OUTLINE LESSONS 11a and 11b

Price and Output Determination: Monopolistic Competition &

Oligopoly

11a - MONOPOLISTIC COMPETITION

|

I. Introduction: The Product Markets

A. Circular

Flow Model

B. Four Product Market Models

1. Competitive

Market (Lessons 8/9a, 8/9b)

2. Monopoly

(Lessons 10a, 10b)

3. Monopolistic

Competition (Lesson 11a)

4. Oligopoly

(Lesson 11b)

C. General Outline for Each Model

1. Characteristics and Examples

2. Nature of the Demand Curve

3. Short Run Equilibrium (Profit Max.)

4. Long Run Equilibrium and Efficiency

5. Other Issues

II. Definition: Monopolistic Competition

A market structure in which

many firms sell a differentiated product into which entry is

relatively easy in which the firm has some control over its

product price and in which there is considerable nonprice

competition.

III. Characteristics

A. NUMBER OF FIRMS: many

Therefore:

1. Small market share (Small concentration ratio)

2. No collusion possible

A situation in which

firms act together and in agreement (collude) to fix prices

divide a market or otherwise restrict competition.

3. Independent action (no mutual interdependence)

B. TYPE OF PRODUCT: differentiated

1. Definition: A

strategy in which one firm’s product is distinguished from

competing products by means of its design, related services,

quality, location, or other attributes (except

price).

2. also called nonprice

competition

distinguishing

one’s product by means of product differentiation and

then advertising the distinguished product to

consumers.

3. How?

a) product quality

b) services

c) location

d) brand names and packaging

4. Effect of product differentiation: some control over

price

5. Cost of product differentiation: need to

advertise

C. CONTROL OVER PRICE:

1. within narrow limits

2. little econ. power

D. EASE OF ENTRY: relatively easy entry

E. NONPRICE COMPETITION: very much

IV. Examples

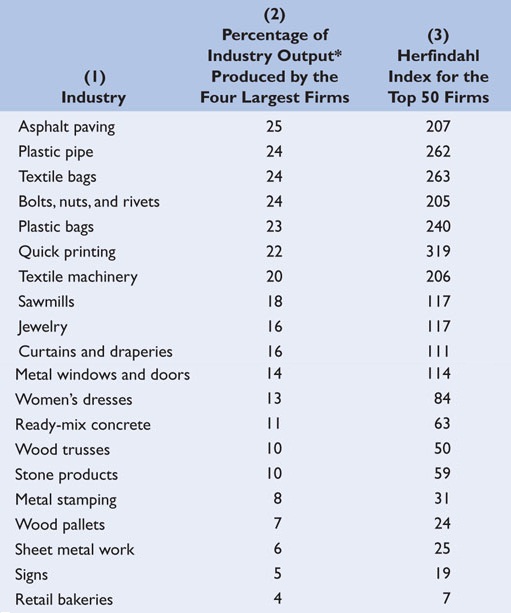

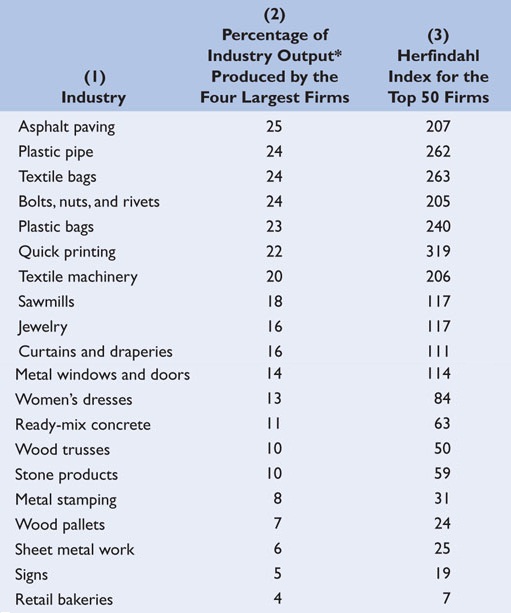

A. Concentration Ratio - low

The percentage of the

total sales of an industry made by the four (or some other

number) largest sellers in the industry.

B. Herfindahl Index - low

A measure of the

concentration and competitiveness of an industry; calculated as

the sum of the squared percentage market shares of the

individual firms.

SUM % market shares

squared

If monopoly = 100

squared = 10,000

If 4 firms with 25% each =

= 25 squared + 25

squared + 25 squared + 25 squared

= 2500

if 100 firms with 1% each =

= SUM 1 squared + 1

squared + . . . . .

= 100

C. Examples

Percentage of Output Produced by Firms in Selected

Low Concentration U.S. Manufacturing Industries

ALSO:

retail

establishments in metropolitan areas, such as

grocery stores

gas stations

barber shops

dry cleaners

clothing stores

restaurants

V. Price and Output Determination

A. Benefit-Cost Analysis - Review 2 Steps

1. find Q where MR=MC

2. produce Q only if AR>AVC

B. Demand and Monopolistic Competition

1. downsloping

2. quite price elastic - WHY?

