OUTLINE LESSONS 10 and 10b

Pure Monopoly

10a - Monopoly: Charcteristics and Short-Run

Equilibrium

|

I. Introduction:

A. Four Product Market Models

1. Competitive

Market (Lessons 8/9a, 8/9b)

2. Monopoly

(Lessons 10a, 10b)

3. Monopolistic

Competition (Lesson 11a)

4. Oligopoly

(Lesson 11b)

B. General Outline for Each Model

1. Characteristics and Examples

2. Nature of the Demand Curve

3. Short Run Equilibrium (Profit Max.)

4. Long Run Equilibrium and Efficiency

5. Other Issues

II. MONOPOLY - Characteristics

A market structure in which

one firm sells a unique product into which entry is blocked in

which the single firm has considerable control over product price

and in which nonprice competition may or may not be found.

A. NUMBER OF FIRMS: single firm

B. TYPE OF PRODUCT: unique product, no close substitutes

C. CONTROL OVER PRICE: "price makers"

D. EASE OF ENTRY: blocked entry

E. NONPRICE COMPETITION: public relations

III. Examples / Importance

|

1.

|

Public utilities: gas, electric, water, cable TV, and

local telephone service companies, are often pure

monopolies.

|

|

2.

|

Central Microprocessors (Intel), First Data Resources

(Western Union), Wham-o (Frisbees), Brannock Device

Company (shoe sizing devices), and the DeBeers diamond

syndicate are examples of "near" monopolies. (See Last

Word.)

|

|

3.

|

Manufacturing monopolies are virtually nonexistent in

nationwide U.S. manufacturing industries.

|

|

4.

|

Professional sports leagues grant team monopolies to

cities.

|

|

5.

|

Monopolies may be geographic. A small town may have

only one airline, bank, etc.

|

Why Study Monoplies?

- because they really do exist

- and because most industries are a combination of pure

competition and pure monoply

- monopolistic competion

- oligopoly

IV. Barriers to Entry

A. Definition

Anything which

artificially prevents the entry of firms into an

industry.

B. Importance of Barriers

C. Types of Barriers

1. economies of scale: costs

a) graphically

b) rationale

c) natural monopolies

3. legal barriers

a) patents

b) licenses

3. ownership or control of essential raw

materials

4. pricing and other strategic barriers

V. Price and Output Determination: Benefit-Cost

Analysis

A. Monopoly Demand

1. Assumptions

- barriers to entry secure the firm's monoploy

- no government regulation

- a single-price monopoly - that is, it charges the

same price to all of its customers (no price

discrimination)

