there are negative

externalities the supply curve is to the right

of the MSC curve. Why?

- what is an excise

tax?

- Why might gasoline prices

be too low?

http://www.npr.org/templates/story/story.php?storyId=4858826

- Why is San Francisco

considering taxing sodas?

- Why did Mexico tax junk

food and soda?

http://www.politico.com/story/2014/01/mexico-soda-tax-101645

- what is the Coase

theorem?

- explain how according to

the Coase Theorem that under certain

circumstances bargaining can solve the problems

created by negative externalities without the

government using an example

- what are the necessary

condition needed for the Coase Theorem to

work?

- what is the tragedy of

the commons?

|

5a Key Terms

|

|

Key

Terms Flash Cards - Click Here

Key Terms:

price ceiling, rent

controls, price floor, market failure,

externality, negative externality (external

cost, spillover cost), internalizing the

externality, excise tax, incidence of a tax, cap

and trade, Coase Theorem

|

5a Practice Quiz (under

construction)

|

|

|

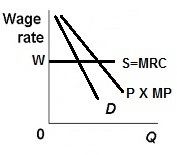

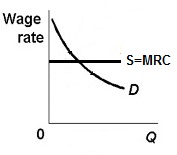

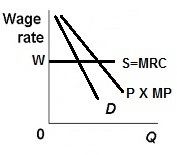

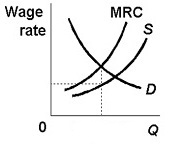

5a Key Graphs

|

|

Price Ceiling (causes a

shortage)

Price Floor (causes a

surplus)

Negative

Externality

Negative Externality and

Taxes

|

|

Unit 1: Markets are

Efficient, Except . . . Intro to

Microeconomics

Lesson 5b: Market Failures

Continued (Positive Externalities and Public

Goods)

5b Introduction

|

|

We have learned that

competitive markets are usually efficient. This is

one of the benefits of a market economy or

capitalism (chapter 2) . But sometimes even markets

can be allocatively inefficient. In lesson 5a we

learned that when negative externalities exist, a

market will produce too much of a good or service

(an overallocation of resources) and therefore the

government should tax the product (like gasoline

taxes) to get consumers to buy less, i.e. without

the tax the price of gasoline is too

low.

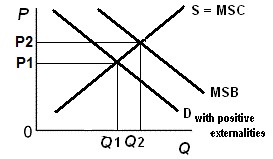

In this lesson we will look

at two other market failures, but this time the

market produces too little (an underallocation of

resources) because the demand curve for the product

does not include all of the benefits. This occurs

when there are positive externalities and when

there are "public goods". Be careful - remember -

economists often change the definitions of words.

Public schools and a public parks are not public

goods according to our definition. Since markets

produce too little when there are negative

externalities or public goods, the goal of

government is to increase production.

In later chapters (10 and 11)

we will discuss another market failure: the lack of

competition. If a market is not competitive, like

when it is a monopoly or an oligopoly, then profit

maximizing businesses will produce less than the

allocatively efficient amount. The invisible hand

of capitalism does not work well if the market is

not competitive.

|

5b Something Interesting -

Why are we studying this?

|

|

Why does the government do

what it does? Governments in the United States,

build and run schools, libraries, and parks, but

not gas stations, clothing stores, or grocery

stores? Why some things and not other things? Does

it make sense or is it just random?

We have learned that

competitve markets achieve efficiency, both

allocative and productive. And we learned that

compeititve markets have a limited role for

government. So why does the government do schools,

libraries, and parks, and we could add roads,

bridges, airports, football stadiums, and

vaccinations. Why these things and not other

things? Why not let private businesses do these

things like they do gas stations, clothing stores,

and grocery stores?

If markets are efficient,

then, if the government is doing something rather

that the market, WE SHOULD ASK, WHY?

In this lesson you will learn

two reasons that explain much of why the government

does what it does: POSITIVE EXTERNALITIES and

PUBLIC GOODS.

One other interesting

question: public schools, public libraries, and

public parks ARE NOT PUBLIC GOODS? Why

not?

|

5b Assignments:

Readings

|

|

Chapter 5: pp 99-110, "Public

Goods", "Externalities" and "Government's Role in

the Economy"

Lecture

Outline

|

5b Outcomes - What you

should learn

|

|

TOPICS

- positive

externalities

- public goods

- tragedy of the

commons

OUTCOMES

Market Failure: positive

externalities (also called external benefits or

spillover benefits)

- define positive

externalities (external benefits or spillover

benefits)