C. Three Short Run Cases

1. profit maximizing economic profits

[graph]

2. loss minimizing (graphs)

3. shut down

D. Long Run Equilibrium

1. Few barriers to entry

2. Therefore, tends toward normal profits

a. if profits: firms enter

b. if losses: firms leave

c. Result: Normal Profits

d. but there are complications:

(1) Some firms may achieve a measure of

differentiation that is not easily duplicated by rivals

(brand names, location, etc.) and can realize economic

profits in the long run.

(2) There is some restriction to entry, such as

financial barriers that exist for new small businesses,

so economic profits may persist for existing firms.

(3) Long-run below-normal profits may persist, because

producers like to maintain their way of life as

entrepreneurs despite the low economic returns.

3. Long Run Equilibrium:

a. profit maximizing quantity (MR=MC) is Q1

b. profit maximizing price is P4

a. profit maximizing quantity (MR=MC)

is Q3

b. profit maximizing price is P3

VI. Monopolistic Competition and Efficiency

A. Allocative Inefficiency

1. At the profit maximizing quantity P>MC

a) underallocation of resources:

b) but close with elastic demand

c) also, some utility gained from product

differentiation

2. only normal profits

3. see graph below

a. the allocative efficient quantity is: Q2 = WHAT WE

WANT

b. the profit maximizing quantity is Q1 = WHAT WE

GET

B. Productive Inefficiency

1. not minimum ATC (not where MC=ATC)

2. excess capacity

Plant resources which

are underused when imperfectly competitive firms produce

less output than that associated with achieving minimum

average total cost.

3. also, advertising may increase costs without

increasing utility (graph)

4. see graph below

the productively efficient quantity is Q3

I. Introduction: Four Product Market Models

A. Competitive Market (Lessons 8/9a, 8/9b)

B. Monopoly (Lessons 10a, 10b)

C. Monopolistic Competition (Lesson 11a)

D. Oligopoly (Lesson 11b)

II. Definition - Oligopoly

A market structure in which

a few firms sell either a standardized or differentiated product

into which entry is difficult in which the firm has limited

control over product price because of mutual interdependence

(except when there is collusion among firms) and in which there is

typically nonprice competition.

III. Characteristics - Oligopoly

A. NUMBER OF FIRMS: few

1. mutual interdependence

A situation in which a

change in price strategy (or in some other strategy) by one

firm will affect the sales and profits of another firm (or

other firms); any firm which makes such a change can expect

the other rivals to react to the change.

2. collusion possible

A situation in which

firms act together and in agreement (collude) to fix prices

divide a market or otherwise restrict competition.

B. TYPE OF PRODUCT:

homogenous OR differentiated

homogeneous

oligopoly - An oligopoly in which the firms produce a

standardized product.

differentiated oligopoly

- An oligopoly in which the firms produce a differentiated

product.

C. CONTROL OVER PRICE:

1. much if there is collusion

2. limited by mutual interdependence

A situation in which a

change in price strategy (or in some other strategy) by one

firm will affect the sales and profits of another firm (or

other firms);

any firm which makes such a

change can expect the other rivals to react to the

change.

D. EASE OF ENTRY: significant obstacles or barriers to entry

(from lesson 10a)