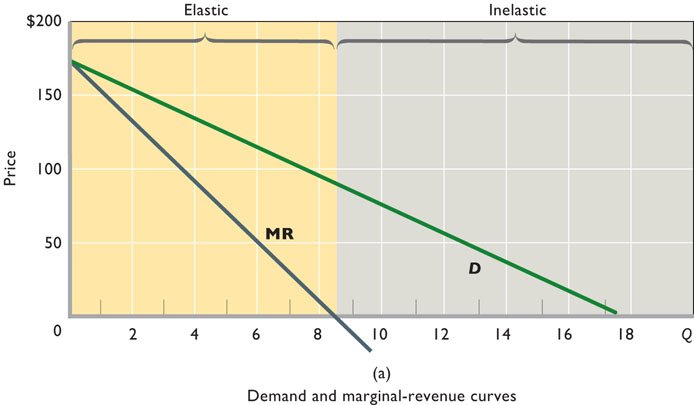

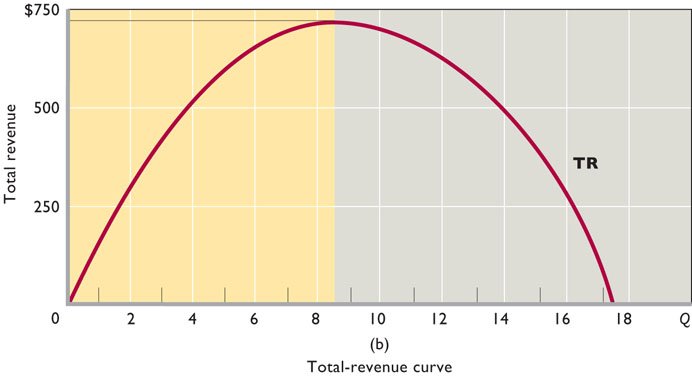

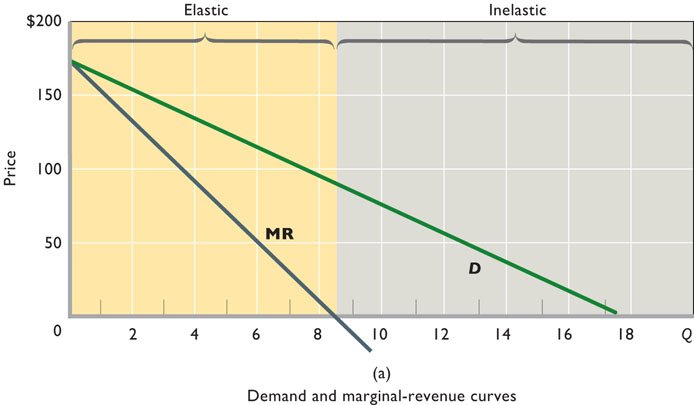

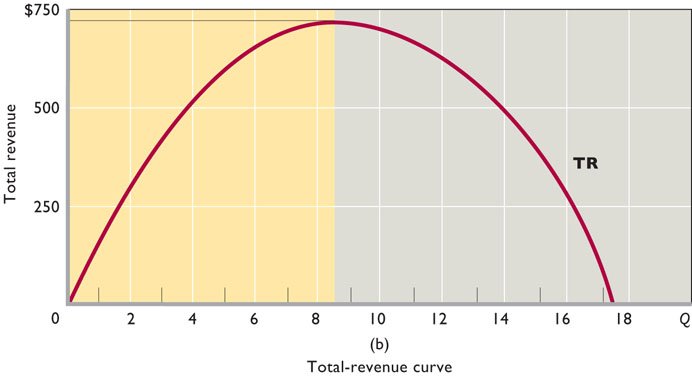

2. firm's demand = market demand (demand is

downsloping)

- P > MR

- price maker

- the monoplolist sets the price in the elastic region

of demand

- in the inelastic region a lower price (to sell

more) would lower total revenue even though it costs more

to produce more

B. Price and Output Determination

1. goal: profit maximization

2. benefit-cost analysis 2 steps (graphically)

a) find best quantity where MR = MC

b) product only if AR > AVC

C. Profits? (graphically)

1. profit

maximizing case: economic profits ( profits/losses)

2. loss

minimizing case( profits/losses)

extra

3. shut

down case ( profits/losses)

extra

4. normal

profit ( profits/losses)

D. Misconceptions Concerning Monopoly Pricing

1. not highest price

2. total, not unit, profits

3. losses

4. graph

VI. Price and Output Determination TC - TR Approach

10b - Monopoly: Long-Run, Efficiency,

and Regulation

|

VII. Monopoly Firms and Long Run Equilibrium

Monopoly:

Long-Run Equilibrium Graph

VIII. Monopoly Firms and Efficiency

A. Competitive Firms and Efficiency (review)

1. allocative efficiency: P = MC

2. productive efficiency: P = MC = ATC

B. Assume Identical Costs

C. Monopoly [GRAPH]

1. allocative inefficiency: P >MC

a) underallocation of resources smaller output

than competitive markets

b) higher prices than competitive markets

2. productive inefficiency

a) not producing at minimum ATC

b) cost complications

1) natural monopoly

An

industry in which economies of scale are so great the

product can be produced by one firm at a lower average

total cost than if the product were produced by more

than one firm.

graphically

2) X-inefficiency

Failure to

produce any specific output at the lowest average (and

total) cost possible.

3) monopoly

preserving expenditures

4) dynamic efficiency?

(a) competitive model

(b) monopoly model

(1) means

(2) incentives?

(3) a mixed picture

- Some monopolies have shown little interest

in technological progress

- On the other hand, research can lead to

lower unit costs, which help monopolies as much

as any other type of firm. Also, research can

help the monopoly maintain its barriers to entry

against new firms.

- MORE

(c) the inverted-U theory of R &D

expenditures

3. inequities (income distribution)

- Income distribution is more unequal than it would be

under a more competitive situation.