- give examples of positive

externalities

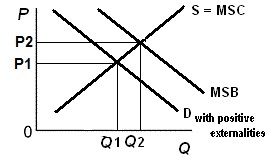

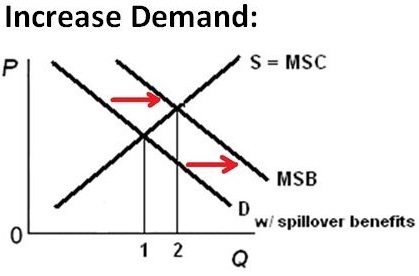

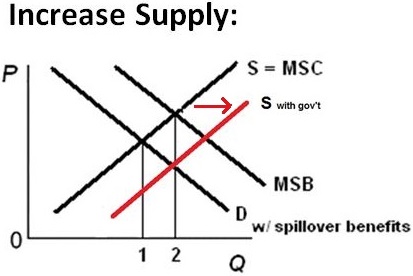

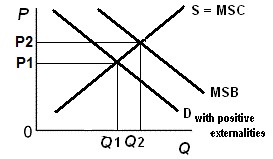

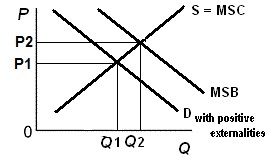

- use the MSB=MSC model to

show the effects on allocative efficiency of

positive externalities

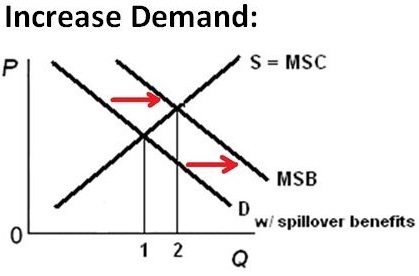

- what can the government

do to correct the market failure caused by

positive externalities and show the effects of

these policies on the MSB=MSC model

- Demand is usually equal

to MSB, but when there are positive

externalities the demand curve is to the left of

the MSB curve. Why?

- Are positive

externalities (spillover benefits) good or bad

for society? Why or why not?

- Comment on:

EconMovies

7: Anchorman (Efficiency and Market Failures)

http://www.youtube.com/watch?v=FBjFDtH-iZM

Market Failure: Public

Goods

- define "public goods

(public goods are non-exclusive and

non-rival)"

- give examples of public

goods and explain why they are public

goods

- define private

(exclusive) goods" and give examples

- define "rival goods" and

give examples

- what is the "free rider

problem"?

- explain how to derive the

demand curve for public goods

- what effect do public

goods have on allocative efficiency?

- what can the government

do to correct for the market failure of public

goods?

- Why are public schools,

public parks, and public libraries NOT "public

goods"? If they are not public goods then why

does the government produce them?

Market Failure: Tragedy of

the Commons

- what is the Tragedy of

the Commons (common goods non-exclusive but

rival)

- how does the tragedy of

the commons affect allocative

efficiency?

- what can be done to

better achieve allocative efficiency when there

is a tragedy of the commons?

|

5b Key Terms

|

|

Key

Terms Flash Cards - Click Here

Key Terms:

positive

externalities (external benefits or spillover

benefits), private goods, public goods, rivalry

(rival goods), nonrival goods, excludability

(exclusion principle, exclusive goods),

nonexcludability, (nonexclusive goods),

free-rider problem, benefit-cost analysis

(marginal-cost-marginal-benefit rule), tragedy

of the commons

|

5b Practice Quiz (under

construction)

|

|

|

5b Key Graphs

|

|

Positive

Externalities

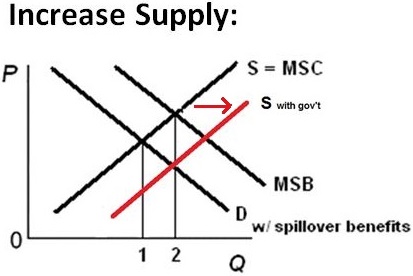

Positive Externalities

and the Role of Government: Increase

Demand

Positive Externalities

and the Role of Government: Increase

Supply

|

5b Review Videos

|

|

- Micro

6.4 Positive Externalities- ACDC

Econ

[2:42 YouTube ACDC

Leadership]

NOTE: These are REVIEW videos

only. In order to learn the material you must read

the assigned textbook readings, watch the assigned

lecture videos, and do problems. See the LESSONS

link on Blackboard for these

assignments.

|

|

Unit 2: Elasticity, Consumer

Choice, Costs

Lesson 4a: Price Elasticity

of Demand and Tax Incidence

4a Introduction

|

|

We learned in chapter 3 that

when the price of pizza goes up the quantity

demanded goes down. (What happens to demand? . . .

. NOTHING.) So we know when the price of a product

goes up then the quantity demanded goes down and

when the price goes down the quantity demanded goes

up. We called this the "law of demand" in chapter

3. What we are going to learn in chapter 4 is HOW

MUCH?

If the price of pizza goes

up, HOW MUCH less will we buy? A LITTLE less

or A LOT less? The price elasticity of

demand will answer this question and it will

also explain why farm incomes were high during a

year of a record drought and were low during a year

of a record harvest.