1. economies of scale: costs

a) graphically

b) rationale

c) natural monopolies

3. legal barriers

a) patents

b) licenses

3. ownership of essential raw materials

4. pricing and other strategic barriers

E. NONPRICE COMPETITION: much with differentiated

products

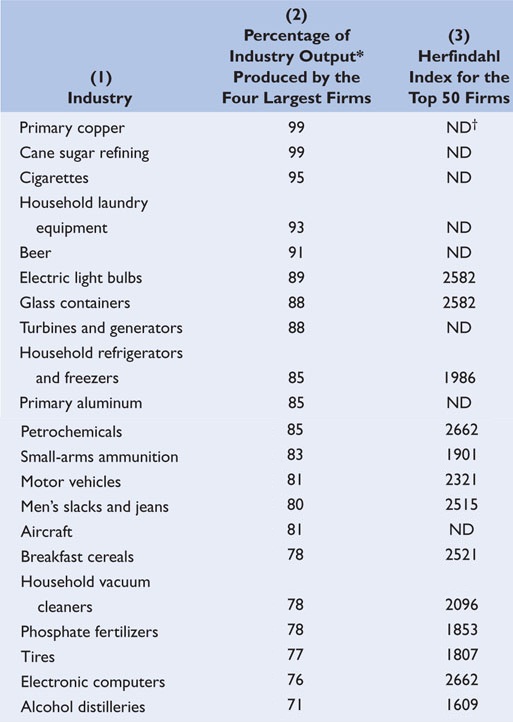

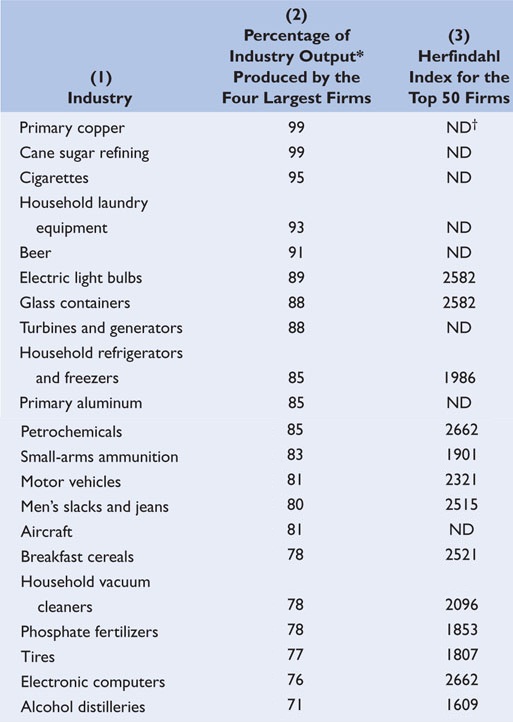

IV. Examples

Percentage of Output Produced by Firms in Selected

High Concentration U.S. Manufacturing Industries

Also:

U.S Aluminum Industry

Auto Parts in Medium-size towns

"Big 4", "Big 3", etc.

V. Measures of Industry Concentration

A. Concentration

ratio

The four-firm concentration ratio gives the percentage

of total industry sales accounted for by the four largest firms

B. The concentration ratio has several shortcomings in terms

of measuring competitiveness.

1. Some markets are local rather than national, and a

few firms may dominate within the regional market.

2. Interindustry competition sometimes exists, so dominance

in one industry may not mean that competition from substitutes

is lacking.

3. World trade has increased competition, despite high

domestic concentration ratios in some industries like the auto

industry.

4. Concentration ratios fail to measure accurately the

distribution of power among the leading firms.

5. Concentration tells us nothing about the actual market

performance of various industries in terms of how vigorous the

actual competition is among existing rivals.

C. The Herfindahl index

- A measure of the concentration

and competitiveness of an industry or another way to measure

market dominance.

- calculated as the sum of the

squared percentage market shares of the individual firms.

- so that much larger weight is given to firms with high

market shares.

- A high Herfindahl index number indicates a high degree

of concentration in one or two firms.

- A high index might be where one firm has 80 percent of

the industry and the others have 6 percent each for a total

of 6400 + (6 squared x 3) = 6,508.

- A lower index might mean that the top four firms have

rather equal shares of the market, for example, 25 percent

each (25 squared x 4 = 2,500).

VI. Oligopoly Behavior: A Game-Theory Overview

A. Game theory

B. Mututal Interdependence Revisited

C. Collusion

D. Incentive to cheat

VII. Price and Output Determination

A. No Standard Model But Common Pricing

Characteristics

1. Why no common model

a) diversity of specific market situations

b) collusion possible

A situation in

which firms act together and in agreement (collude) to

fix prices divide a market or otherwise restrict

competition.

c) mutual interdependence

A strategy in which

one firm’s product is distinguished from competing

products by means of its design, related services,

quality, location, or other attributes (except

price).

2. Common pricing characteristics

a) prices tend to be inflexible

b) when prices do change, firms tend to change prices

together

B. Three Oligopoly Pricing Models

1. kinked demand: noncollusive oligopoly

2. collusion

3. price leadership

C. Kinked Demand: Noncollusive Oligopoly

1. Kinked Demand Curve

IMPORTANT: based on

the assumption that rivals will:

- follow a price

decrease, and

- ignore a price

increase.

2. demand and MR curve

a. if competitors IGNORE price increases

A firm will expect demand will be elastic

(flatter) when it increases price.

From the total-revenue test, we know raising prices

when demand is elastic will decrease revenue.

So the noncolluding firm will not want to raise

prices.

b. if competitors MATCH price decreases

The individual firms believe that rivals will

match any price cuts.

Therefore, each firm views its demand as inelastic

(steeper) for price cuts,

which means they will not want to lower prices since

total revenue falls when demand is inelastic and prices

are lowered.

c. result:

d. textbook

graph

e. lecture graph

3. price and output determination (see graph

above)

a. profit maximizing quantity: 0g

b. profit maximizing price: 0d

|

|

|

4. price inflexibility

a. This analysis shows how prices tend to be

inflexible in oligopolistic industries.

b. The figure above shows that marginal cost has

substantial ability to increase at price P before it no

longer equals MR; thus, changes in marginal cost will also

not tend to affect price.

