1. Calculating Total Revenue (TR)

a.

Definition

- The total number of

dollars received by a firm (or firms) from the sale of a

product;

- equal to the quantity

sold (demanded) multiplied by the price at which it is

sold.

b. Formula

2. Total Revenue Test

A test to determine

elasticity of demand between any two prices

3. Summary of Total Revenue Test

a. when demand is price elastic:

(1) and P , then TR

, then TR (because

quantity

(because

quantity  a lot)

a lot)

(2) and P , then TR

, then TR (because

quantity

(because

quantity  a lot)

a lot)

Demand is elastic if

total revenue moves in the opposite direction as

price;

b. when demand is price

inelastic:

(1) and P

, then TR

, then TR (because quantity

(because quantity  a little)

a little)

(2) and P  ,

then TR

,

then TR (because quantity

(because quantity  a little)

a little)

Demand is inelastic when

total revenues move in the same direction as

price;

c. when demand is unit

elastic: TR does not change if P

changes

Demand is of

unitary elasticity when total revenues do not change when

price changes.

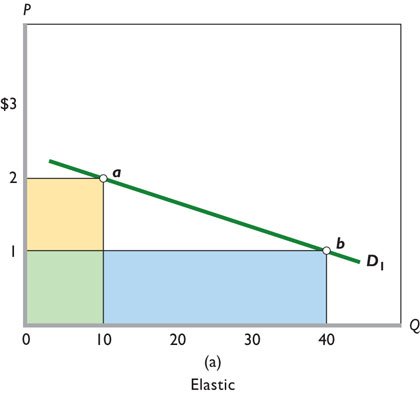

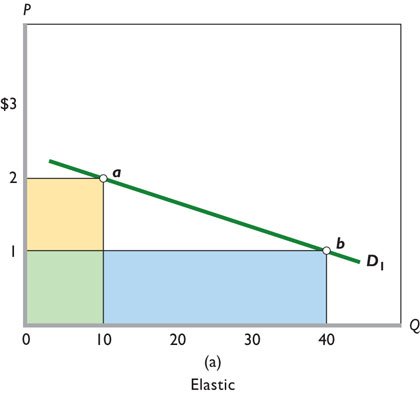

4. Graphic Portrayal

a. elastic demand

- if demand is elastic and the price goes up

from $1 to $2, what happens to TR?

- P=$1: TR = P x Q = $1 x 40 = $40

- P=$2: TR = P x Q = $2 x 10 = $20

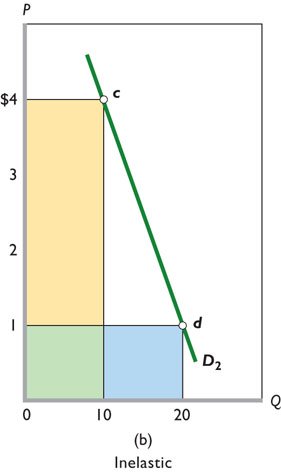

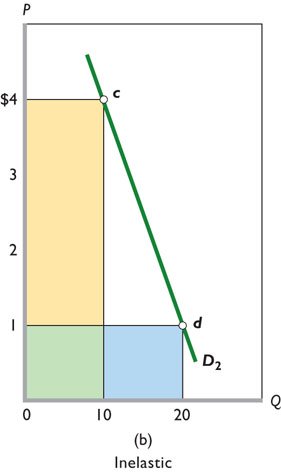

b. inelastic demand

|

|

- if demand is inelastic and the

price goes up from $1 to $4, what happens to

TR?

- P=$1: TR = P x Q = $1 x 20 =

$20

- P=$4: TR = P x Q = $4 x 10 =

$40

|

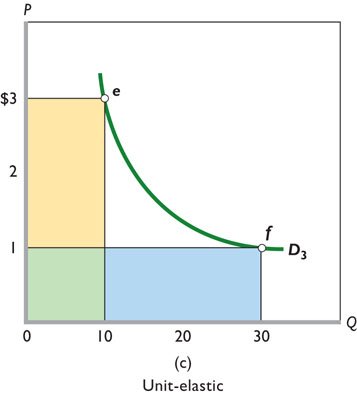

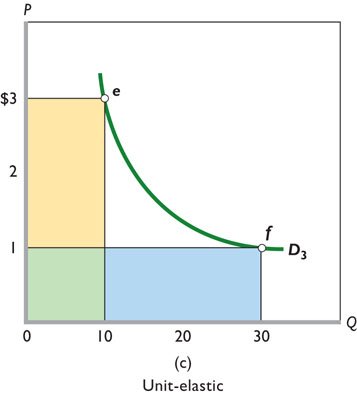

c. unit elastic demand

|

|

- if demand is unit elastic and the

price goes up from $1 to $3, what happens to

TR?