You already understand

elasticity. Think about this:

if the price of gasoline goes

up HOW MUCH less will consumers buy? A little less

or a lot less?

I believe most students will say A LITTLE

less.

If the price of a Big Mac

goes up, HOW MUCH less will consumers buy? A little

less or a lot less?

I bet most of you answered A LOT less.

If the price of salt goes up,

how much less will consumers buy? A little less or

a lot less?

Correct. Only A LITTLE less.

If the price of a new car

goes up, how much less will consumers buy? A little

less or a lot less?

A LOT less.

The price elasticity of

demand measures how responsive consumers are to

changes in prices. Don't confuse elasticity with

the law of demand. The law of demand tells us that

when prices go up, the quantity

demanded will go down. Elasticity tells us

HOW MUCH it will go down.

Chapter 3 - law of

demand:

if the P  Qd

Qd

Chapter 4 - price elasticity

of demand:

if the P  does Qd

does Qd or Qd

or Qd  ? ?

if price changes, HOW MUCH will the Qd change? A

little or a lot?

In chapter 3 we learned the

direction of the arrows (up or down). In chapter 4

we learn the size of the arrows (big or small).

|

4a Something Interesting -

Why are we studying this?

|

|

In 2012 there was a severe

drought in the US corn growing region. In 2014 the

weather was great and the corn crop was at a record

high. In which year did farmers make the most

money?

They made more in 2012 when

the weather was bad !!!

After studying this lesson

you should understand why good farming weather

results in low farm incomes and bad farming weather

results in high farm incomes. Really!

See:

Sept. 2012:

Despite

Record Drought, Farmers Expect Banner

Year

Sept. 2014:

Corn,

soybean crop expected to hit record high --

Great season could mean bad prices for

farmers ("This

year, farming income is expected to drop by 14

percent.")

ANSWER: The answer to this

paradox is that the demand for corn and soybeans is

price INELASTIC. You will learn that bad weather

causes the price of crops to increase whch causes

farm incomes to increase and good weather causes

the price of farm corps to decrease causing incomes

to decrease BECAUSE THE DEMAND FOR CORN AND

SOYBEANS IS PRICE INELASTIC.

|

4a Assignments:

Readings

|

|

Chapter 4: pp.

75-84,

Chapter

4: pp 86-87, Last Word

Chapter

16: pp 347-354, "Tax Incidence and Efficiency

Loss

Lecture

Outline

|

4a Outcomes - What you

should learn

|

|

TOPICS

- price elasticity of

demand

- tax incidence and

efficiency loss

OUTCOMES

- define price elasticity

of demand

- What is the difference

between the "Law of Demand" and the "Price

Elasticity of Demand"?

- calculate the coefficient

of price elasticity of demand using the midpoint

formula

- explain why the midpoint

formula is used

- know how to interpret the

coefficient (what does the number

mean?)

- price elastic

demand

- price inelastic

demand

- unit elastic

demand

- how does the price

elasticity of demand change along a single

demand curve?

- perfectly price elastic

demand (graph)

- perfectly price inelastic

demand (graph)

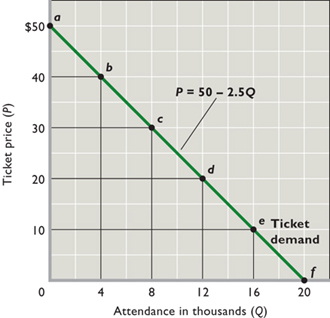

- total revenue test (how

do price changes affect total revenue with

different elasticities (show

graphically)

- P x Q = TR

- explain how the shape of

the total revenue graph is explained by the

price elasticity of demand

- know the determinants of

price elasticity of demand and be able to use

them to make an educated guess as to whether a

product has an elastic or inelastic

demand

- Why might farm incomes

fall if crops are good (bumper

crops)?

- how does the price

elasticity of demand explain the rise in street

crime after a major drug bust?

- how does price elasticity

of demand help explain how the minimum wage

affects unemployment?