5. criticisms

a. There is no explanation of why P is the original

price.

b. In the real world oligopoly prices are often not

rigid, especially in the upward direction.

6. Quick

Quiz

7. Examples ?

8. optional: The

Kinked Demand Model

D. Cartels and Other Collusion

Cartels and collusion agreements constitute another oligopoly

model

1. definition collusion

2. examples

OPEC Cartel

Cartel: A

formal agreement among firms in an industry to set the

price of a product and the outputs of the individual

firms or to divide the market for the product

geographically.

3. price and output determination

a. assumptions

b. joint profit maximization

c. graph

To maximize profits, the firms collude and agree to a

certain price. Assuming the firms have identical cost,

demand, and marginal-revenue date the result of collusion is

as if the firms made up a single monopoly firm.

4. overt collusion: the OPEC cartels

A cartel is a group of producers that creates a

formal written agreement specifying how much each member

will produce and charge.

The Organization of Petroleum Exporting Countries (OPEC)

is the most significant international cartel.

map

5. covert collusion - tacit understanding

Cartels are illegal in the U.S., so any collusion

here is secret, or covert.

When firms

reach verbal understandings with one another on product

price - frequently through interaction on golf courses,

cocktail parties, via phone, or at trade association

meetings.

Historically,

these understandings are referred to as Gentlemen's

Agreements.

Tacit

understandings are in violation of antitrust laws, but their

elusive nature makes them difficult to detect.

Examples of these illegal, covert agreements include:

- the 1993 collusion between dairy companies

convicted of rigging bids for milk products sold to

schools

-in 1996, American agribusiness Archer Daniels

Midland, three Japanese firms, and a South Korean firm

were found to have conspired to fix the worldwide price

and sales volume of a livestock feed additive.

- electrical equipment conspiracy

- ND highway contractors

6. obstacles to collusion

a. Differing demand and cost conditions among firms

in the industry;

b. A large number of firms in the industry;

c. The temptation to cheat;

d. Recession and declining demand;

e. The attraction of potential entry of new firms if

prices are too high; and

f. Antitrust laws that prohibit collusion.

E. Price Leadership

1. definition

An

informal method which firms in an oligopoly may employ to

set the price of their product: one firm (the leader) is the

first to announce a change in price and the other firms (the

followers) soon announce identical or similar

changes.

2. Price leadership in oligopoly occasionally breaks down

and sometimes results in a price war.

A recent example occurred in the breakfast cereal

industry in which Kellogg had been the traditional price

leader.

3. Examples - current or recent

Farm Machinery

Cement

Copper

Newsprint

Glass Containers

Beer,

Fertilizer

Cigarettes

VII. Oligopoly and Efficiency

A. Allocative and Productive

Efficiency

Allocative and productive efficiency are not realized

because price will exceed marginal cost and, therefore, output

will be less than minimum average-cost output level

1. Kinked Demand

a. profit maximizing quantity:

0g

(where MR = MC, "what we get')

b. allocatively efficient quantity: 0h

(where P = MC, "what we want')

c. productively efficient quantity:

minimum ATC

2. Collusion

a. profit maximizing quantity:

0M

(where MR = MC, "what we get')

b. allocatively efficient quantity: 0Q

(where P = MC, "what we want')

c. productively efficient quantity: 0N

(minimum ATC)

3. The economic inefficiency may be lessened

because:

a. Foreign competition can make oligopolistic

industries more competitive (efficient) on a global

scale.

b. Oligopolistic firms may keep prices lower (and

more efficient) in the short run to deter entry of new

firms.

c. Over time, oligopolistic industries may foster

more rapid product development and greater improvement of

production techniques than would be possible if they were

purely competitive.

called Dynamic Efficiency

- they have the means = long run

profits

- they have an incentive - barriers to entry

protect profits

VIII. Oligopoly and Advertising

A. Product development and advertising campaigns are

more difficult to combat and match than lower prices.

B. Oligopolists have substantial financial resources with

which to support advertising and product development.

C. Advertising can affect prices, competition, and

efficiency both positively and negatively.

1. Advertising reduces a buyers’ search time

and minimizes these costs. - GOOD

2. By providing information about competing goods,

advertising diminishes monopoly power, resulting in greater

economic efficiency. - GOOD

3. By facilitating the introduction of new products,

advertising speeds up technological progress. - GOOD

4. If advertising is successful in boosting demand,

increased output may reduce long run average total cost,

enabling firms to enjoy economies of scale. ( from a to

b)

5. Not all effects of advertising are positive.

a. Much advertising is designed to manipulate

rather than inform buyers.

b. When advertising either leads to increased monopoly

power, or is self-canceling, economic inefficiency

results.