- The effect of the monopoly power is to transfer income

from consumers to business owners.

- This will result in a redistribution of income in favor

of higher-income business owners, unless the buyers of

monopoly products are wealthier than the monopoly

owners.

IX. Price Discrimination

A. Definition

The selling of a product

to different buyers at different prices when the price

differences are not justified by differences in cost.

B. Examples: Who pays more? / Who pays less?

1. ELECTRICITY: heating or lighting? homes or

businesses?

2. DOCTORS: insured patients or uninsured?

3. AIR TRAVEL: business travellers or

vacationers?

4. MOVIES / SKIING / GOLF: adults or children?

5. RAILROADS: expensive cargo or inexpensive

cargo?

6. COUPONS

7. INTERNATIONAL TRADE

8. OTHERS ????

C. Conditions

1. Monopoly power ( price maker )

2. Market segregation: ability to segregate buyers

according to their price elasticity of demand

3. No resale

D. Consequences (graphically)

1. more profits

2. more production = more efficient

X. Regulated Monopoly: Rate Regulation

A. Why rate regulation instead of antitrust?

1. definition: antitrust

The use of the

antitrust laws to promote competition and economic

efficiency.

2. natural monopoly

An

industry in which economies of scale are so great the

product can be produced by one firm at a lower average total

cost than if the product were produced by more than one

firm.

3. graphically:

demand crosses ATC while ATC is still downward

sloping

B. Why government gets involved

1. to improve allocative efficiency: "public

interest "

The presumption that

the purpose of the regulation of an industry is to protect

the public (consumers) from abuse of the power possessed by

natural monopolies.

2. political reasons: legal cartel theory

The hypothesis that

some industries seek regulation or want to maintain

regulation so they may form or maintain a legal

cartel.

a. Proponents of this theory

contend that regulators guarantee a return to the regulated

firms while blocking entry and dividing up the market -

activities that would be illegal in unregulated

markets.

b. Occupational licensing is

an example of this theory in certain labor

markets.

C. How the government regulates rates (prices)

1. P = MC: socially optimum price (alloc. eff.

price)

a. Definition

The price of a product which

results in the most efficient allocation of an economy's

resources and is equal to the marginal cost of the

product.

Means the same thing as

ALLOCATIVE EFFICIENCY

b. graphically

c. achieves allocative efficiency

The price of a

product which results in the most efficient allocation of

an economy’s resources and is equal to the marginal

cost of the product.

c) but results in a loss for the firm

d) government could subsidize or use AC

pricing

2. P = ATC: "fair" return price

a. definition

The price of a

product which enables its producer to obtain a normal

profit and which is equal to the average total cost of

producing it.