- define price

discrimination and explain the role of the price

elasticity of demand

- define "excise tax" and

give examples

- understand the connection

between price elasticity of demand and the

effect of excise taxes on (1) tax incidence

(burden), (2) tax revenue, and (3) allocative

efficiency (social welfare)

- explain the efficiency

loss of excise taxes using the (1) MSB = MSC

model and (2) the consumer and producer surplus

model (dead weight loss)

- the role of excise taxes

in income redistribution and reducing negative

externalities

- Use the concept of the

price elasticity of demand to answer these

questions:

|

4a Key Terms

|

|

Key

Terms Flash Cards - Click Here

Key Terms:

elasticity, price

elasticity of demand, midpoint formula,

coefficient of price elasticity of demand, price

elastic demand, price inelastic demand, unit

elastic demand, perfectly elastic demand,

perfectly inelastic demand, total revenue, price

discrimination, excise tax, tax incidence (tax

burden), efficiency loss of a tax, payroll

tax

|

4a Practice Quiz (under

construction)

|

|

|

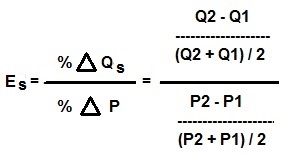

4a Formulas

|

|

coefficient of price

elasticity of demand (midpoints

formula)

total

revenue

TR = P x Q

|

4a Key Graphs

|

|

Price Elasticity of

Demand

Total Revenue and Price

Elasticity of Demand

|

4a Review Videos

|

|

- Elasticity

and the Total Revenue Test- Micro 2.9

[6:13 YouTube ACDC

Leadership]

NOTE: These are REVIEW videos

only. In order to learn the material you must read

the assigned textbook readings, watch the assigned

lecture videos, and do problems. See the LESSONS

link on Blackboard for these

assignments.

|

|

Unit 2: Elasticity, Consumer

Choice, Costs

Lesson 4b: Other Types of

Elasticity

4b Introduction

|

|

Elasticity tells us HOW MUCH

one variable changes in response to a change in

another variable.

Chapter 3: If price increases

what happens to the quantity demanded?

Chapter 4: If price increases HOW MUCH does the

quantity demanded decrease?

We will study four different

types of elasticity:

1. price elasticity

of demand (lesson 4a)

(If price changes, HOW MUCH does quantity

demanded change?)

2. price elasticity of

supply (lesson 4b)

(If price changes, how HOW MUCH quantity

supplied change?)

3. cross elasticity of

demand (lesson 4b)

(If the price of one product changes, HOW MUCH

does the quantity of another product

change?)

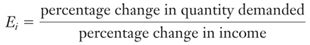

4. income elasticity of

demand (lesson 4b)

(If income changes, HOW MUCH does the quantity

of a product purchased change?)

|

4b Outcomes - What you

should learn

|

|

Price Elasticity of

Supply

- define price elasticity

of supply

- calculate and interpret

the coefficient of price elasticity of supply

using the midpoint formula

- determinants of price

elasticity of supply

- price elasticity of

supply and the market period, the short run, and

the long run

- What is the difference

between the "Law of Supply" and the "Price

Elasticity of Supply"?

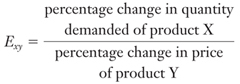

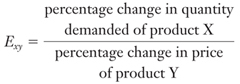

Cross Elasticity of

Demand

- define cross elasticity

of demand

- interpret the coefficient

of cross elasticity of demand including both its

value and the sign (substitutes, complements,

and unrelated goods)

- Interpret this

coefficient of cross elasticity of demand: Eab =

-2

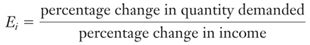

Income Elasticity of

Demand

- define income elasticity

of demand

- interpret the coefficient

of income elasticity of demand including both

its value and the sign (inferior goods, normal

goods, luxury goods)

- Interpret this

coefficient of income elasticity of demand: Edy

= + 0.5

|

4b Key Terms

|

|

Key

Terms Flash Cards - Click Here

Key Terms:

price elasticity of

supply, coefficient of price elasticity of

supply, midpoints formula, market period, short

run, long run, cross elasticity of demand,

substitute good, complement good, income

elasticity of demand, normal good, inferior

good

|

4b Practice Quiz (under

construction)

|

|

|

4b Formulas

|

|

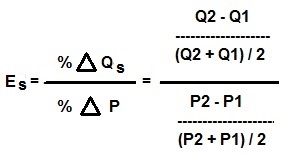

coefficient of price

elasticity of supply (midpoints formula)