- P=$1: TR = P x Q = $1 x 30 =

$30

- P=$3: TR = P x Q = $3 x 10 =

$30

|

5. The Total Revenue Graph

a. shape of the graph:

|

|

- As prices decrease we know that the

quantity sold will increase (law of

demand)

- As prices decreases and quantity

increases, why do total revenues (TR):

- increase at first

- and then decrease?

|

b. explanation of the shape of the TR graph : price

elasticity of demand

- what happens to the price elasticity of demand for

a product as the price decreases?

|

|

- at high prices demand is

elastic

- at low prices demand is

inelastic

|

|

|

- so as prices begin to decrease, and

demand is elastic, TR will increase

- as prices continue to decrease demand

becomes inelastic and TR decline

|

1. Large Crop Yields ("Bumper Crops")

- Inelastic demand for agricultural products helps to

explain why bumper crops depress the prices and total

revenues for farmers.

2. Government Excise Taxes

- Governments look at elasticity of demand when levying

excise taxes.

- Excise taxes on products with inelastic demand will

raise the most revenue and have the least impact on quantity

demanded for those products.

- More below (Excise Tax and Efficiency Loss).

3. Decriminalization of Illegal Drugs

- What will happen to price?

- What will happen to quantity used?

- Proponents: Demand is inelastic

- Demand for cocaine is highly inelastic and

presents problems for law enforcement.

- Stricter enforcement reduces supply, raises prices

and revenues for sellers, and provides more incentives

for sellers to remain in business.

- Crime may also increase as buyers have to find

more money to buy their drugs.

- Opponents: Demand is elastic

- Opponents of legalization think that occasional

users or "dabblers" have a more elastic demand and

would increase their use at lower, legal prices.

- Removal of the legal prohibitions might make drug

use more socially acceptable and shift demand to the

right.

4. Drug Busts and Street Crime

5. Minimum Wage (how much unemployment?)

6. Price Discrimination: Why Different Consumers Pay

Different Prices

a. Sellers often charge different prices for

goods based on differences in price elasticity of

demand.

b. The ability to charge different prices depends on

some market power; that is, some ability to control price

(unlike the competitive model where all buyers and sellers

exchange at exactly the same price).

c. EXAMPLES -- Customers are grouped according to

elasticities.

|

QUESTIONS:

- Who pays the higher price:

A. The person with the more

elastic demand, or

B. The person with the less elastic

demand ?

- What happens to Total

revenue?

|

- CHILDREN / ADULTS / SENIORS: Who pays more?

Why?

- COLLEGES: students with different incomes and

financial aid -- Who pays more? Why?

- ELECTRICITY: heating or lighting? homes or

businesses? -- Who pays more? Why?

- DOCTORS: insured patients or uninsured? -- Who

pays more? Why?

- AIR TRAVEL: business travellers or vacationers?

-- Who pays more? Why?

- MOVIES / SKIING / GOLF: adults or children? --

Who pays more? Why?

- RAILROADS: expensive cargo or inexpensive cargo?

-- Who pays more? Why?

1. Definition: Excise tax

2. Examples:

3. Excise tax and the supply curve

4. Incidence of Taxes and Price Elasticity of

Demand

a. "With a specific supply curve, the more

inelastic the demand for a product, the larger the portion

of the tax shifted to consumers."

b. Government Revenue and Price Elasticity of

Demand

c. Allocative Inefficiency and Price Elasticity of

Demand

d. efficiency loss: definition

"the sacrifice of net benefit accruing to

society because consumption and production of the taxed

product are reduced below their allocatively efficient

levels"

e. graphically: smaller quantity

5. Why DO they tax alcohol, cigarettes, and

gasoline?

6. Efficiency loss is one result of an excise or sales

tax.

a. MSB=MSC Approach (yellow page):

- if there are no externalities what is the

allocatively efficient quantity?

- what is the quantity with the excise tax?

- assuming no externalities do excise taxes result

in an UNDERallocation or an OVERallocation of

resources?

- The efficiency loss is the sacrifice of net

benefit accruing to society because consumption and

production of the taxed product are reduced below their

allocatively efficient levels.

b. Consumer and Producer Surplus Approach

- The figure below illustrates the concept of

efficiency loss, which occurs as a result of an excise

tax or sales tax.

- The efficiency loss is the reduction of well being

(consumer and producer surplus) that occurs because there

will be less produced at the higher price caused by the

tax.

- The efficiency loss is the sacrifice of net

benefit accruing to society because consumption and

production of the taxed product are reduced below their

allocatively efficient levels.

b. Elasticities play a role in determining the extent of

the efficiency loss. Other things being equal, the greater the

elasticities of supply and demand, the greater the efficiency

loss of a particular tax.

c. Qualifications to the analysis relate to the idea that

the goals of tax policy may be more important than the goal of

minimizing efficiency losses from taxes. Two examples are

given.

(1) Redistributive goals - Excise taxes placed

on luxury items in 1990 resulted in efficiency losses, but

the benefits from redistributing income from the wealthier

consumers who buy luxury items may have been worth the loss

in efficiency. However, these luxury taxes were unpopular

and have been repealed.

(2) Reducing negative externalities-If there is less

alcohol and tobacco consumption as a result of excise taxes,

the taxes may have socially desirable consequences.

Qd

or Qd

?

Qs

or Qs

?