- Economic Systems

- A particular set of institutional arrangements and a coordinating mechanism for solving the economizing problem;

- A method of organizing an economy

- Two main types:

- Command Economy or socialism

- Market Economy or Capitalism

- Economic systems are ways that countries answer the 5

fundamental questions:

- What will be produced?

- How will goods and services be produced?

- Who will get the output?

- How will the system accommodate change?

- How will the system promote progress?

- Economic Systems:

- There are no PURE command economies

- There are no PURE market economies

- Instead there is a continuum of different

characteristics

- All over the world countries are changing their

economies from command economies to market economies

- this process is called "Structural Adjustment", or sometimes "Globalkization"

- Economic Systems: Characteristics

- who owns

- who decides

- Types of Economic Systems

- Pure Capitalism

- also called:

- market economy

- competition

- free enterprise

- laissez-faire capitalism

- also called:

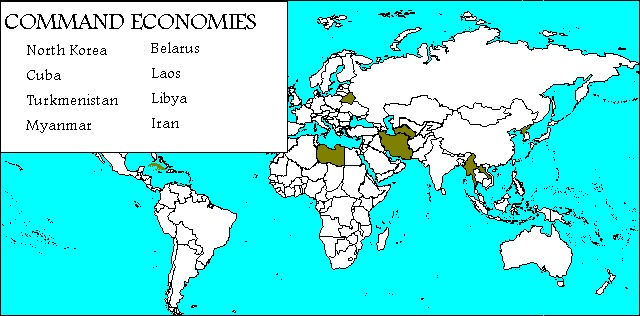

- Command Economy

- also called

- socialism

- state-run economy

- centrally planned economy

- communism

- Examples:

- North Korea

- Cuba,

- Turkmenistan

- Myanmar

- Belarus

- Laos

- Libya

- Iran

- Iraq (until 2003)

- also called

- Pure Capitalism

- All economic systems are Mixed Systems

TYPE OF SYSTEM WHO OWNS? WHO DECIDES? Pure Capitalism:

private ownership the market system Command Economy:

government ownership centralized (or gov't) decision-making Mixed Economy

some private and some government some private and some government

- The Demise of the Command Systems / Structural

Adjustment

- The Coordination Problem

- The Incentive Problem

- http://www.npr.org/blogs/money/2012/01/20/145360447/the-secret-document-that-transformed-china

- note the important role of INCENTIVES

- http://www.npr.org/blogs/money/2012/01/20/145360447/the-secret-document-that-transformed-china

- Paul

Solman Video: Capitalism vs. Socialism - The Cuban

Quandary (YouTube PBS NewsHour

13:56)

https://www.youtube.com/watch?v=UmI00B2nKFs- note the important role of INCENTIVES

-

B. So, What is Capitalism? - Capitalist Ideology

- Basic Characteristics:

CLASS:

TEXTBOOK:

2. freedom of enterprise and choice

3. role of self interest

4. competition

5. markets and prices

6. limited role for government

2. freedom of enterprise and choice

3. role of self interest

4. competition

5. markets and prices

6. technology and capital goods

7. specialization

8. use of money

9. active, but limited government1. private property

- provides an incentive for economic growth

- Paul Solman Video: Private Property (and Pilgrims too)

[Ch2 http://highered.mcgraw-hill.com/sites/0077337735/student_view0/chapter2/_paul_solman_videos.htm ]

OPTIONAL: http://www.npr.org/templates/story/story.php?storyId=1565953

China Considers Private Property Rights on National Public Radio

All Things Considered, December 22, 2003 · In Beijing, legislators propose an amendment to the Chinese constitution guaranteeing private property rights. The move has great symbolic importance in a country that is nominally communist, but whose people have been buying property and trading stocks for years as the result of economic reforms by Deng Xiaoping. NPR's Rob Gifford reports.2. markets and prices

- prices GUIDE resources

- pickups driving to Florida with plywood

- consumer sovereignty and dollar votes

- prices RATION goods and services

- high prices after a hurricane encourage people to conserve

- markets and prices affect allocative efficiency

Quick Quiz:

TO DECIDE HOW TO USE ITS LIMITED RESOURCES TO SATISFY HUMAN WANTS PURE CAPITALISM RELIES ON:A. CENTRAL PLANNING

B. FREE TRADE

C. A PRICE SYSTEM

D. FULL EMPLOYMENT3. role of self interest

- Introduction: would you rather have government or private business . . . . ? WHY?

- gas station near a desert

- your e-mail service

- 24 hour gas stations

- other

- Self interest is a powerful force and IF THERE IS COMPETITION IN AN ECONOMY it will result in improving the social good as if there is some "invisible hand" guiding their decisions.