cross elasticity of

demand

income elasticity of

demand

|

4b Key Graphs

|

|

Price Elasticity of Spply in

the Immediate Market Period

Price Elasticity of Spply in

the Short Run

Price Elasticity of Spply in

the Long Run

|

|

Unit 2: Elasticity, Consumer

Choice, Costs

Lesson 6a: Consumer

Decisions: Utility Maximization

6a Introduction

|

|

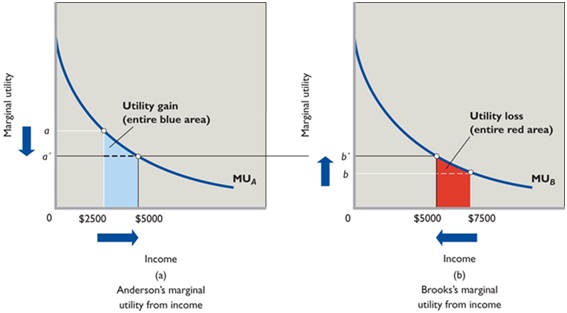

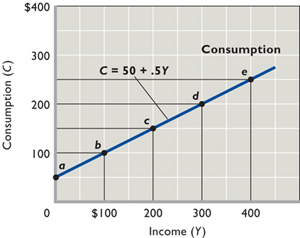

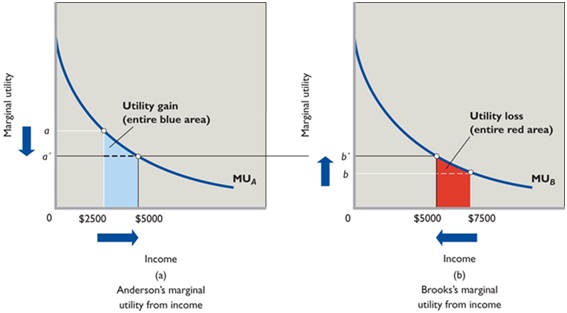

When I go into the grocery

store why do I buy 12 cans of pop, 3 frozen pizzas,

and 1 pound of hamburger? Why don't I buy 12 pounds

of hamburger and 1 can of pop? In this lesson we

will use benefit-cost analysis to understand why we

buy what we do. We will calculate the marginal

benefits (MB) of consuming something and the

marginal costs (MC) of consuming something.

(Remember: all costs in economics are opportunity

costs.)

If our goal is to maximize

our satisfaction we will consume the quantity of

goods and services where MB = MC.

First, we will examine the

benefits we get from consumption. Economists call

these benefits "utility". We will calculate and

graph total utility (TU) and marginal utility (MU).

As always, be sure you understand the SHAPES of

these graphs. Remember: Define, Draw,

Describe.

Then, we will use the utility

maximizing rule,

MUx/Px = MUy/Py =

MUz/Pz = . . . ,

to calculate how much we

should buy in order to maximize our satisfaction

(utility).

Be sure that you can see that

the utility maximizing rule is really just a

version of benefit cost analysis, MB=MC. If I am

thinking about going skiing today, the MB would be

the extra utility that I get from a day of skiing:

MBskiing = MUskiing. Since all costs are

opportunity costs, the marginal cost of skiing

would be the utility that I would lose because I am

not doing something else like going to a movie with

my wife: MCskiing = MUmovie.

Finally, why do we divide the

MU by the price? It doesn't make sense to compare a

$45 ski ticket with a $12 movie ticket. By dividing

by price we end up comparing $1 worth of skiing

with $1 worth of a movie.

So, to maximize my utility I

should go skiing and go to movies with my wife so

that the:

MUskiing/Pskiing=

MUmovie/Pmovie.

Even though MUx/Px =

MUy/Py looks different than MBx=MCx, it

is really the same thing. Be sure you do the

exercises in the yellow pages.

|

6a Something Interesting -

Why are we studying this?

|

|

In October and November ski

resorts in the west begin to open with just a few

runs open and large crowds of skiers and

snowboarders. In late April most western ski areas

have a lot of snow and are mostly 100% open but few

skiers and snowboarders come. Why? Why are there so

many customers when the snow is bad in the fall and

so few when the snow is good in the

spring?

Read the following from an

online skiing discussion forum: http://www.epicski.com/t/39322/skiing-in-past-march-why-not-popular

Note: "PNW" means the "Pacific northwest" (i.e. the

states of Oregon and Washington).

The skier asks, "But, for

some reason, people just stop skiing (in April).

WHY? I just don't understand." After studying this

lesson you should be able to explain WHY to the

skier who posted on the forum.

Here is another interesting

question: Why do pop vending machines allow you to

only get one can at a time while newspaper vending

machines allow you to take as many as you want when

you only pay for one?

ANSWER: The answer to both

questions has to do with the "law of diminishing

marginal utility".

|

6a Outcomes - What you

should learn

|

|

TOPICS

- diminishing marginal

utility

- utility

maximization

OUTCOMES

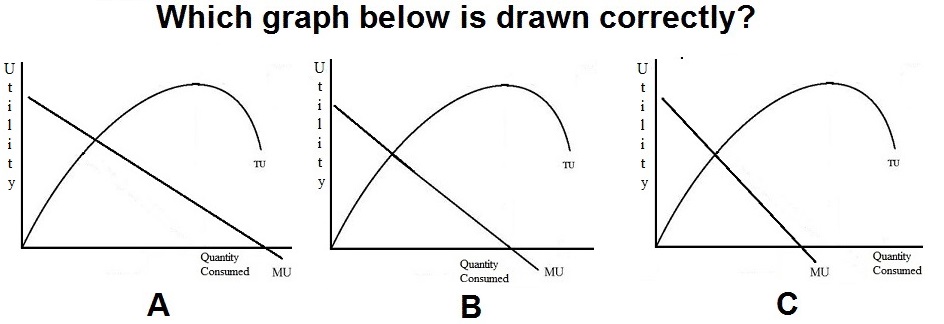

- Define, Draw, and

Describe the total utility and marginal utility

graphs

- Understand the

relationship between the total utility and

marginal utility graphs

- Understand the law of

diminishing marginal utility.