b. graphically

c. some inefficiency

d. but normal profits earned no losses

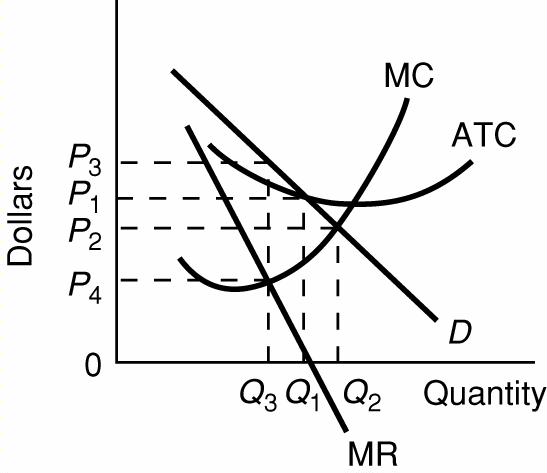

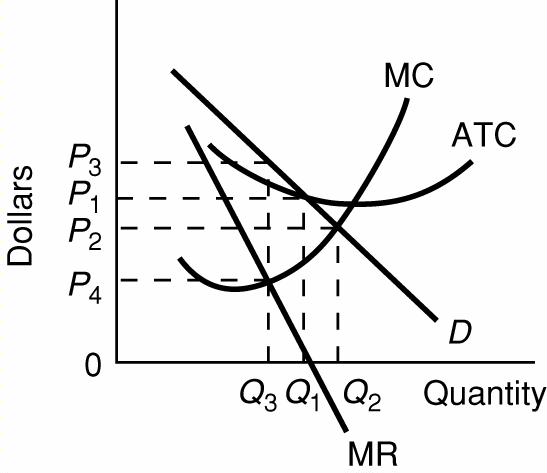

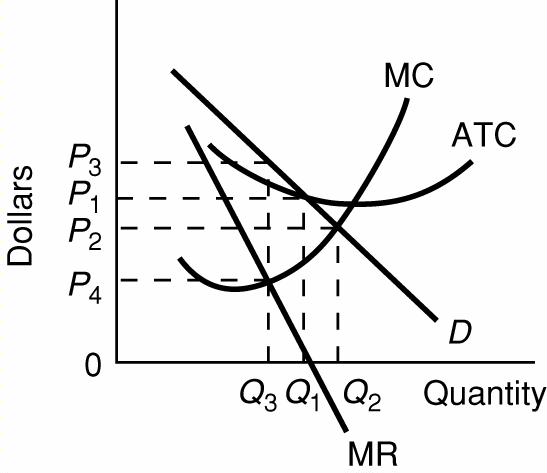

3. Review: GRAPH

|

Unregulated Profit Maximizing Price and Quantity:

P3 and Q3

(where MR = MC)

Allocatively Efficient Price and Quantity: P2 and

Q2

(where P = MC)

Fair Return Price and Quantity: P1 and Q1

(where P = ATC)

|

D. Dilemma with Industrial

Regulation

The tradeoff a regulatory

agency faces in setting the maximum legal price a monopolist

may charge:

The socially optimal price is

below average total cost (and either bankrupts the firm or

requires that it be subsidized) while the higher fair-return

price does not produce allocative efficiency.

E. Deregulation in the United States

1. Deregulation came about in the 1970s and 1980s

as a result of the greater acceptance of the legal cartel

theory, increasing evidence of inefficiency in regulated

industries, and the contention that government was regulating

potentially competitive industries.

2. Industries that were deregulated included airlines,

trucking, banking, railroads, natural gas, television

broadcasting, electricity, and telecommunications.

3. Although some criticize deregulation, on balance it

appears to have benefited consumers and the economy.

a. Benefits to society through lower prices,

lower costs, and increased output are estimated at $50

billion annually. The gains come primarily from airlines,

railroads, and trucking.

b. Deregulation has lead to technological advances in

new and improved products.

4. Deregulation in the electricity industry has generated

significant controversy.

a. The industry is most deregulated at the

wholesale level. This allows wholesalers to build facilities

and sell electricity to distributors at unregulated

prices.

b. Some states have also deregulated retail

electricity prices and, for the most part, electricity rates

have fallen for consumers.

c. In California, where wholesalers are deregulated

and retailers regulated, a dramatic increase in wholesale

prices in 2001 resulted in substantial financial losses for

retail providers, as they were legally prevented from

raising retail prices to cover the higher costs. The problem

was exacerbated by the fraudulent activities of

energy-trader Enron.

XI. De Beers' Diamonds: Are Monopolies Forever?

A. De Beers Consolidated Mines of South Africa has

been one of the world's strongest and most enduring monopolies.

1. It produces about 50 percent of all rough-cut

diamonds in the world

2. and buys for resale many of the diamonds produced

elsewhere,

3. for a total of about 80 percent of the world's

diamonds.

B. Its behavior and results fit the monopoly model portrayed

in the figure below It sells a limited quantity of diamonds that

will yield an "appropriate" monopoly price.

C. The "appropriate" price is well over production costs and

has earned substantial economic profits.

D. How has De Beers controlled the production of mines it

doesn't own?

1. It convinces producers that "single-channel"

monopoly marketing is in their best interests.

2. Mines that don't use De Beers may find the market flooded

from De Beers stockpiles of the particular kind of diamond they

produce, which causes price declines and loss of profits.

3. Finally, De Beers purchases and stockpiles diamonds

produced by independents.

E. Threats and problems face De Beers' monopoly

power.

1. New diamond discoveries have resulted in more

diamonds outside their control.

2. Russia, which has been a part of De Beers' monopoly, has

been allowed to sell a part of its stock directly into the

world market.

F. In mid-2000, De Beers abandoned its attempt to control

the supply of diamonds.

G. The company is transforming itself into one that sells

"premium" diamonds and luxury goods under the De Beers

label