- "greed" and productive efficiency

- "greed" and allocative efficiency

- "greed" and economic growth

4. freedom of enterprise and choice

- definitions

- Freedom of enterprise means that entrepreneurs and businesses have the freedom to obtain and use resources, to produce products of their choice, and to sell these products in the markets of their choice.

- Freedom of choice means:

- Owners of property and money resources can use their resources as they choose.

- Workers can choose the training, occupations, and job of their choice.

- Consumers are free to spend their income in such a way as to best satisfy their wants (consumer sovereignty).

- provides the means for "greedy" people to help the economy achieve allocative and productive efficiency, and economic growth

5. competition = capitalism

- what is competition?

- 1. Large numbers of sellers mean that no single producer or seller can control the price or market supply.

2. Large number of buyers means that no single consumer or employer can control the price or market demand.

3. Depending upon market conditions, producers can enter or leave industry easily.

- competition is the "invisible hand"

- plywood after a hurricane

- monopolies and inefficiency

6. limited role for government

- What IS the economic role for government? (lessons 5a, 5b, more in macroeconmics)

- education?

- highways?

- defense

- health care?

- restaurants?

- making skis?

- Whenever the government does something we should as "WHY?"

- Why should we ask "WHY?"

- Why not let the government do everything?

- Why not let private businesses do everything?

- Economic goals: 5 Es

- Problems with capitalism:

- at times even market economies achieve allocative INefficiency:

- overproduction (too much produced) of goods with negative externalities (lesson 5a)

- underproduction (too little produced) of goods with positive externalities (lesson 5b)

- tendency for business to increase monopoly power and produce less to increase profits (lesson 10b)

- macroeconomic instability (periods of high unemployment and periods of high inflation) (macroeconomics)

- no mechanism to guarantee equity

1. The Market and the 5Esa. Economic Growth(1) Define

(2) Economic Growth and the characteristics of Capitalism(a) private property

(s) self interest

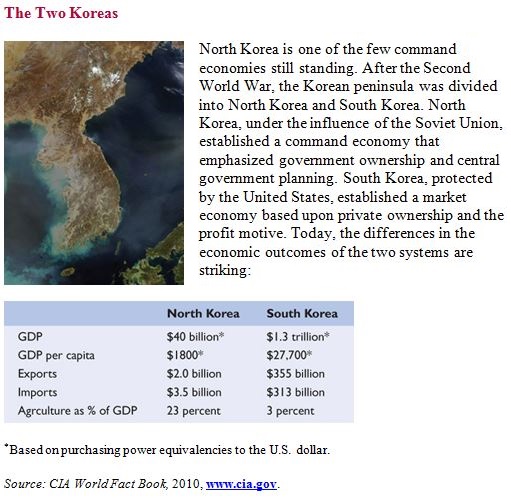

(c) freedom of enterprise and choice(3) market economies tend to have faster growth rates than do command economies

b. Allocative Efficiency: Producing what consumers want

(1) The role of self interest in capitalism provides INCENTIVES to be allocatively efficient.

- more profits = produce more (industry expands)

- losses = produce less (industry shrinks)

- Profits, and losses, are important

(2) Capitalism's use of the market (supply and demand - lessons 3a, 3b, 3c) provides a MEANS to achieve allocative efficiency

- consumer sovereignty and "dollar votes"

(3) Capitalism tends to achieves allocative efficiency (this is why we will study supply and demand in lessons 3a, 3b, 3c)

c. Productive Efficiency: Producing at a minimum cost

(1) The role of self interest (greed?) in capitalism provides INCENTIVES to be productively efficient.(a) profits = total revenues - total cost

(b) minimizing costs means more profits

(c) minimizing costs is productive efficiency(2) Capitalism tends to achieve productive efficiency

d. Equity

- Capitalism does not have a mechanism to assure EQUITY. This may be a role of government

e. Full Employment

- Economists disagree over whether capitalism will guarantee FULL EMPLOYMENT.

- studied in macroeconomics

2. Summary:

a. The move toward capitalism has resulted in high rates of ECONOMIC GROWTH in many countries. Profits, private property, and freedom of enterprise and choice promote growthb. The price mechanism (supply and demand) and the role of self interest provides for an ALLOCATIVELY EFFICIENT use of resources

c. Capitalism provides the incentives (profit) for a PRODUCTIVELY EFFICIENT use of resources

d. Capitalism does not have a mechanism to assure EQUITY. This may be a role of government

e. Economists disagree over whether capitalism will guarantee FULL EMPLOYMENT.

- Some say yes, and if there is unemployment it is usually caused by government interference

- Some say no, and at times government involvement is needed to move the economy towards full employment