- Describe how rational

consumers maximize utility by using

benefit-cost-analysis. (Utility maximizing rule;

MUx/Px = MUy/Py = MUz/Pz )

- Explain how a demand

curve can be derived by observing the outcomes

of price changes in the utility-maximization

model

- If lobster was free and

if lobster was your favorite food, would you eat

lobster for every meal everyday? Why or why

not?

- Why do pop vending

machines allow you to only get one can at a time

while newspaper vending machines allow you to

take as many as you want when you only pay for

one?

- Why do we have to divide

by price in the utility maximizing rule?

- Benefit Cost Analysis:

MB = MC

- Utility Maximizing

Rule: MUa/Pa = MUb/Pb

|

6a Key Terms

|

|

Key

Terms Flash Cards - Click Here

Key Terms:

utility, total

utility (TU), marginal utility (MU), law of

diminishing marginal utility, rational behavior,

benefit-cost analysis, budget constraint,

utility-maximizing rule, marginal utility per

dollar (MU/P), "util", income effect,

substitution effect, diamond-water

paradox

|

6a Practice Quiz (under

construction)

|

|

|

6a Formulas

|

|

marginal utility

MU =

TU /

TU /  Qconsumed

Qconsumed

benefit-cost

analysis

MB =

MC

utility-maximizing

rule

MUa/Pa = MUb/Pb =

MUc/Pc = . . .

|

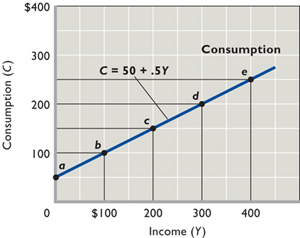

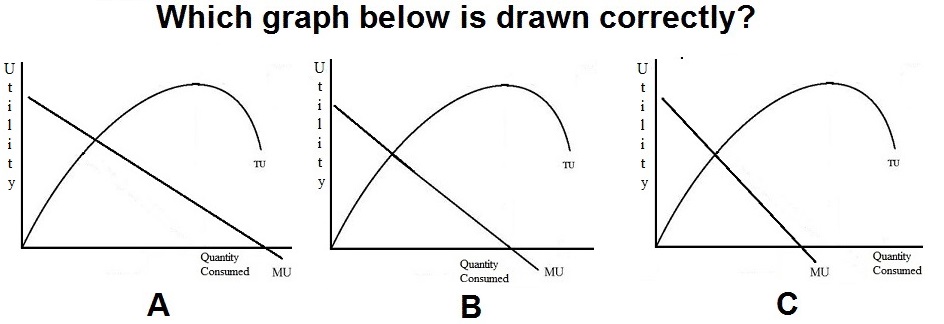

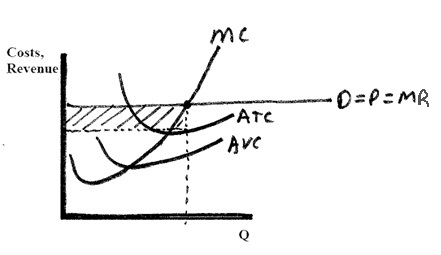

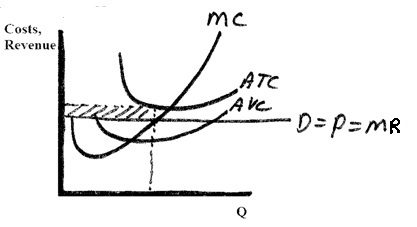

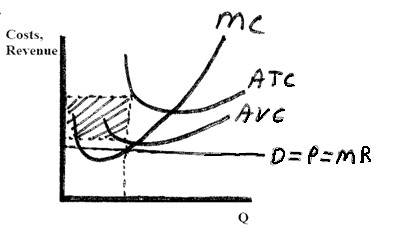

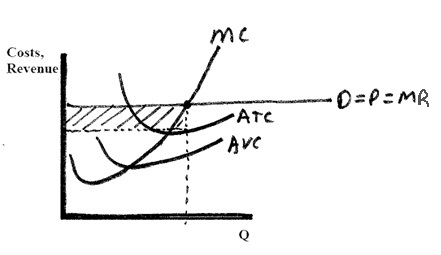

6a Key Graphs

|

|

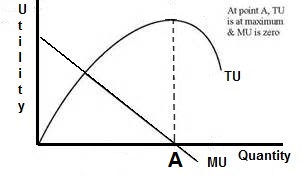

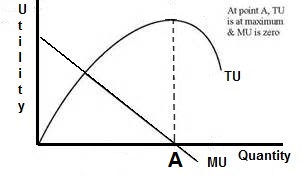

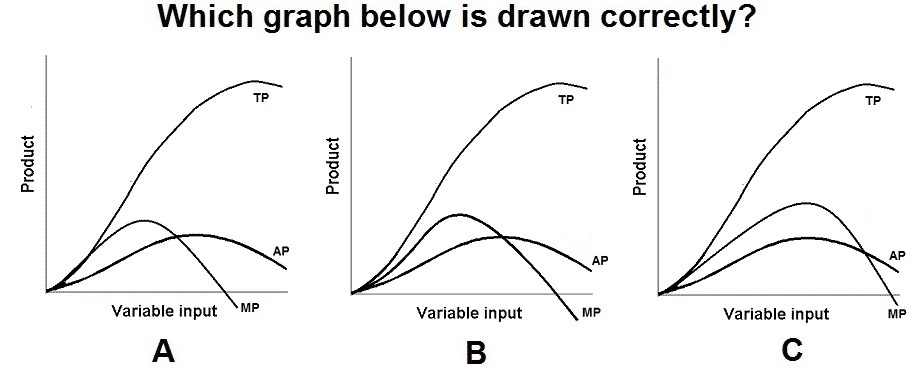

Total Utility (TU) and

Marginal Utility (MU).

Remember: the marginal is

the slope of the total. The slope of the TU

curve is getting smaller and smaller (less

steep) as the quantity consumed increases. At

the same time MU is less and less. At its peak

the slope of the TU curve is zero and at this

quantity MU is zero (it crosses the X

axis).

|

|

Unit 2: Elasticity, Consumer

Choice, Costs

Lesson 7a: Price Elasticity

of Demand and Tax Incidence

7a Introduction

|

|

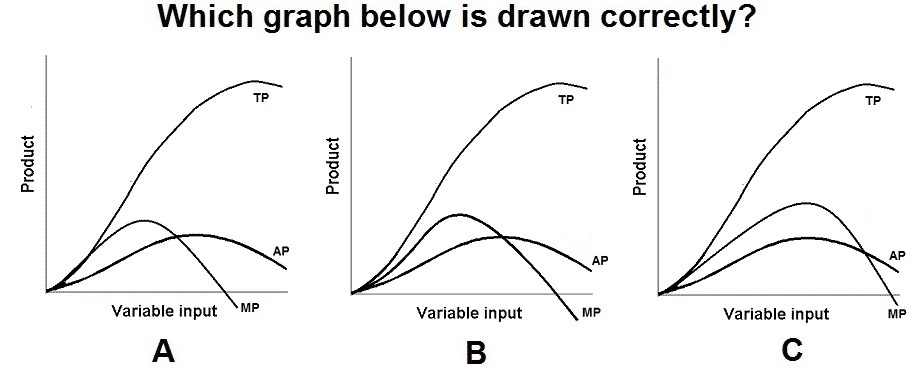

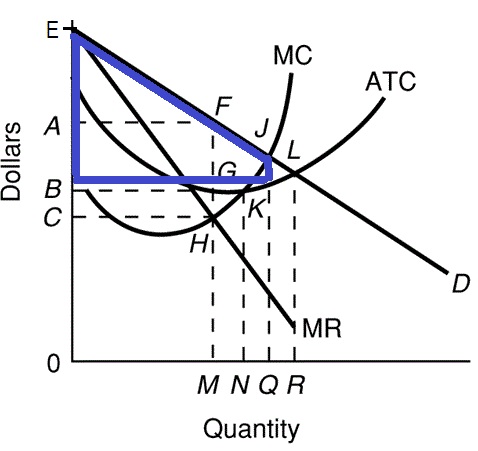

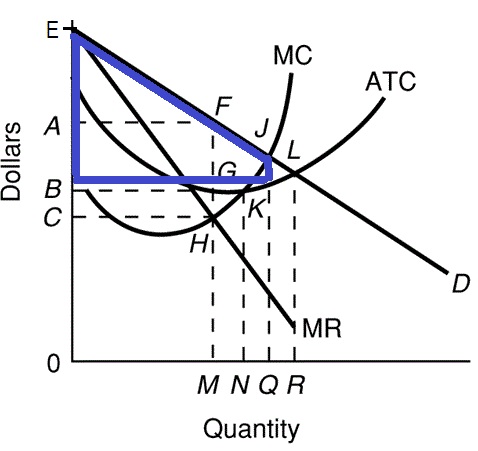

In chapters 7, 8, 9, 10, and

11 we will be looking at the producer decision of

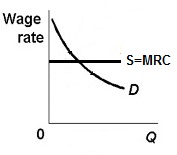

HOW MUCH TO PRODUCE. We will use benefit cost

analysis (MB=MC) to find the profit maximizing

quantity or WHAT WE GET. Once we know how much

businesses will produce, we will ask: Is this

quantity efficient (both allocatively and

productively)?

To find the profit maximizing

quantity we will use benefit-cost analysis: MB=MC.

So, what are the extra benefits of producing one

more unit of output? How do businesses benefit when

they produce one more? Well, they get more money,

called revenue. Even if they are earning losses,

they receive more revenue when they sell more. The

extra revenue that businesses get when they produce

and sell one more unit is their marginal revenue

(MR). This is the MB of producing one

more.

But there are also extra

costs of producing one more unit of output. We call

these the marginal costs (MC). When MR=MC (MB=MC)

their profits will be maximized. NOTE: when MR=MC

profits are not necessarily zero, but they are as

large as possible. We will calculate these profits

in chapters 8, 9, 10, and 11.

In this chapter, chapter 7 we

begin by looking at the MC. Then in chapters 8, 9,

10, and 11 we add the MR.

In chapter 7 we will

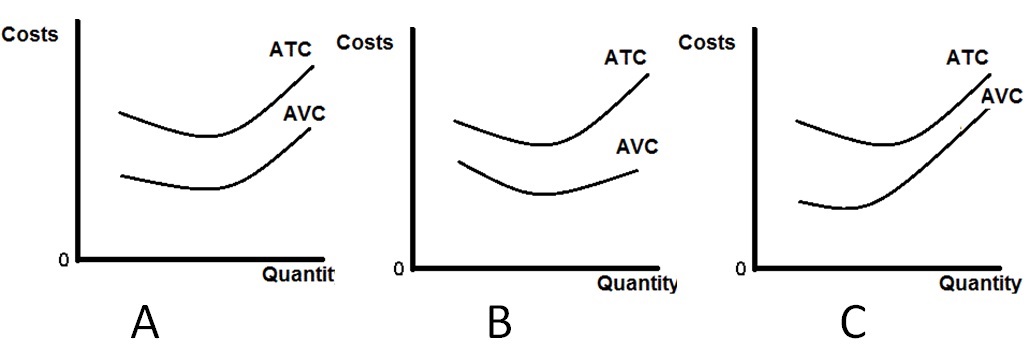

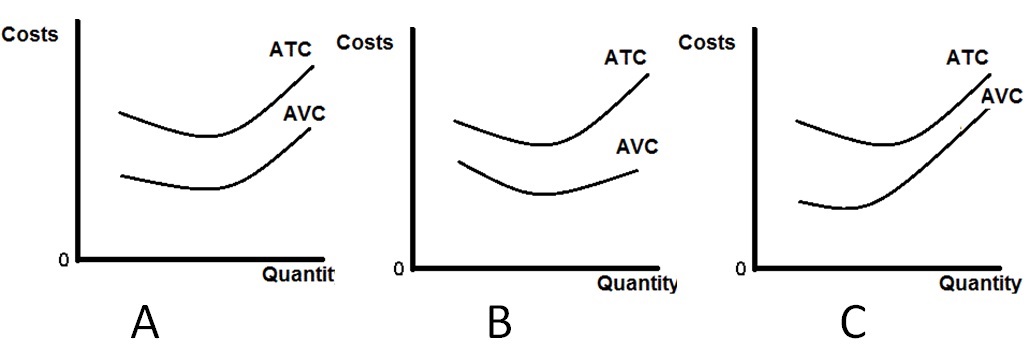

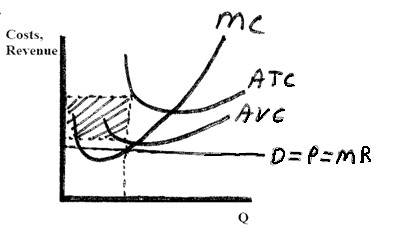

introduce three new sets of graphs. First (lesson

7a) we will look at the production function thast

shows how output changes when we add more

resources. We will then (lesson 7b) use the

production function graph to understand the SHAPES

of the other two sets of graphs. The two sets of

cost graphs show us what happens to costs when we

produce more. These two sets of cost graphs are the

total cost graphs (TC, TVC, and TFC) and the

average cost graphs (ATC, AVC, AFC, and

MC).

Let's begin with the

production function, or HOW DOES OUTPUT CHANGE WHEN

WE ADD MORE RESOURCES?

One more thing. If a firm is

earning zero economic profits, that is OK!!! But a

zero economic profit is NOT the same as a zero

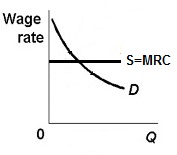

accounting profit. A zero economic profit could be